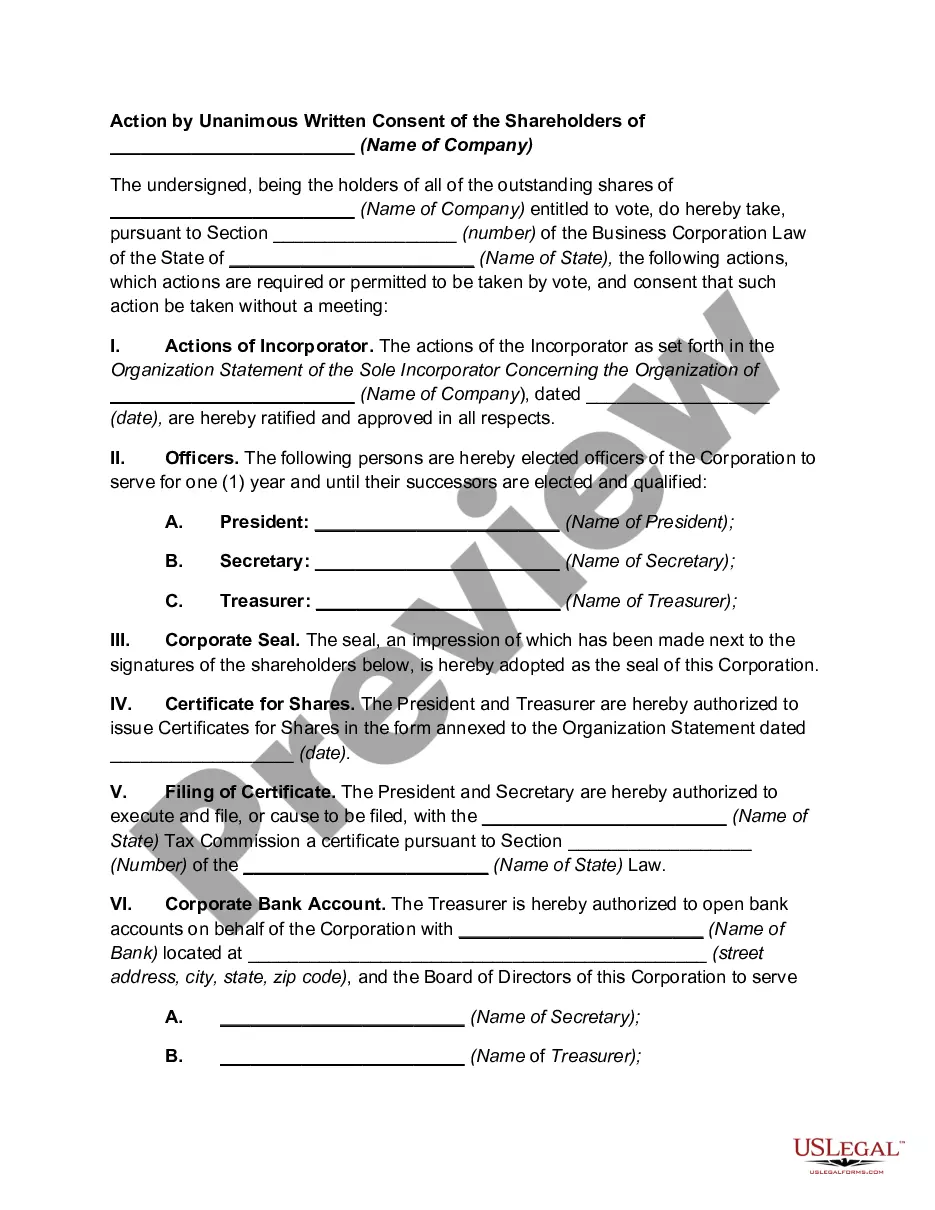

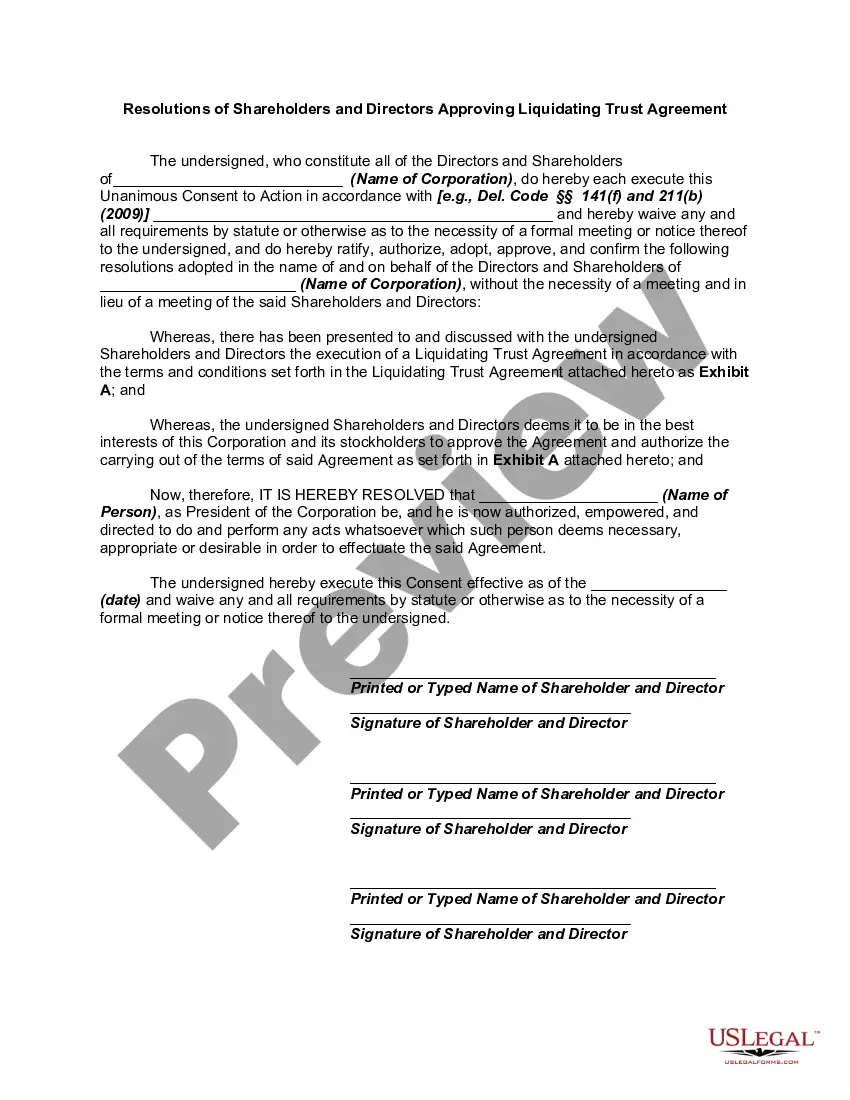

Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement

Description

How to fill out Resolutions Of Shareholders And Directors Approving Liquidating Trust Agreement?

If you wish to be thorough, obtain or print legitimate document templates, consider US Legal Forms, the largest collection of legal forms accessible online. Employ the site’s simple and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and jurisdictions or keywords. Use US Legal Forms to find the Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Download button to acquire the Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. You can also access forms you previously downloaded within the My documents section of your account.

Each legal document template you obtain is yours permanently. You have access to every form you downloaded with your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and download, and print the Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other models of the legal form template.

- Step 4. Once you have located the form you desire, click the Acquire now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

Form popularity

FAQ

To dissolve a corporation in Pennsylvania, start with a formal meeting to secure approval from the board and shareholders. Following this approval, you'll file the appropriate paperwork with the Department of State. The process may also require Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement for the distribution of assets and liabilities. Our platform can assist you in managing these legal requirements efficiently.

Dissolving a corporation in Pennsylvania involves several critical steps. First, the board of directors must recommend the dissolution, followed by a shareholder vote to approve it. After obtaining the necessary approvals, you'll need to file the Certificate of Dissolution and any required resolutions, such as Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. Our user-friendly template services can guide you through each step.

In Pennsylvania, a corporation can dissolve through voluntary or involuntary dissolution. Voluntary dissolution happens when the shareholders choose to discontinue the operation of the company, while involuntary dissolution occurs due to legal action or non-compliance with state mandates. Understanding these options is crucial before proceeding with Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to manage the ensuing processes. Our platform offers the tools you need to navigate this efficiently.

