This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

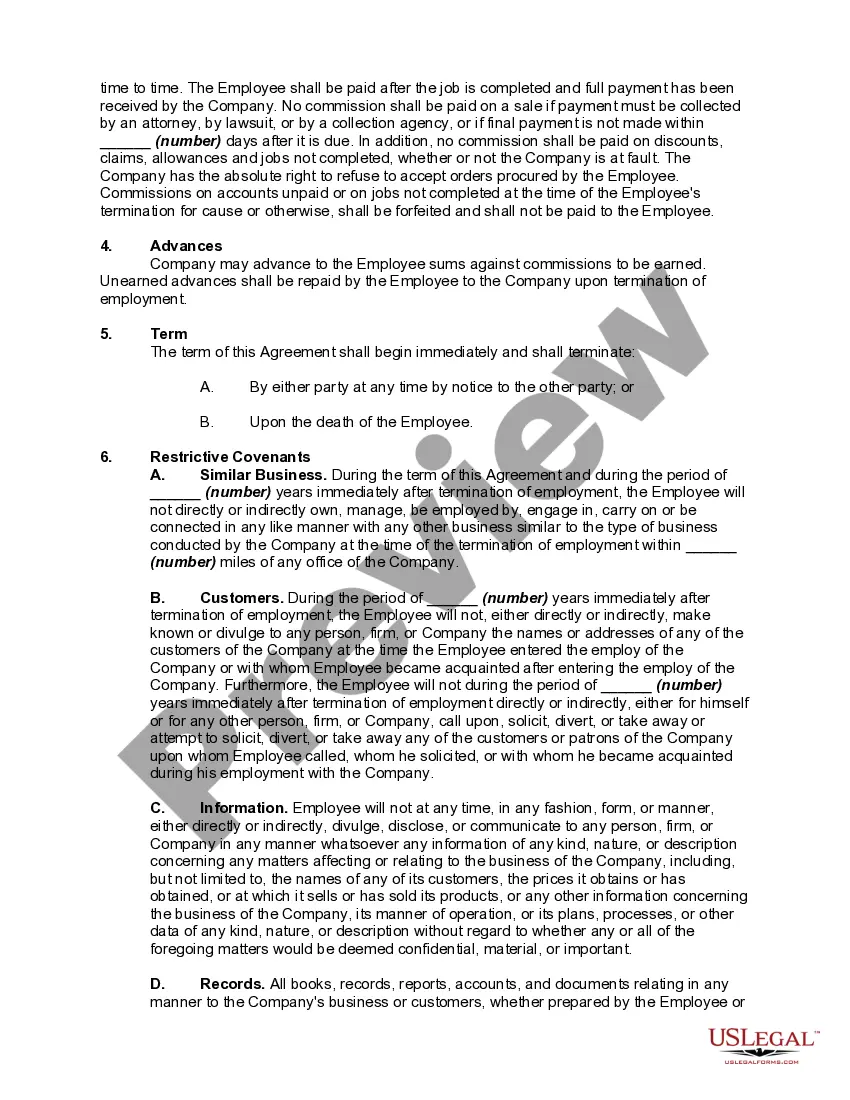

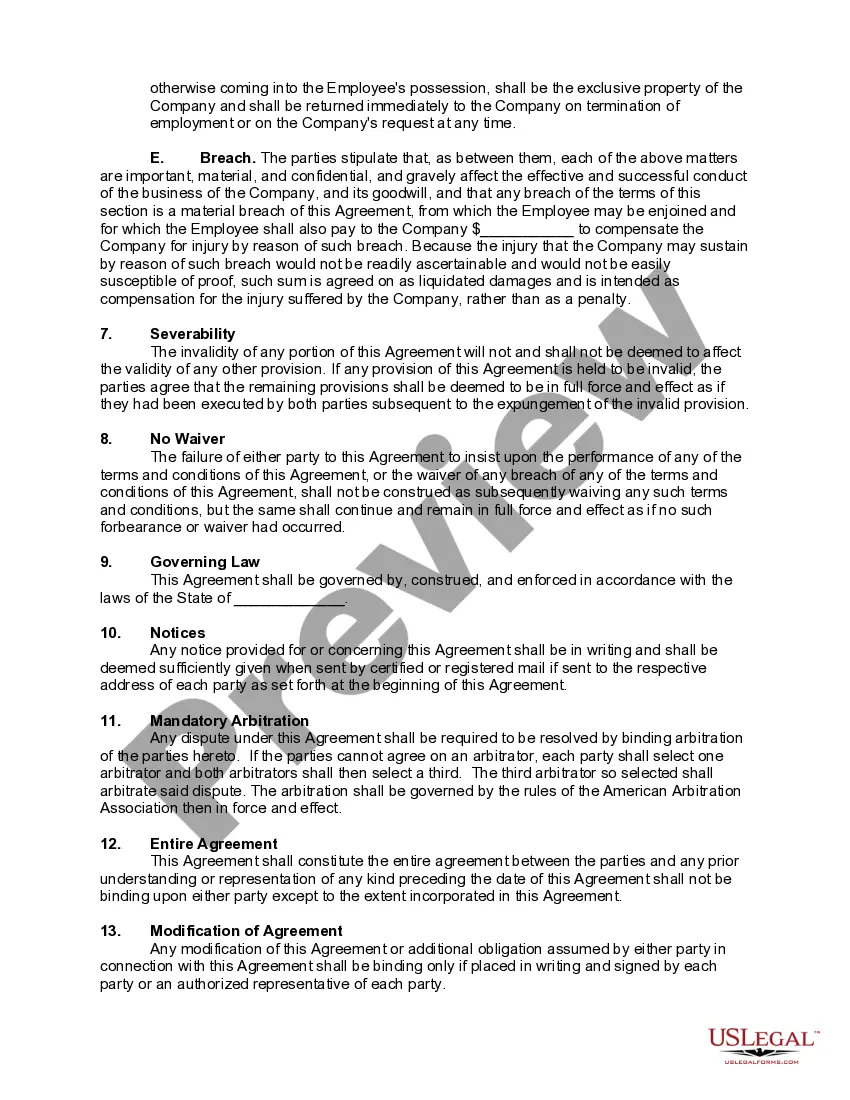

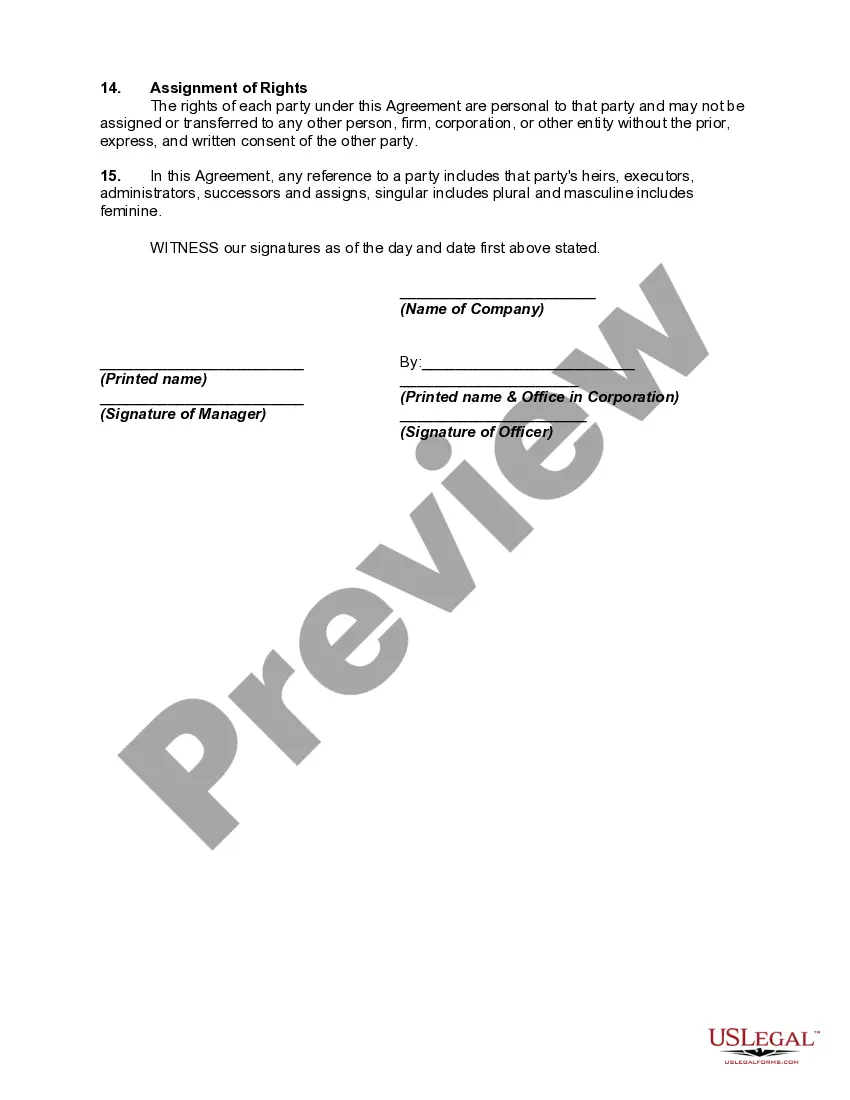

Pennsylvania Employment of Manager of Business that Sells and Install Products

Description

How to fill out Employment Of Manager Of Business That Sells And Install Products?

It is feasible to spend time on the internet searching for the legal document template that complies with the federal and state requirements you need.

US Legal Forms offers a vast selection of legal forms that are assessed by experts.

You can acquire or print the Pennsylvania Employment of Manager of Business that Sells and Installs Products through the service.

If available, utilize the Preview button to browse the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Pennsylvania Employment of Manager of Business that Sells and Installs Products.

- Every legal document template you purchase is yours permanently.

- To get another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure that you have selected the correct document template for your region/city of preference.

- Review the form description to confirm you have chosen the accurate document.

Form popularity

FAQ

The PA 501 form is a state income tax form used by individuals and businesses in Pennsylvania. It is essential for reporting tax obligations accurately and ensuring compliance with state laws. If you participate in the Pennsylvania Employment of Manager of Business that Sells and Install Products, familiarity with this form is beneficial for tax preparation.

