A Pennsylvania Employment Agreement with a Chief Financial Officer (CFO) is a legally binding contract between a company based in the state of Pennsylvania and a CFO hired to oversee the financial management of the organization. This agreement outlines the terms and conditions of employment, including compensation, duties and responsibilities, benefits, and other pertinent details. Keywords: Pennsylvania Employment Agreement, Chief Financial Officer, CFO, company, financial management, terms and conditions, compensation, duties and responsibilities, benefits, pertinent details. There are different types of Pennsylvania Employment Agreements with CFOs, depending on the specific needs and circumstances of the company. Some common variations include: 1. Full-Time Employment Agreement: This type of agreement is typically entered into when a company hires a CFO on a full-time basis. It outlines the CFO's regular work hours, salary or hourly pay rate, benefits, and other provisions related to full-time employment. 2. Part-Time Employment Agreement: In certain cases, a company may require the services of a CFO on a part-time basis. This agreement specifies the CFO's work schedule, compensation structure, and any applicable benefits based on their part-time status. 3. Fixed-Term Employment Agreement: When a company intends to hire a CFO for a predetermined period, such as during a specific project or to cover a temporary absence, a fixed-term employment agreement is established. This agreement lays out the duration of employment and clearly defines the CFO's responsibilities and compensation during that period. 4. At-Will Employment Agreement: An at-will employment agreement allows either party (the company or the CFO) to terminate the employment relationship at any time, with or without cause or notice. This agreement is flexible and provides both parties the freedom to part ways if necessary. 5. Equity Incentive Employment Agreement: In some cases, a company may offer an equity ownership stake or other stock options as part of a CFO's compensation package. This type of agreement outlines the terms and conditions for the acquisition, vesting, and eventual sale of equity or stock. Regardless of the specific type of Pennsylvania Employment Agreement with a Chief Financial Officer, it is crucial for both the company and the CFO to carefully review and negotiate the terms to ensure clarity, fairness, and compliance with applicable employment laws. Seeking legal counsel or guidance is recommended to draft a comprehensive agreement that protects both parties' interests.