To dissolve a Pennsylvania corporation, you must first obtain approval from the shareholders and directors through a formal vote. The next step involves filing the appropriate dissolution documents with the Pennsylvania Department of State. This process often requires Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to facilitate the smooth transfer of assets. Utilizing our platform can simplify this process and ensure compliance.

Yes, shareholders can dissolve a corporation through a resolution passed according to the bylaws or state laws. This process typically requires a majority vote among shareholders and may involve further steps, including legal paperwork. Leveraging Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can simplify the dissolution process.

In Pennsylvania, a trust is recognized as a legal entity, applicable in various legal and financial situations. Trusts often play a role in estate planning and can be utilized in agreements like the Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. Understanding the legal standing of trusts can ensure proper compliance and functionality.

A shareholder may petition a court for dissolution if the corporation has engaged in illegal activities or if there is deadlock among shareholders preventing it from functioning. Additionally, if the corporation's purposes are no longer achievable, a court may grant dissolution. This situation highlights the importance of Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement in managing corporate affairs.

A shareholder can sue on behalf of the corporation in a derivative action when the corporation suffers harm due to the actions of its directors or officers. This type of lawsuit aims to protect the interests of the corporation and its shareholders. Utilizing Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement could strengthen these claims.

A shareholder may seek a judicial dissolution when there are significant conflicts among shareholders or when the corporation cannot operate effectively. Judicial dissolution may also be pursued if the business activities are illegal or if it becomes impractical to continue operations. In cases involving a Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, judicial dissolution might be a crucial step.

The Pennsylvania corporation law of 1988 governs the formation and operation of corporations in Pennsylvania. This law outlines the rights and responsibilities of shareholders and directors, including liquidating trusts. Understanding this law helps in implementing Pennsylvania Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement correctly.