Pennsylvania follows the doctrine of at-will employment, meaning an employer can terminate an employee for almost any reason. However, there are limitations, such as firings based on discrimination or retaliation. Understanding this aspect is essential for anyone involved in Pennsylvania Employment of Manager of Business that Sells and Install Products.

Yes, to legally sell products in Pennsylvania, you must obtain a business license. This license ensures compliance with state regulations and local ordinances. For those engaged in Pennsylvania Employment of Manager of Business that Sells and Install Products, securing the proper licensing is a critical step toward operation.

In Pennsylvania, the convenience of the employer rule helps streamline the tax process for employers who manage remote employees. This rule allows employers to designate a specific tax location based on business needs, rather than employee residence. This understanding can greatly benefit those involved in the Pennsylvania Employment of Manager of Business that Sells and Install Products.

The statutory employer doctrine in Pennsylvania protects businesses from liability regarding worker's compensation claims. It establishes that any entity that hires independent contractors may still be seen as the employer for certain legal purposes. If you operate a Pennsylvania Employment of Manager of Business that Sells and Install Products, knowing this doctrine can safeguard your business.

The convenience of the employer rule allows employers to determine the tax implications of their remote workers. Under this rule, employees working from home or in other locations may be subject to different tax obligations. Understanding this rule is vital when managing a Pennsylvania Employment of Manager of Business that Sells and Install Products.

The PA W3R form is a crucial tax document used in Pennsylvania. It reports the total amount of wages, taxes withheld, and other critical information from employers to the state. If you are involved in the Pennsylvania Employment of Manager of Business that Sells and Install Products, filing this form accurately is essential for compliance.

Yes, you can potentially write off items purchased for your job, including supplies or equipment. This is especially relevant for someone engaged in Pennsylvania employment as a manager for a business that sells and installs products. Proper documentation is key to ensuring that these claims are valid and meet tax regulations. USLegalForms can help you navigate the specifics and optimize your deductions.

Yes, if you plan to sell crafts in Pennsylvania, you typically need a business license. This applies even if you manage a small enterprise focused on the sale and installation of products. It is important to check local regulations and ensure that you are compliant. USLegalForms can assist you in obtaining the necessary licenses and permits to operate legally in your area.

Writing off tools as an employee is allowed under certain conditions. If you use these tools as part of your role in Pennsylvania’s employment landscape, especially if you manage a business that sells and installs products, you can take this deduction. Documenting your expenses and the necessity of these tools is crucial. Platforms like USLegalForms offer guidance on how to prepare your tax returns effectively.