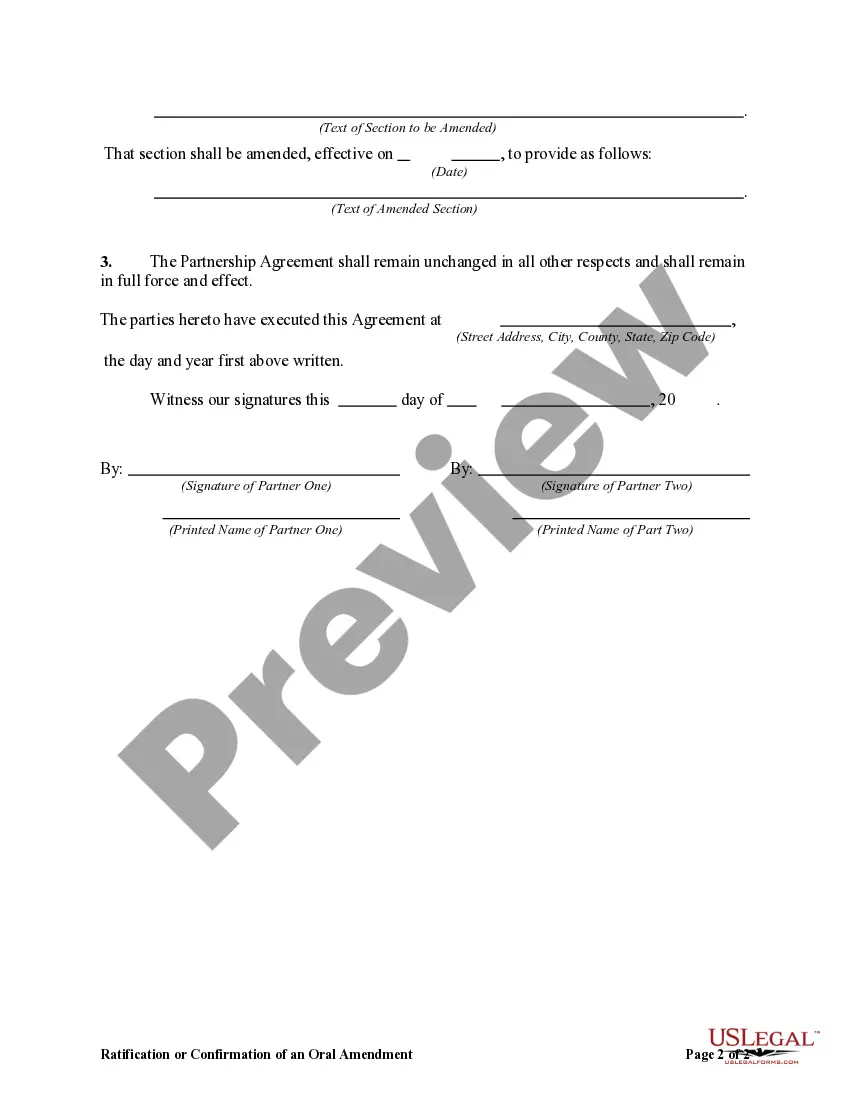

Pennsylvania Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

Selecting the finest approved document template might be challenging.

Clearly, there is an array of digital templates accessible online, but how can you acquire the authorized form you require.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Pennsylvania Ratification or Confirmation of an Oral Amendment to a Partnership Agreement, suitable for both business and personal purposes.

First, ensure you have selected the correct form for your state/region. You can review the form using the Review button and read the form description to confirm it is suitable for you.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Pennsylvania Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

- Use your account to search through the legal forms you have previously purchased.

- Access the My documents tab of your account to get an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines for you to follow.

Form popularity

FAQ

Although there's no requirement for a written partnership agreement, often it's a very good idea to have such a document to prevent internal squabbling (about profits, direction of the company, etc.) and give the partnership solid direction. Limited liability partnerships do have a writing requirement.

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.

How is a partnership dissolved? Limited and general partnerships desiring to withdraw from Pennsylvania must obtain a clearance certificate from the PA Department of Revenue. Limited liability partnerships must obtain a clearance certificate from the PA Department of Revenue and Department of Labor and Industry.

Pennsylvania has adopted the following Articles of the UCC: Article 3: Negotiable instruments: UCC Article 3 applies to negotiable instruments. It does not apply to money, to payment orders governed by Article 4A, or to securities governed by Article 8.

An oral agreement to form a partnership for an indefinite period creates a partnership at will and is not barred by the statute of frauds.

Partnerships are unique in that they can be legally formed with a verbal agreement and a handshake. However, disputes and questions often arise regarding financial responsibilities and expected activities. A written contract can reduce the chances of legal disputes.

How is a partnership dissolved? Limited and general partnerships desiring to withdraw from Pennsylvania must obtain a clearance certificate from the PA Department of Revenue. Limited liability partnerships must obtain a clearance certificate from the PA Department of Revenue and Department of Labor and Industry.

Limited liability companies have an operating agreement for this purpose. Partnerships have a similar document, known as a partnership agreement.

What to Include in Your Partnership AgreementName of the partnership. One of the first things you must do is agree on a name for your partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision making.

Terminating the BusinessThe partners may agree by unanimous consent in a general partnership to terminate the business and wind up the business affairs upon a change in the relation between the partners. Alternatively, the partnership may be automatically dissolved according the terms of the partnership agreement.