Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

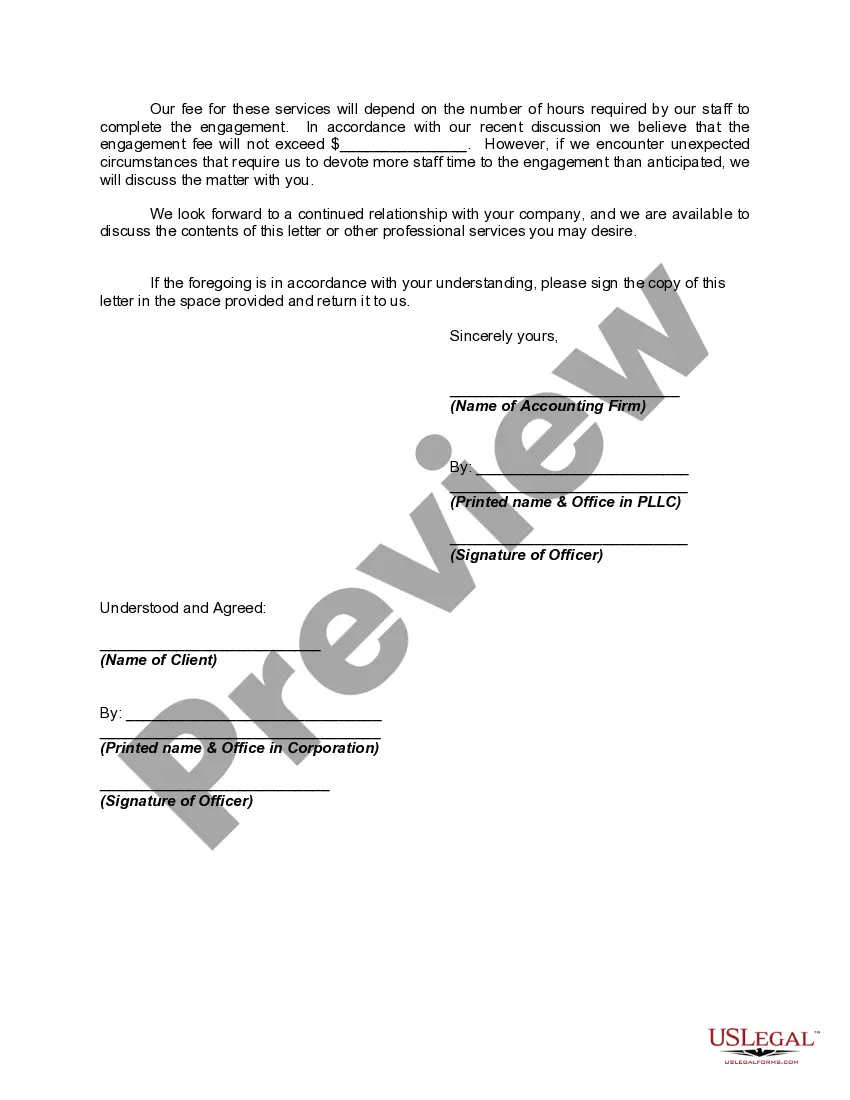

Pennsylvania Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm An Engagement Letter is a contract between an accounting firm and a client that outlines the terms and conditions of the engagement. In the state of Pennsylvania, there are specific engagement letter requirements for conducting a review of financial statements and performing compilations. These engagements are conducted by accounting firms to provide assurance on the financial statements of an organization. The Pennsylvania Engagement Letter for Review of Financial Statements is a formal agreement that establishes the scope of work, responsibilities, and expectations of both the accounting firm and the client. This type of engagement requires the accounting firm to assess and analyze the financial statements provided by the client and offer limited assurance that no material modifications are necessary. On the other hand, the Pennsylvania Engagement Letter for Compilation of Financial Statements is a different type of engagement that does not provide any form of assurance on the financial statements. Instead, it focuses on assisting the client in the preparation and presentation of their financial statements in accordance with the applicable accounting framework. When drafting these engagement letters, there are several important keywords that should be included to ensure clarity and compliance with Pennsylvania regulations: 1. Scope of engagement: Clearly articulate the specific tasks that the accounting firm will undertake, including the extent of the review or compilation procedures to be performed. 2. Independence: Address the independence requirements, ensuring that the accounting firm is free from any conflicts of interest that may compromise their objectivity and integrity. 3. Responsibilities of the client: Clearly outline the client's responsibilities, such as providing complete and accurate financial records and ensuring compliance with relevant laws and regulations. 4. Limitations of engagement: Highlight the limitations of the engagement, emphasizing that the review or compilation procedures do not constitute an audit or assurance of the financial statements. 5. Reporting and communication: Specify how the findings and conclusions of the review or compilation will be communicated to the client, as well as any restrictions on the use and distribution of the report. 6. Fees and payment terms: Detail the fees associated with the engagement and outline the payment terms, including any additional costs that may be incurred. 7. Termination: Include provisions for termination of the engagement, such as circumstances that may lead to termination or the right for either party to terminate the engagement with advance notice. By addressing these key elements within the Pennsylvania Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm, both the accounting firm and the client can establish a clear understanding of the engagement's objectives and responsibilities. This ensures compliance with Pennsylvania regulations and promotes transparency and professionalism in financial reporting procedures.