A Non-Disclosure Agreement (NDA) is a legally binding contract that aims to protect confidential information shared during the merger or acquisition process in Pennsylvania. This agreement ensures that both parties involved in the transaction are legally obligated to keep the disclosed information confidential, preventing unauthorized disclosure to third parties. In Pennsylvania, there are different types of Non-Disclosure Agreements specifically tailored for merger or acquisition activities. These agreements may vary depending on the needs and preferences of the parties involved. Some common types of Pennsylvania Non-Disclosure Agreements for merger or acquisition include: 1. Standard Pennsylvania NDA: This is a general NDA used in various business situations, including merger or acquisition negotiations. It stipulates the terms and conditions for confidential information protection, such as the types of information covered, the duration of the agreement, and the consequences of breaching the agreement. 2. Pennsylvania Mutual Non-Disclosure Agreement: This type of NDA is typically used when both parties anticipate the need to share confidential information during the merger or acquisition process. It ensures that both parties agree to keep each other's sensitive information confidential. 3. Pennsylvania Unilateral Non-Disclosure Agreement: This agreement is employed when only one party anticipates sharing confidential information with the other party during the merger or acquisition process. It binds the receiving party to maintain strict confidentiality. 4. Pennsylvania Non-Disclosure Agreement with Non-Compete Clause: In some merger or acquisition scenarios, the parties may include a non-compete clause within the NDA. This additional provision restricts the receiving party from engaging in similar business activities or competing with the disclosing party for a specified period after the merger or acquisition. 5. Pennsylvania Non-Disclosure Agreement for Due Diligence: This agreement focuses specifically on protecting the confidential information shared during the due diligence process of a merger or acquisition. It may establish more stringent guidelines considering the sensitivity of financial, legal, and operational data exchanged. Pennsylvania Non-Disclosure Agreements for merger or acquisition ensure that both the buyer and seller can discuss critical information necessary to evaluate the deal, negotiate terms, and make informed decisions, without fear of unauthorized disclosure. These agreements play a crucial role in maintaining confidentiality throughout the entire merger or acquisition process, safeguarding the parties' interests and potential business opportunities.

