Pennsylvania Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

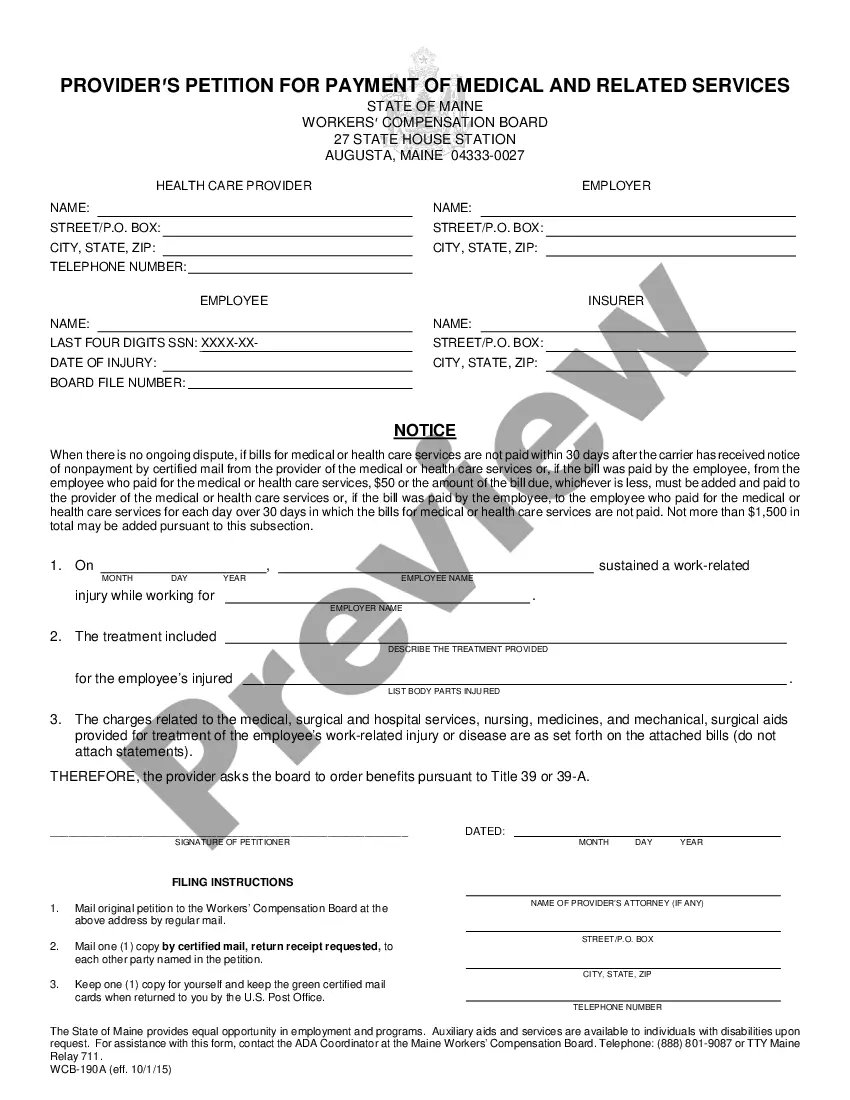

How to fill out Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

US Legal Forms - among several largest collections of legal documents in the United States - offers a variety of legal form templates that you can obtain or print. Through the website, you can access numerous forms for business and personal purposes, categorized by type, state, or keywords.

You can obtain the latest versions of forms like the Pennsylvania Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement in just a few minutes.

If you are a member, Log In and obtain the Pennsylvania Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms from the My documents section of your account.

Edit. Complete, modify, and print/sign the downloaded Pennsylvania Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement.

Each format you add to your account has no expiration date and is yours forever. So, if you wish to obtain or print another copy, simply visit the My documents section and click on the form you need.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state. Click the Review button to evaluate the form's content. Check the form details to confirm that you have chosen the appropriate form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your payment option and provide your information to register for an account.

- Process the payment. Use a credit card or PayPal account to complete the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

A corporate stock transfer agreement, also known as a share purchase agreement or a stock purchase agreement, is used to sell or transfer one's shares in a company to another individual.

A transfer agreement is a legally binding document that conveys ownership from one person or entity to another.

Change in Ownership means any sale, disposition, transfer or issuance or series of sales, dispositions, transfers and/or issuances of shares of the capital stock by the Corporation or any holders thereof which results in any person or group of persons (as the term group is used under the Securities Exchange Act of

What is a "secondary sale"? A secondary sale is a sale by an existing stockholder to a third-party purchaser, the proceeds of which benefit the selling stockholder. This is in contrast to a "primary" issuance, in which the company is selling its stock to an investor and using the proceeds for corporate purposes.

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties.

A secondary stock transaction is when an investor buys shares in a company directly from an existing stockholder (typically a founder, employee or existing investor). The funds paid go to the seller, not to the company.

A shares transfer agreement, also known as a stock purchase agreement, is an legal document used to transfer the ownership of shares of stock. The party transferring shares could be a person or a company.

A secondary sale is the sale by an existing stockholder of shares in a private company to a third party that does not occur in connection with an acquisition of the company. When a lot of secondary sales happen together as part of the same transaction, it is sometimes referred to as a liquidity round.

A Sale and Purchase Agreement (SPA) is a legally binding contract outlining the agreed upon conditions of the buyer and seller of a property (e.g., a corporation). It is the main legal document in any sale process.