Pennsylvania Employment Agreement with Chief Financial Officer

Description

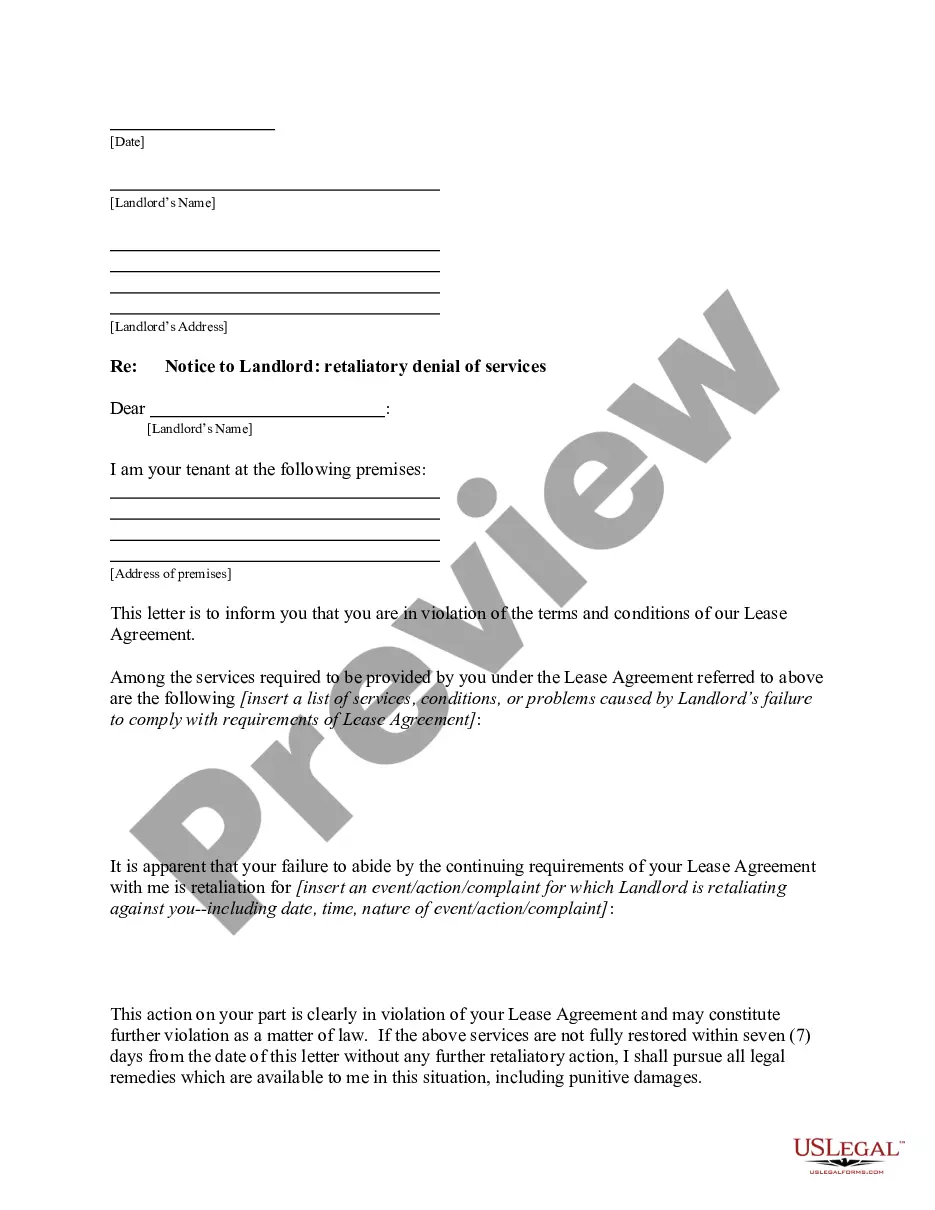

How to fill out Employment Agreement With Chief Financial Officer?

It is feasible to dedicate hours online searching for the proper legal document format that satisfies the federal and state requirements you require.

US Legal Forms provides a vast array of legal documents that are vetted by experts.

You can easily download or print the Pennsylvania Employment Agreement with Chief Financial Officer from our platform.

If available, use the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Pennsylvania Employment Agreement with Chief Financial Officer.

- Every legal document format you acquire is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple guidelines below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Review the form description to verify you have chosen the right form.

Form popularity

FAQ

A company should consider hiring a CFO when it reaches a stage of significant growth or complexity. This often occurs during scaling operations, entering new markets, or managing larger financial obligations. A Pennsylvania Employment Agreement with Chief Financial Officer can help establish clear expectations and responsibilities when you bring this key role into your organization. It's essential to recognize the right moment to secure professional financial leadership for your business's success.

Finding a good chief financial officer involves several steps. Start by defining your company's specific financial needs and goals. Next, utilize professional networks and platforms like UsLegalForms to draft a Pennsylvania Employment Agreement with Chief Financial Officer, ensuring both parties understand the terms of employment. Lastly, conduct thorough interviews to assess each candidate's expertise and fit for your organization.

While not legally required, providing a contract is good practice for employers. A Pennsylvania Employment Agreement with Chief Financial Officer can clarify expectations and protect both parties' rights. If you have concerns about your employment terms, consider discussing this with your employer or seek legal guidance to understand your options.

Yes, employment contracts are enforceable in Pennsylvania as long as they meet legal standards. A well-drafted Pennsylvania Employment Agreement with Chief Financial Officer can protect both parties in the event of a dispute. Consulting with legal experts can help ensure that the contract is compliant with state laws and effectively addresses potential issues.

Yes, CEOs typically have employment contracts in place, especially in larger organizations. These contracts, such as a Pennsylvania Employment Agreement with Chief Financial Officer, serve to formalize the terms of employment. They ensure clarity around essential aspects like salary, benefits, and job responsibilities, making them a common practice in corporate governance.

A CEO contract generally spans three to five years, depending on the company’s needs and the specific Pennsylvania Employment Agreement with Chief Financial Officer. This duration allows for stability while offering opportunities for review and renewal. It's essential to strike a balance that benefits the company and aligns with the CEO's performance goals.

Yes, a CEO should have a contract, typically a Pennsylvania Employment Agreement with Chief Financial Officer, to define the terms of their employment clearly. This contract outlines responsibilities, expectations, compensation, and other key details that protect both the CEO and the company. A well-structured agreement helps prevent disputes and provides clarity in the employment relationship.

To hire a chief financial officer, start by defining the specific skills and experience needed for your organization. Create a detailed job description and outline the hiring process. Additionally, consider using platforms like uslegalforms to draft a Pennsylvania Employment Agreement with Chief Financial Officer that can serve as a guide for both hiring and onboarding.

The main responsibility of a finance officer is to manage the financial activities of the organization. This includes budgeting, forecasting, and comprehensive financial reporting. Utilizing a Pennsylvania Employment Agreement with Chief Financial Officer helps clarify these responsibilities, ensuring the finance officer can focus on strategic financial objectives.

Yes, a CEO should ideally have an employment contract to establish clear expectations and responsibilities. This contract delineates the terms of employment, compensation, and governing regulations. Incorporating a Pennsylvania Employment Agreement with Chief Financial Officer into your company can ensure that both the CEO and CFO's roles are well-defined and aligned with business objectives.

More info

There is also the option to exercise certain executive restricted stock units (RSS) and SARS. Mr. Nostrum has also agreed to receive 100,000 shares upon vesting of each restricted stock unit. Mr. Nostrum also has the option to purchase up to 2,500 additional shares of common stock on the date that the options and SARS are exercised, subject to exercise price and the number of shares subject to the option and SAR. There are also options and SARS exercisable under the SARS exercisable by certain members of Executive's family. In each case, the Company will make payments in cash equal to the exercise price of the options and SARS with a strike price of 100% vested. The Company will also pay 100% of the difference between the strike price and the exercise price of the option.