Pennsylvania Non Disclosure Agreement

Description

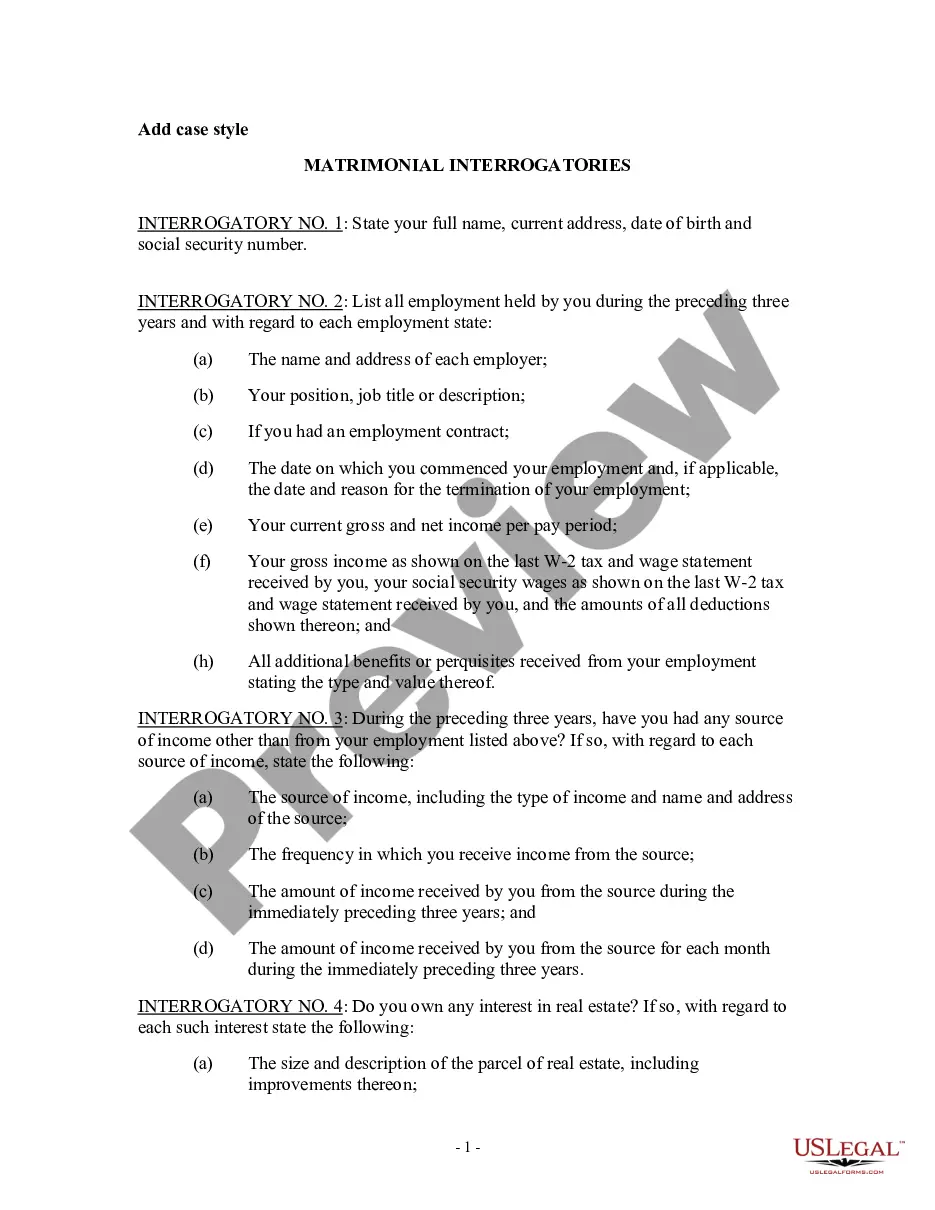

How to fill out Pennsylvania Non-Disclosure Agreement For Merger Or Acquisition?

Are you in the location where you require documentation for potentially business or specific objectives nearly every day.

There are numerous legal form templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides a multitude of template options, including the Pennsylvania Non-Disclosure Agreement for Merger or Acquisition, designed to comply with federal and state regulations.

Once you find the appropriate document, click on Buy now.

Select the payment plan you prefer, fill in the necessary details to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Pennsylvania Non-Disclosure Agreement for Merger or Acquisition template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct area/county.

- Utilize the Review feature to assess the form.

- Check the description to confirm you have chosen the correct document.

- If the document is not what you are looking for, leverage the Search function to find the form that suits your needs and criteria.

Form popularity

FAQ

Disclosure Agreement (NDA) and a Mutual NonDisclosure Agreement (MNDA) serve different purposes in the realm of confidentiality. An NDA typically protects one party's sensitive information from being disclosed by the other party. In contrast, an MNDA involves both parties agreeing to protect each other's confidential data. When considering a Pennsylvania NonDisclosure Agreement for Merger or Acquisition, it's crucial to understand which type best suits your needs.

To fill out a nondisclosure agreement, start by identifying the parties involved and the purpose of the agreement. Next, carefully define the confidential information to be protected and the duties of each party regarding that information. Finalize the document by including signature lines for all parties, ensuring that the Pennsylvania Non-Disclosure Agreement for Merger or Acquisition is legally complete and binding.

An example of a statement in a Pennsylvania Non-Disclosure Agreement for Merger or Acquisition might be: 'The Recipient agrees to keep all Confidential Information disclosed by the Discloser confidential and shall not disclose such information to any third party without prior written consent.' This type of language establishes a clear understanding of confidentiality duties, ensuring both parties are aware of their responsibilities.

The five key elements of a Pennsylvania Non-Disclosure Agreement for Merger or Acquisition include: a definition of confidential information, obligations of the parties, the term of the agreement, exclusions from confidentiality, and remedies for breach. Each element plays a critical role in creating a robust agreement that serves the interests of both parties. Understanding these components will help ensure that the NDA is effective in protecting sensitive information.

Yes, you can write your own Pennsylvania Non-Disclosure Agreement for Merger or Acquisition, but it’s essential to ensure that it meets all legal requirements. Include specific details about the information to be protected, the obligations of the parties, and the duration of the agreement. However, consider using a template from USLegalForms to ensure that your NDA is comprehensive and legally sound, especially for complex business transactions.

A good Pennsylvania Non-Disclosure Agreement for Merger or Acquisition is clear, concise, and comprehensive. It should clearly define the confidential information and the responsibilities of each party. Additionally, it should specify the duration of confidentiality and include clauses regarding legal remedies in case of a breach. Overall, a well-structured NDA provides clarity and protects all parties involved.

Filling out a Pennsylvania Non-Disclosure Agreement for Merger or Acquisition involves a few key steps. Start by entering the names of the parties involved and the date of the agreement. Next, clearly state the confidential information that needs protection, along with the obligations of both parties regarding that information. Finally, ensure that both parties sign and date the document to make it legally binding.

The confidentiality clause in mergers and acquisitions outlines the obligations of both parties to keep shared information private. This provision within the Pennsylvania Non-Disclosure Agreement for Merger or Acquisition specifies what constitutes confidential information and the repercussions for unauthorized disclosure. Having a clear confidentiality clause helps mitigate risks and fosters a trusting relationship throughout the negotiation process.

An NDA in mergers and acquisitions is a formal agreement designed to protect sensitive information exchanged by parties exploring a potential deal. The Pennsylvania Non-Disclosure Agreement for Merger or Acquisition lays out the terms under which confidential information must be handled. This helps preserve business secrets and ensures that both parties can engage in discussions safely.

The purpose of the NDA in an acquisition is to safeguard confidential information shared during negotiations. This Pennsylvania Non-Disclosure Agreement for Merger or Acquisition creates a secure environment for discussing sensitive business elements without fear of exposure. By signing this agreement, parties commit to maintaining confidentiality, allowing for a smoother negotiation process.