Pennsylvania Lease of Patented Machinery with License Agreement

Description

How to fill out Lease Of Patented Machinery With License Agreement?

Are you presently within a position that requires documents for both business and personal reasons almost every time.

There is a multitude of valid document templates accessible online, yet finding ones you can rely on can be challenging.

US Legal Forms provides thousands of template forms, like the Pennsylvania Lease of Patented Machinery with License Agreement, which can be crafted to satisfy federal and state regulations.

Once you find the correct form, click Purchase now.

Select the payment plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Lease of Patented Machinery with License Agreement template.

- If you do not have an account and wish to start using US Legal Forms, take these steps.

- Find the form you require and ensure it is for the correct region/county.

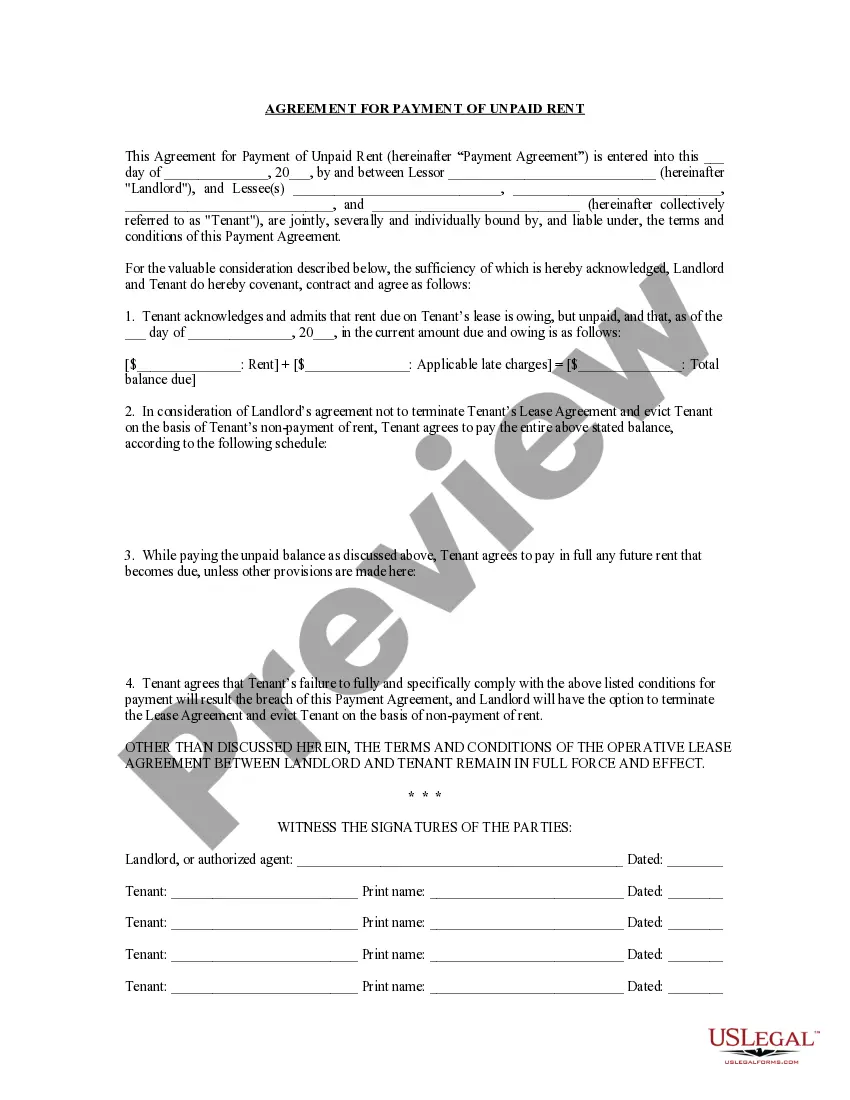

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the appropriate document.

- If the form isn’t what you need, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

A ground lease is a long-term agreement that allows a tenant to use land for a specified period, typically for building or developing property. In contrast, a master lease encompasses various types of assets, including equipment, and offers broader usage options. Understanding these differences is vital when considering a Pennsylvania Lease of Patented Machinery with License Agreement, as each has its implications for ownership, liability, and investment.

A master equipment lease agreement is a comprehensive document that allows businesses to lease various equipment assets under a single agreement. This type of lease provides flexibility and efficiency, especially when a company has fluctuating needs for equipment. By opting for a Pennsylvania Lease of Patented Machinery with License Agreement, businesses can leverage specialized equipment without incurring large upfront costs, facilitating growth and innovation.

A patent is a legal right granted to an inventor for a specific invention, allowing them to exclude others from making, using, or selling the invention for a limited time. On the other hand, a license agreement enables someone to use the patent under certain conditions, usually in exchange for royalties or fees. When you enter into a Pennsylvania Lease of Patented Machinery with License Agreement, you engage in a contractual relationship where the licensing terms dictate the use of the patented machinery.

The purpose of a master lease agreement is to simplify the leasing process for businesses that require various types of equipment. It serves as a single framework under which multiple leases can exist, making it easier to manage obligations and payments. In the context of a Pennsylvania Lease of Patented Machinery with License Agreement, this approach ensures that companies can maintain compliance while efficiently utilizing patented machinery.

A master lease agreement for equipment is a broad contract that outlines the terms for leasing multiple pieces of equipment over time. This type of agreement allows for flexibility, as it can accommodate new assets and changes in business needs. When considering a Pennsylvania Lease of Patented Machinery with License Agreement, a master lease can streamline the process, enabling businesses to manage their equipment effectively without the need for individual contracts.

Yes, the Pennsylvania Landlord-Tenant Act does apply to commercial leases, although the regulations may differ from residential leases. Understanding your rights and responsibilities under this act is essential when entering into a Pennsylvania Lease of Patented Machinery with License Agreement. Having clear agreements and knowing legal protections helps in nurturing a successful landlord-tenant relationship.

A Schedule E for royalties allows taxpayers to report income earned from intellectual property, including patents and licenses. When you engage in transactions involving a Pennsylvania Lease of Patented Machinery with License Agreement, it's vital to document and report any royalties received. This ensures that your income is accurately taxed and helps maintain compliance with state regulations.

If you inherit property from a decedent in Pennsylvania, you generally must file a PA inheritance tax return. This includes both tangible and intangible assets, such as those associated with a Pennsylvania Lease of Patented Machinery with License Agreement. Timely filing ensures compliance and helps avoid any penalties associated with failure to report inherited assets.

Schedule E qualifies for reporting income from rental real estate, royalties, and partnerships. Specifically, if you earn income from a Pennsylvania Lease of Patented Machinery with License Agreement, you may report that income on this form. It's essential to identify all relevant sources of income to comply with Pennsylvania tax regulations.

The PA 40 Schedule E is a valuable tax form used in Pennsylvania to report income from various sources, including partnerships, estates, trusts, and royalties. When dealing with the Pennsylvania Lease of Patented Machinery with License Agreement, it's important to understand how this form applies to income derived from leased machinery and licensing transactions. This form helps ensure that your tax obligations are met accurately and efficiently.