Pennsylvania Cash Flow Statement

Description

How to fill out Cash Flow Statement?

US Legal Forms - among the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Pennsylvania Cash Flow Statement in mere seconds.

If you already have a subscription, Log In and download the Pennsylvania Cash Flow Statement from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Select the format and download the form onto your device.

Make edits. Fill out, modify, print, and sign the downloaded Pennsylvania Cash Flow Statement. Each template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

- If you wish to utilize US Legal Forms for the first time, here are simple instructions to get started.

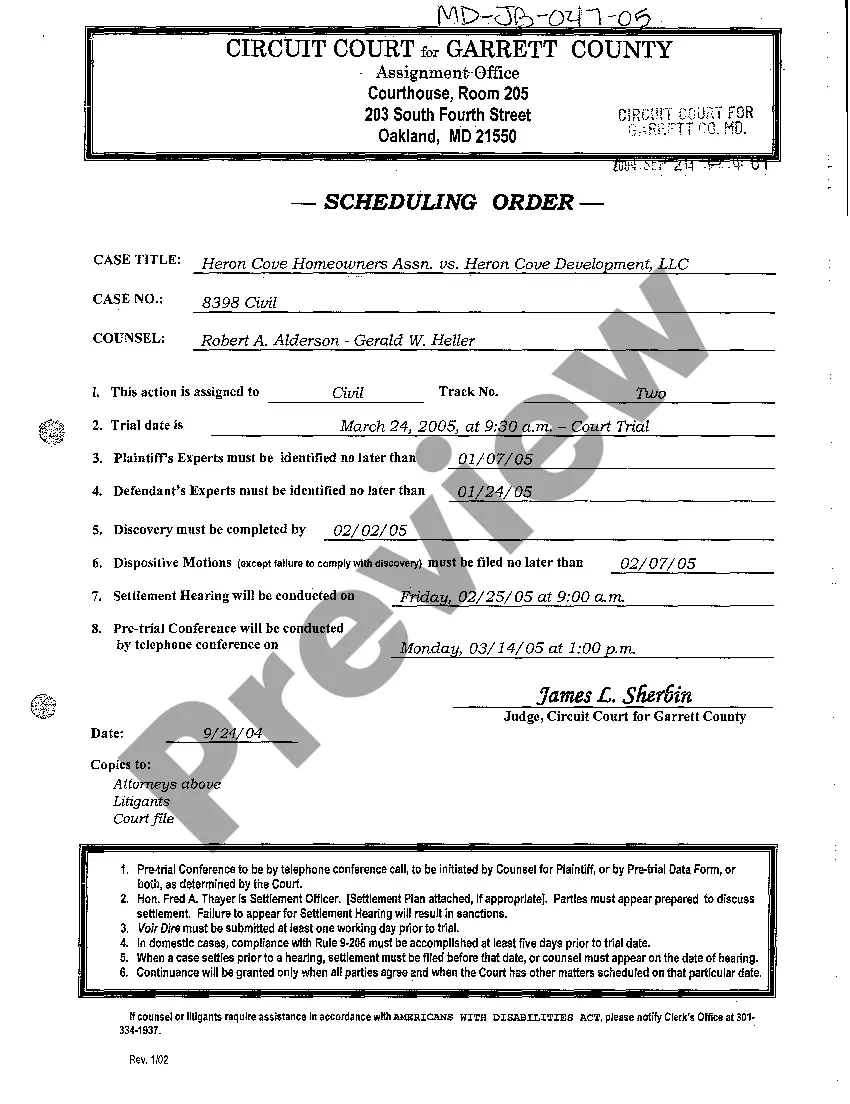

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form description to confirm that you have selected the right form.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for the account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Form popularity

FAQ

Yes, if you live or operate a business in Pennsylvania, you may need to file a local tax return. Many localities in Pennsylvania impose their own income taxes, separate from state taxes. It's important to check the specific requirements for your municipality. Proper filing ensures you adhere to local guidelines, which is crucial for maintaining compliance.

The main components of the CFS are cash from three areas: Operating activities, investing activities, and financing activities.

The cash flow statement records the company's cash transactions (the inflows and outflows) during the given period. It shows whether all of the revenues booked on the income statement have been collected.

A typical cash flow statement comprises three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

Format Of The Statement Of Cash FlowsCash involving operating activities. Cash involving investing activities. Cash involving financing activities. Supplemental information.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. The CFS highlights a company's cash management, including how well it generates cash. This financial statement complements the balance sheet and the income statement.

The cash flow statement differs from the balance sheet and income statement in that it excludes non-cash transactions required by accrual basis accounting, such as depreciation, deferred income taxes, write-offs on bad debts and sales on credit where receivables have not yet been collected.

The cash flow statement is broken down into three categories: Operating activities, investment activities, and financing activities.

The 3-year cash flow statement includes: Cash received. This may include income from sales, loan proceeds, or interest income. If your business is a startup and has already made some sales or received orders, you can estimate when you will actually get paid.