Pennsylvania Lease of Hotel

Description

How to fill out Lease Of Hotel?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide variety of legal templates that you can access or create.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Pennsylvania Lease of Hotel within minutes.

If you already have a subscription, Log In and obtain the Pennsylvania Lease of Hotel from the US Legal Forms library. The Download button will appear on every form you view.

Process the transaction. Use a credit card or PayPal account to complete the payment.

Select the file format and download the form to your device. Make edits. Fill out, modify, and print and sign the saved Pennsylvania Lease of Hotel.

Every template you add to your account has no expiration date and is yours forever. So, if you want to download or print another copy, simply go to the My documents section and click on the form you want.

- You have access to all previously saved forms in the My documents tab of your account.

- To use US Legal Forms for the first time, here are some basic guidelines to help you get started.

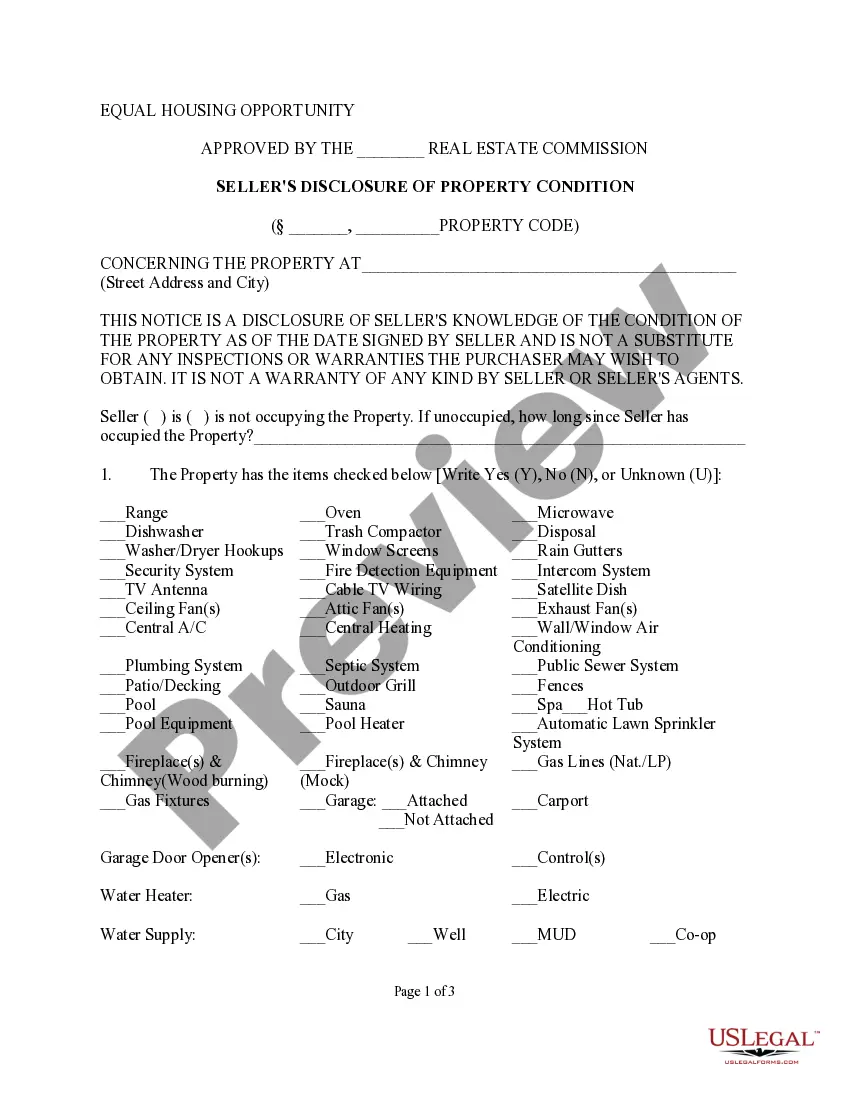

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the contents of the form.

- Read the form description to make sure you have selected the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Establishing residency at a hotel in Pennsylvania can be complex. Generally, renting a room under a Pennsylvania Lease of Hotel does not confer residency status. However, if you stay for an extended period and meet certain conditions, you may consider various registration factors related to residency. It’s advisable to check with local authorities to clarify your status.

To qualify as a tax-exempt individual in Pennsylvania, you must generally be involved in specific activities that are deemed exempt under state law. Common examples include individuals representing non-profit organizations or government bodies. When renting under a Pennsylvania Lease of Hotel, it is important to present valid proof of your exempt status to benefit from the waiver.

Qualifications for sales tax exemption in Pennsylvania typically involve being a tax-exempt organization or utilizing services for exempt purposes. For instance, guests staying under a Pennsylvania Lease of Hotel for business or non-profit activities may claim exemption if they meet the criteria and provide the necessary forms at the time of booking.

In Pennsylvania, certain categories are exempt from sales tax, including purchases for resale and items used by non-profits. Additionally, specific situations related to lodging under a Pennsylvania Lease of Hotel may also qualify for exemption. To fully understand your eligibility, consult with a tax professional or review the guidelines from the Pennsylvania Department of Revenue.

Yes, if you are operating a business in Pennsylvania and selling taxable items or services, you need a Pennsylvania sales tax license. This includes businesses that may utilize a Pennsylvania Lease of Hotel for accommodations. It's essential to register online or through the Department of Revenue to ensure compliance.

In Pennsylvania, various organizations and individuals can claim a sales tax exemption. Typically, non-profit entities, government agencies, and certain educational institutions qualify. If you are renting under a Pennsylvania Lease of Hotel for exempt purposes, you must provide the appropriate documentation to the vendor.

In Pennsylvania, most leases are subject to taxation unless specific exemptions apply. Commercial leases, such as a Pennsylvania Lease of Hotel, typically fall under this tax. Make sure to consult with a tax professional to navigate these rules effectively and ensure compliance when managing your lease obligations.

Yes, rentals in Pennsylvania are generally subject to taxation, including residential and commercial leases. If you're considering a Pennsylvania Lease of Hotel, it's vital to understand the tax implications. Familiarizing yourself with local regulations can help avoid unexpected financial commitments down the line.

Hotel occupancy tax revenue in Pennsylvania primarily funds tourism promotion and local infrastructure projects. By facilitating a Pennsylvania Lease of Hotel, you contribute to the local economy and support initiatives that enhance the hospitality industry. Understanding these funds' uses can provide insight into the positive impact of hotel operations in your area.

Certain individuals and entities are exempt from hotel occupancy tax in Pennsylvania. Common exemptions include government employees and organizations with tax-exempt status. Knowing these exemptions can help you optimize your costs when entering into a Pennsylvania Lease of Hotel, as it may reduce your overall expenses.