Pennsylvania Petition Against Sports Facility Construction

Description

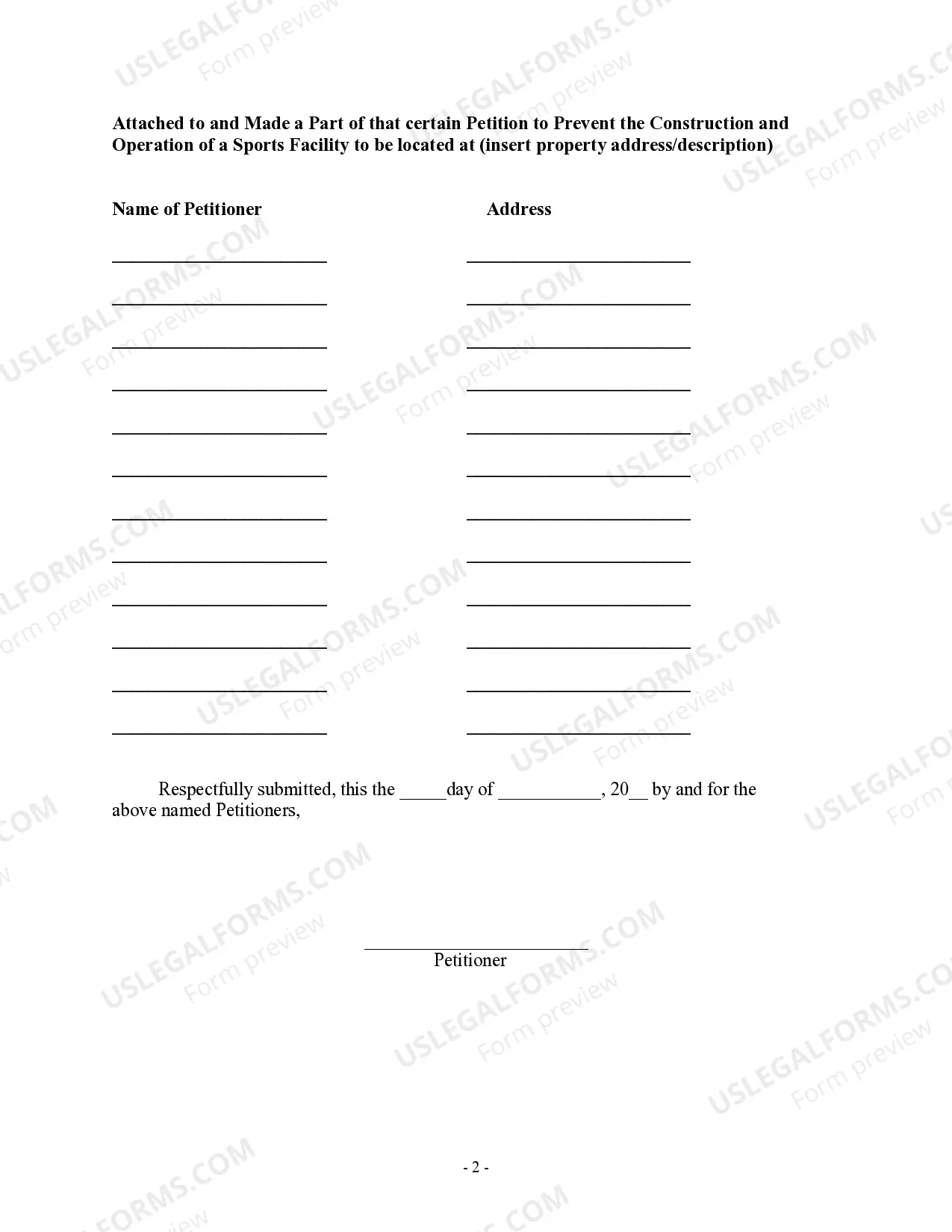

How to fill out Petition Against Sports Facility Construction?

US Legal Forms - one of the biggest libraries of lawful forms in the States - provides a wide array of lawful file web templates you are able to down load or printing. While using internet site, you will get a large number of forms for enterprise and person uses, sorted by classes, states, or search phrases.You can find the most recent models of forms much like the Pennsylvania Petition Against Sports Facility Construction in seconds.

If you have a registration, log in and down load Pennsylvania Petition Against Sports Facility Construction from your US Legal Forms collection. The Acquire button will show up on each and every kind you look at. You gain access to all in the past saved forms inside the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, listed here are basic recommendations to help you started out:

- Make sure you have picked out the correct kind for the city/area. Go through the Review button to check the form`s content material. Browse the kind information to actually have selected the proper kind.

- In the event the kind doesn`t satisfy your specifications, take advantage of the Research industry towards the top of the display screen to discover the one who does.

- In case you are happy with the shape, affirm your choice by clicking on the Purchase now button. Then, pick the pricing program you prefer and offer your qualifications to sign up on an bank account.

- Method the transaction. Make use of bank card or PayPal bank account to accomplish the transaction.

- Pick the format and down load the shape in your product.

- Make changes. Fill out, edit and printing and indication the saved Pennsylvania Petition Against Sports Facility Construction.

Every design you put into your bank account does not have an expiry particular date and is also the one you have permanently. So, if you want to down load or printing one more duplicate, just proceed to the My Forms area and then click on the kind you need.

Obtain access to the Pennsylvania Petition Against Sports Facility Construction with US Legal Forms, one of the most comprehensive collection of lawful file web templates. Use a large number of expert and express-certain web templates that satisfy your organization or person needs and specifications.

Form popularity

FAQ

No estate will have to pay estate tax from Pennsylvania. There is still a federal estate tax. The federal estate tax exemption is $12.06 million in 2022 and $12.92 million in 2023. This exemption is portable.

If the decedent and his or her current spouse are their parents, the children are entitled to an inheritance only after the surviving spouse inherits $30,000 and half of the balance of the estate. But if the children were born out of marriage or during a previous relationship, their share shifts to half of the estate.

The instant Certificate is filed pursuant to Pa. C.S.A. §925, which permits the filing of a Certificate where an original death certificate cannot be obtained and it is not necessary to administer an estate but a public record of death is necessary.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in ance with Section 3121 of the Probate, Estate and Fiduciaries Code. For decedents dying after January 29, 1995, the family exemption is $3,500.

Intestate Succession Generally Intestate succession is designed to first protect the surviving spouse and the surviving children. If there is no surviving spouse or surviving children, the law will provide for extended family, including parents, siblings, aunts, uncles, and their children and grandchildren.

In Pennsylvania, the surviving spouse is generally entitled to receive at least one-third of the decedent's estate if there are descendants of both spouses that survive him or her; otherwise, they can receive up to one-half.