Title: Pennsylvania Sample Letter for Dormant Accounts — Important Information for Account Holders Introduction: In the state of Pennsylvania, financial institutions are required to periodically reach out to account holders with dormant accounts as a part of their fiduciary responsibility. This process aims to safeguard the interests of the account holders, ensure prompt communication, and facilitate the recovery of funds. Pennsylvania provides clear guidelines and sample letters for financial institutions to use in their communication with account holders regarding dormant accounts. This article provides a detailed description of the Pennsylvania Sample Letter for Dormant Accounts, its purpose, important sections, and variations for different account types. Key Topics: 1. Definition of Dormant Accounts in Pennsylvania Banking: Pennsylvania defines dormant accounts as accounts that have shown no activity or customer-initiated transaction for a specified period. Generally, this duration ranges from one to five years, depending on the financial institution's policy. 2. Purpose of Pennsylvania Sample Letter for Dormant Accounts: The purpose of this sample letter is to notify account holders about their dormant accounts and encourage them to reactivate or manage their accounts to avoid enchantment or loss of funds. 3. Important Elements of Pennsylvania Sample Letter for Dormant Accounts: The Pennsylvania Sample Letter for Dormant Accounts typically includes the following sections: a. Introduction: Clearly stating the sender's information, including the financial institution's name, address, and contact details. b. Account Holder Information: Information about the account holder, such as name, address, and account number. c. Dormant Account Notification: Informing the account holder that their account has been classified as dormant and explaining the time period of inactivity that triggered the status. d. Account Reactivation Options: Presenting various options for the account holder to reactivate their account, such as making a deposit, initiating a transaction, or contacting the financial institution to discuss their account status. e. Enchantment Warning: Explaining the risk of enchantment if no action is taken within a specific timeframe (generally 30-60 days) or if the account holder fails to establish communication. f. Contact Information: Encouraging the account holder to contact the financial institution for clarifications, assistance, or to provide updated information. g. Closing: A courteous closing remark and instructions for any enclosure, such as updated terms and conditions or account reactivation forms. 4. Variations for Different Account Types: a. Checking/Savings Accounts: Specific details for reactivating the account, such as making a deposit, withdrawing funds, or performing an online transaction. b. Certificate of Deposit (CD) Accounts: Guidelines for renewing the CD or reaching out to the financial institution to discuss available options. c. Credit Card Accounts: Instructions for using the credit card for a purchase, activating the card, or contacting the institution for assistance. Conclusion: Pennsylvania's Sample Letter for Dormant Accounts is a helpful tool for financial institutions to communicate with account holders whose accounts have become dormant. By providing clear guidelines and options for reactivation, this letter helps account holders to safeguard their funds and maintain an active financial relationship with the institution. It is crucial for account holders to carefully review and follow the instructions provided in the letter to avoid unintended consequences, such as enchantment or loss of funds.

Pennsylvania Sample Letter for Dormant Letter

Description

How to fill out Pennsylvania Sample Letter For Dormant Letter?

You may spend several hours on-line trying to find the legal papers format that meets the state and federal needs you will need. US Legal Forms provides 1000s of legal types which can be reviewed by pros. It is simple to obtain or printing the Pennsylvania Sample Letter for Dormant Letter from our assistance.

If you already possess a US Legal Forms profile, it is possible to log in and then click the Down load option. Following that, it is possible to complete, modify, printing, or sign the Pennsylvania Sample Letter for Dormant Letter. Each and every legal papers format you acquire is your own for a long time. To obtain yet another duplicate of the obtained form, check out the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms internet site for the first time, adhere to the easy guidelines below:

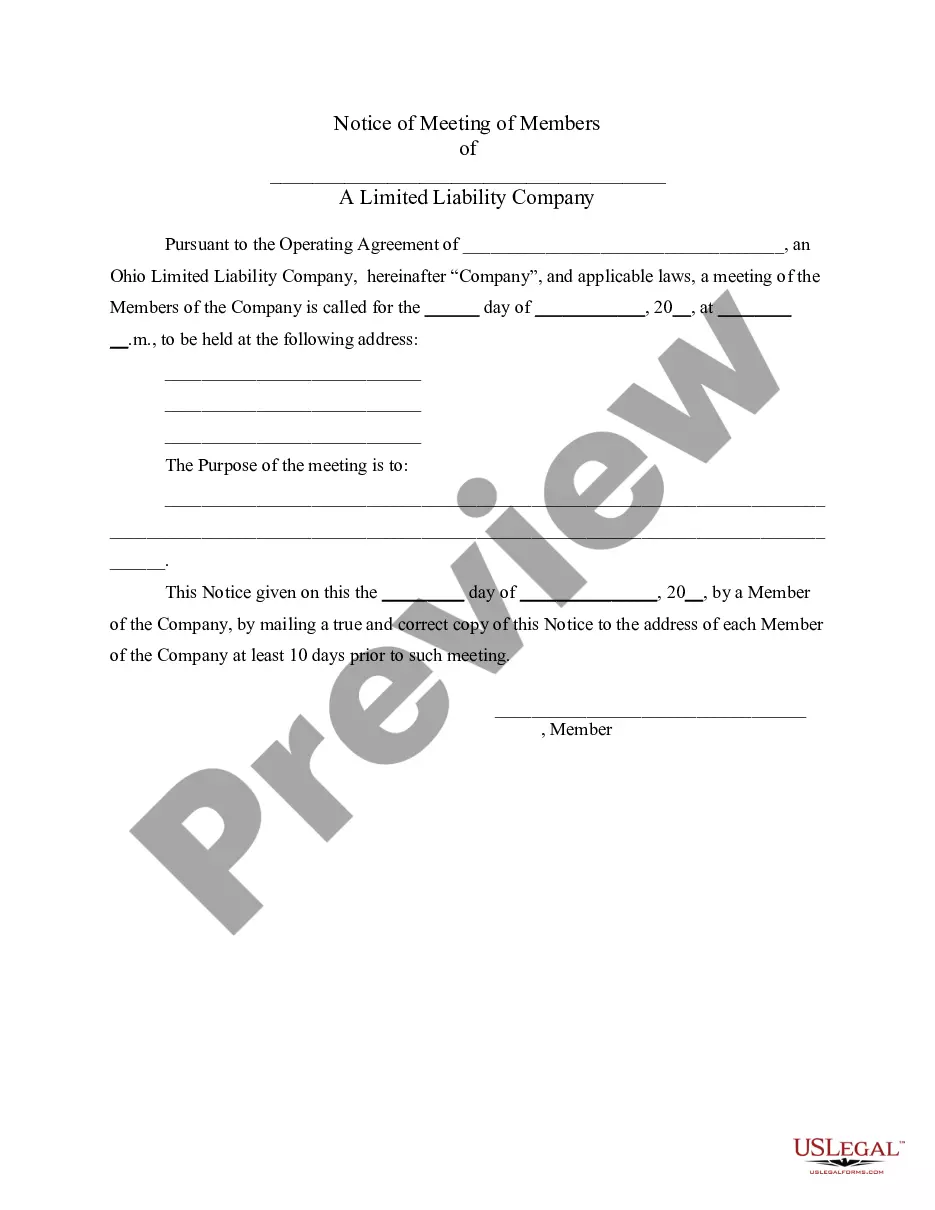

- Initial, make certain you have chosen the proper papers format for that area/city of your choice. Look at the form description to ensure you have chosen the right form. If offered, make use of the Preview option to appear throughout the papers format too.

- If you want to find yet another variation from the form, make use of the Look for industry to obtain the format that suits you and needs.

- Once you have discovered the format you desire, click on Acquire now to carry on.

- Select the pricing program you desire, key in your credentials, and sign up for your account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal profile to purchase the legal form.

- Select the formatting from the papers and obtain it to the device.

- Make modifications to the papers if possible. You may complete, modify and sign and printing Pennsylvania Sample Letter for Dormant Letter.

Down load and printing 1000s of papers templates making use of the US Legal Forms site, that provides the biggest variety of legal types. Use professional and condition-certain templates to take on your organization or specific demands.