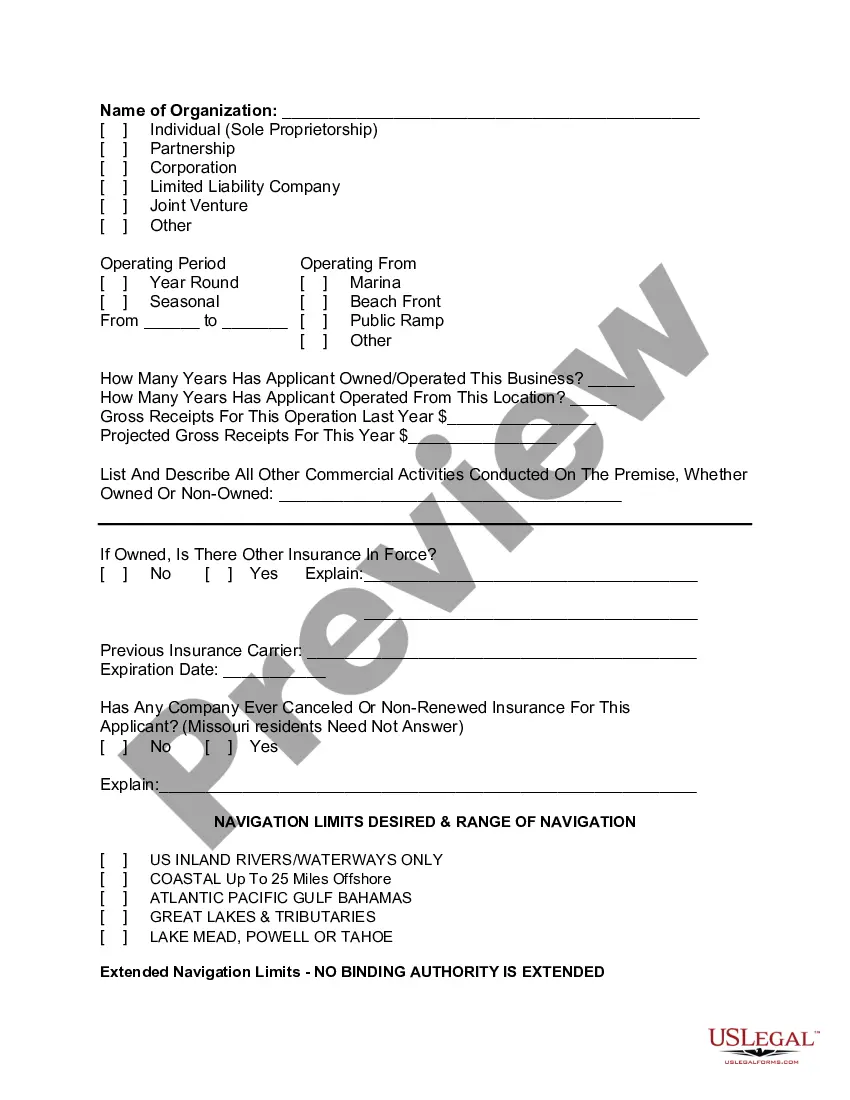

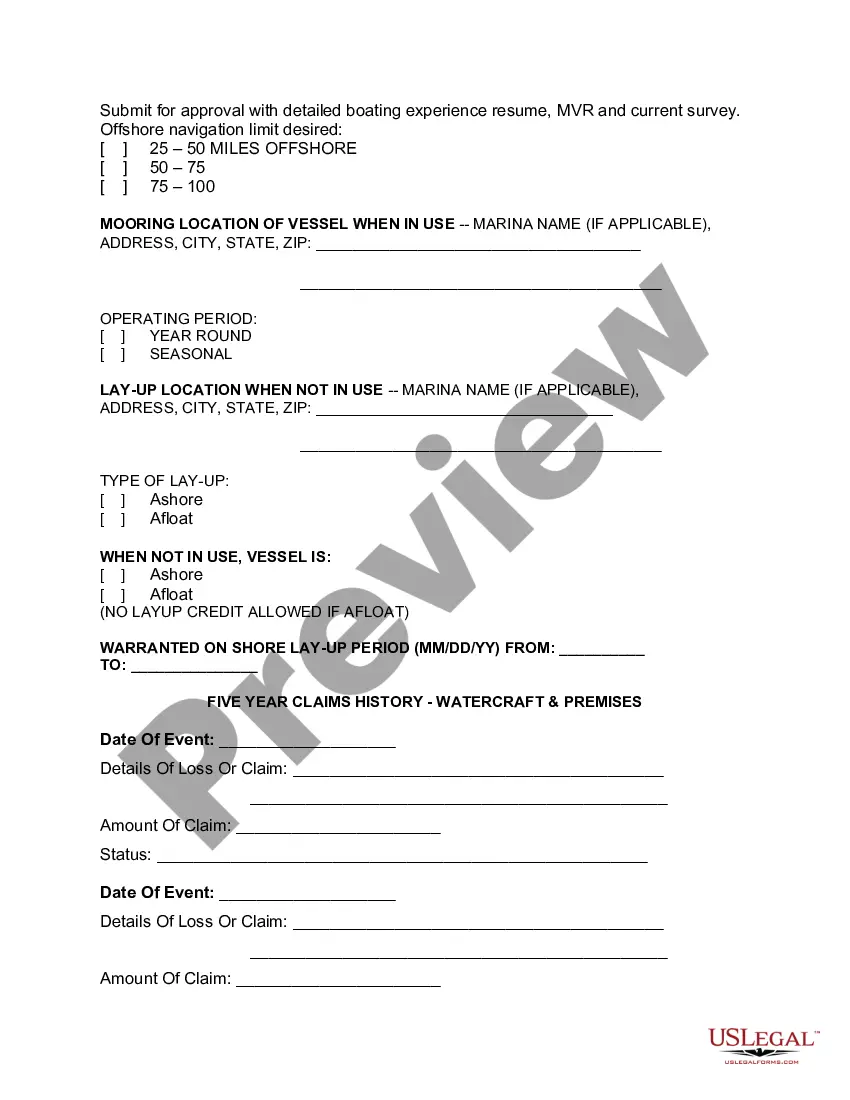

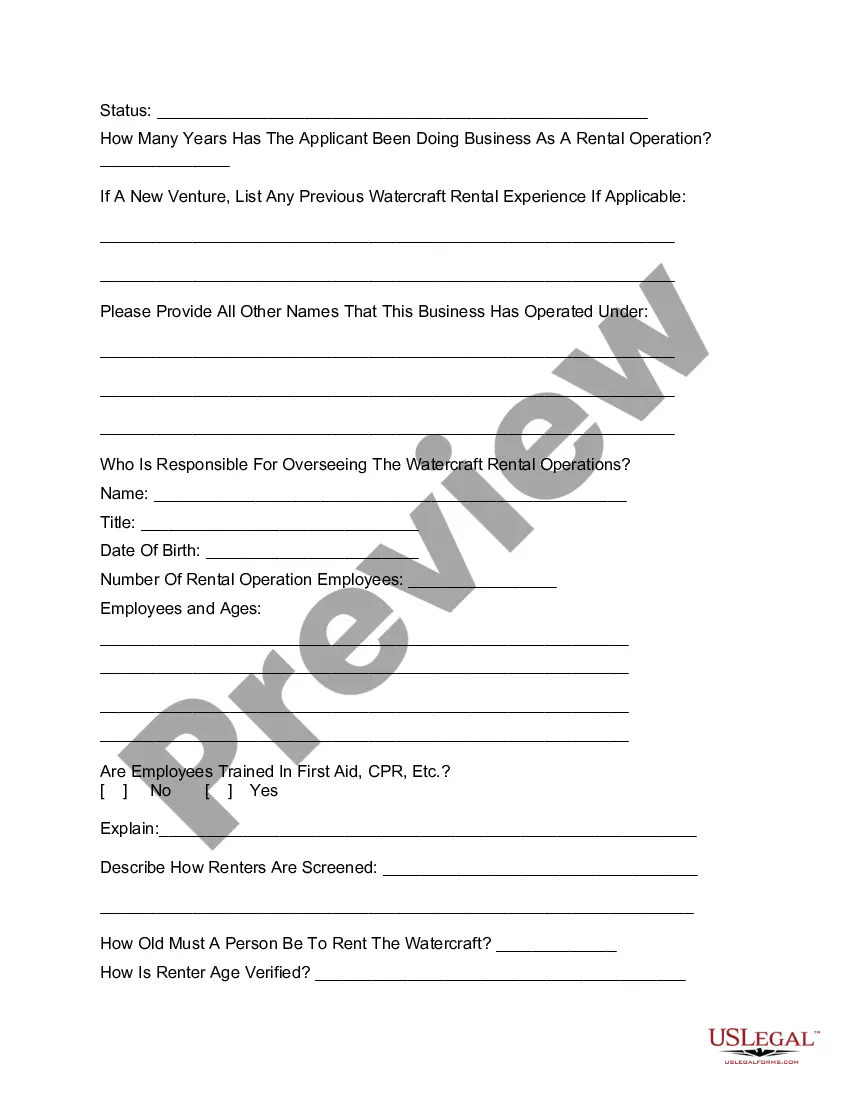

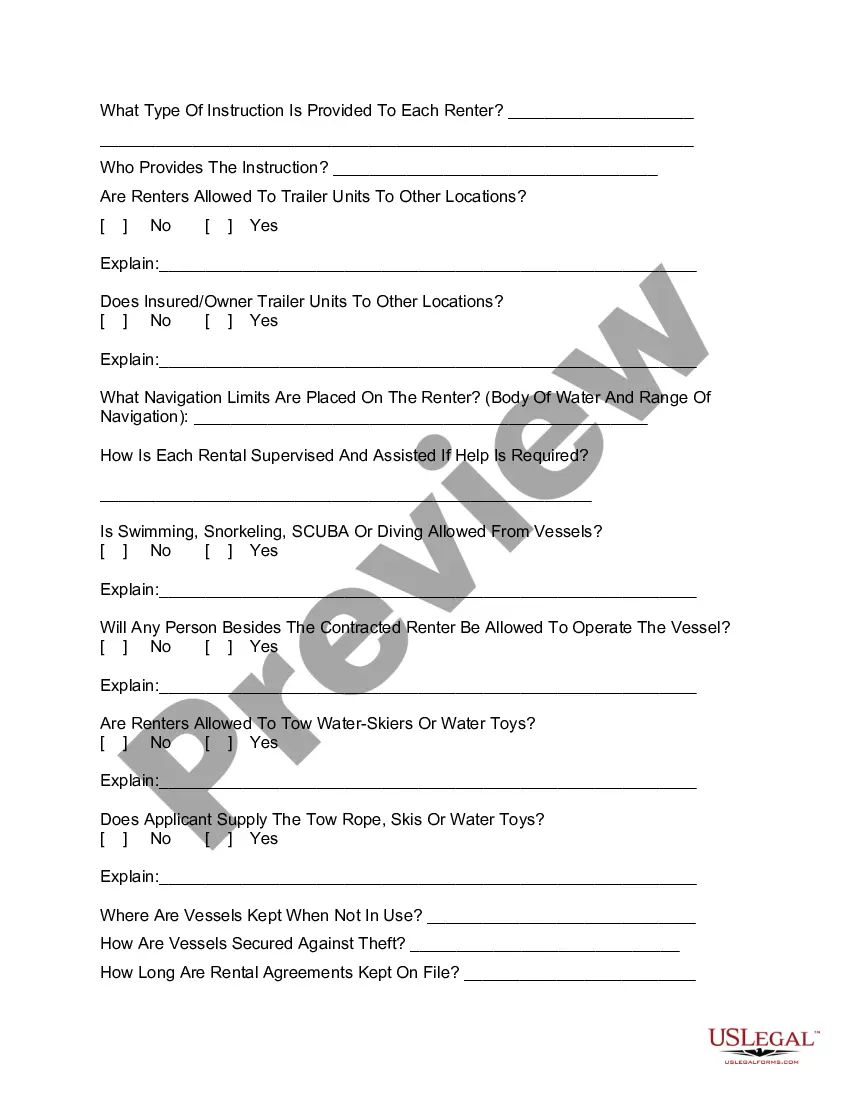

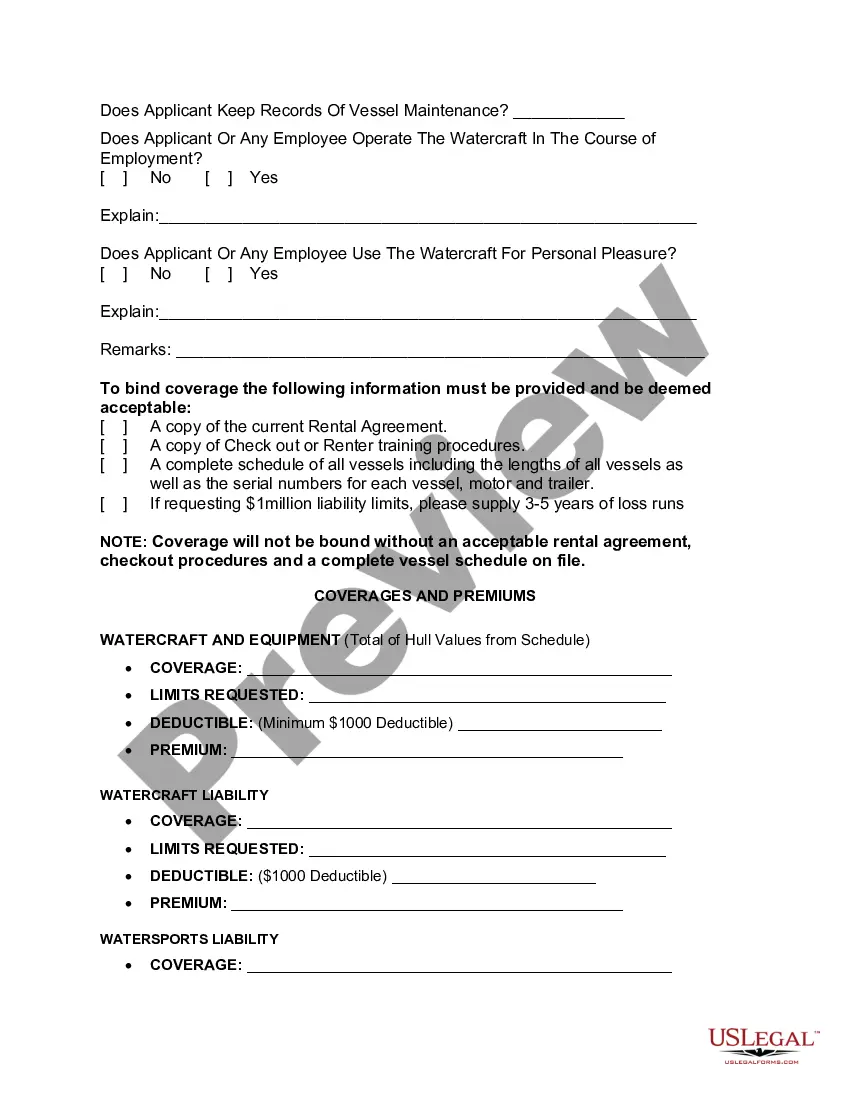

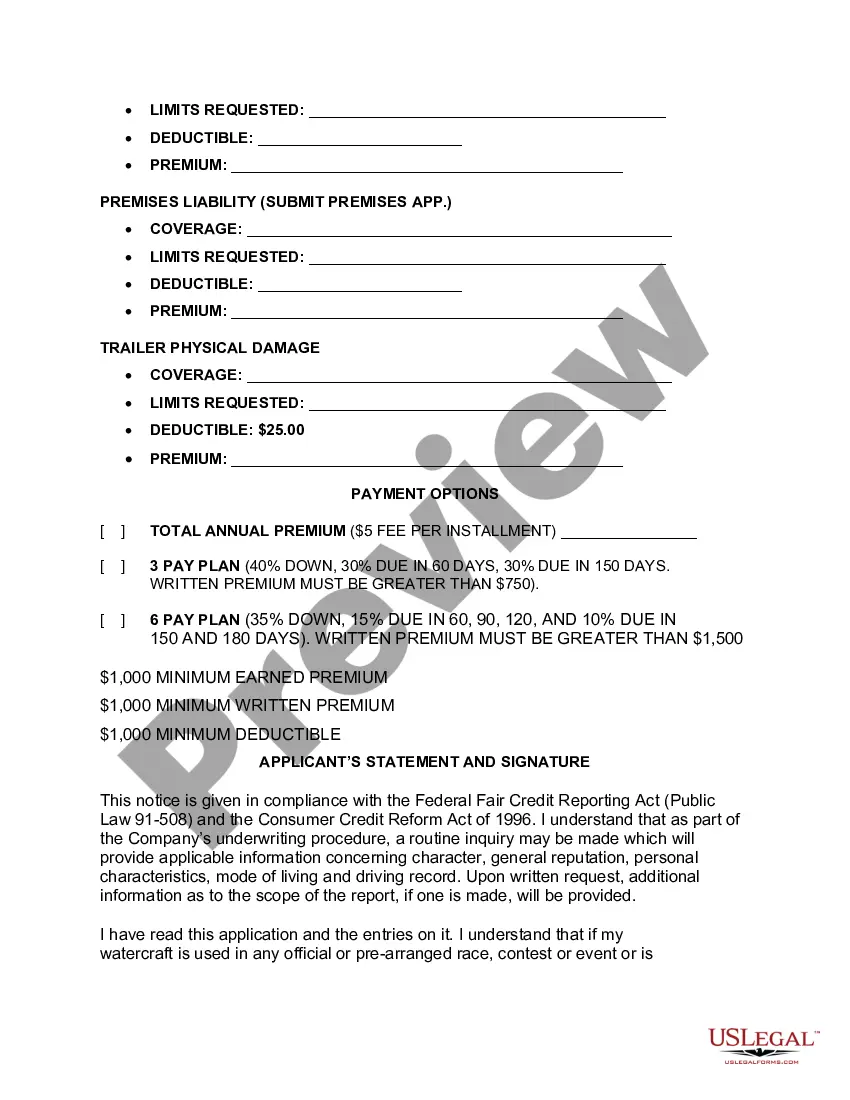

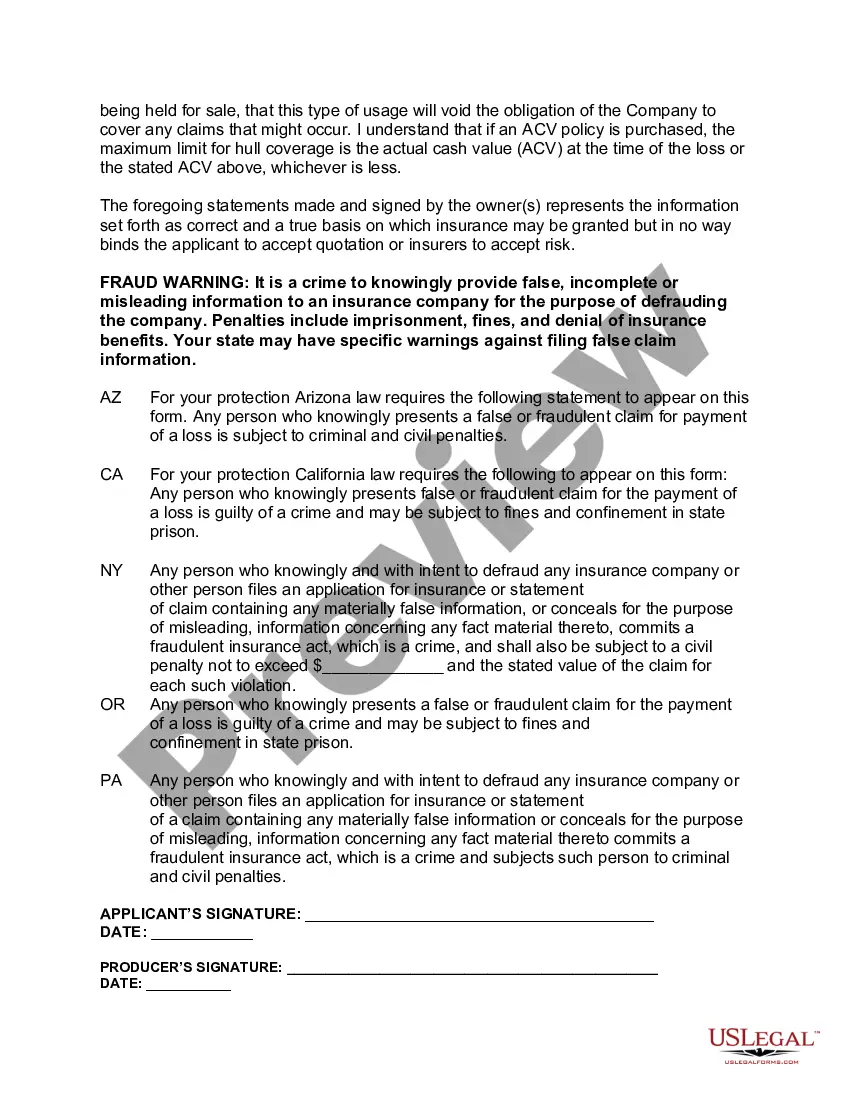

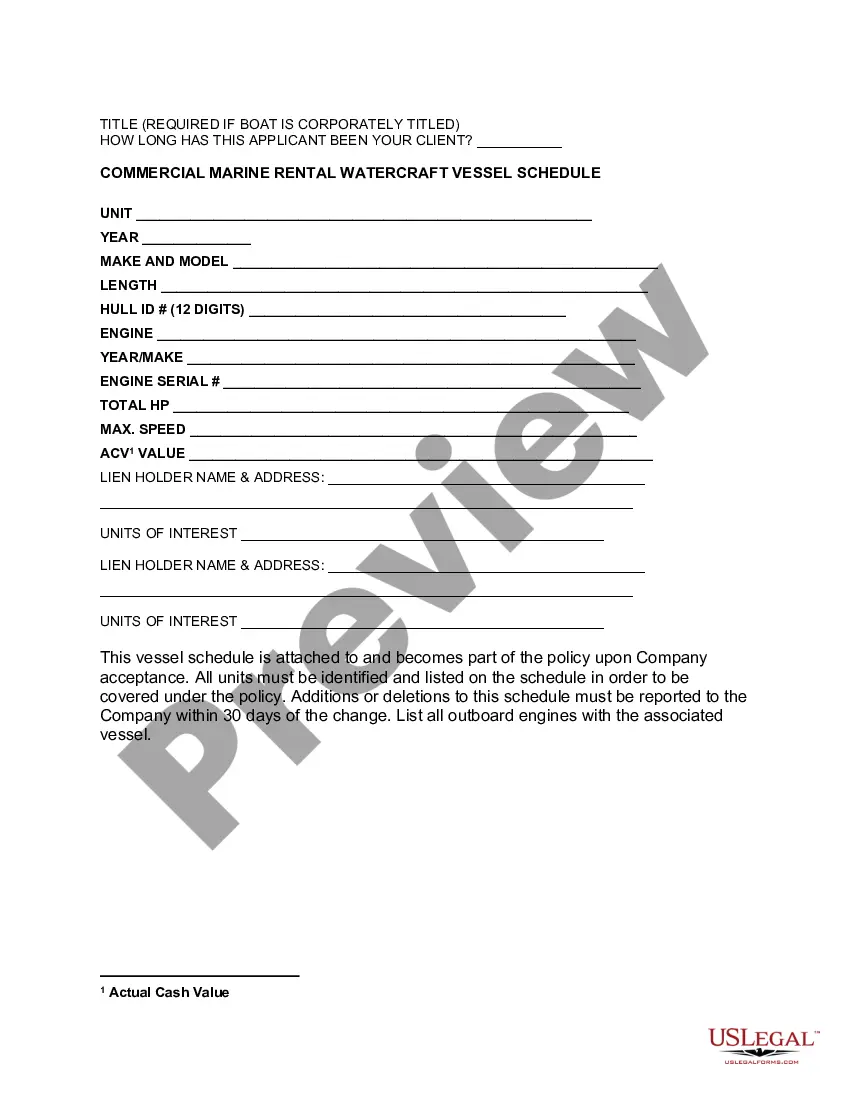

Pennsylvania Commercial Watercraft Rental Insurance Application

Description

How to fill out Commercial Watercraft Rental Insurance Application?

If you have to complete, acquire, or print out legitimate document themes, use US Legal Forms, the largest assortment of legitimate types, that can be found on-line. Take advantage of the site`s basic and hassle-free lookup to discover the files you will need. Different themes for enterprise and individual reasons are categorized by classes and claims, or key phrases. Use US Legal Forms to discover the Pennsylvania Commercial Watercraft Rental Insurance Application in just a handful of click throughs.

In case you are previously a US Legal Forms customer, log in to the account and click on the Obtain button to have the Pennsylvania Commercial Watercraft Rental Insurance Application. You may also gain access to types you in the past acquired inside the My Forms tab of the account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for that right city/region.

- Step 2. Use the Review choice to look over the form`s content. Do not forget about to read the explanation.

- Step 3. In case you are unsatisfied with the kind, utilize the Search area at the top of the display screen to get other versions of the legitimate kind format.

- Step 4. Upon having identified the form you will need, go through the Buy now button. Select the rates plan you like and add your accreditations to sign up for an account.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal account to finish the deal.

- Step 6. Pick the file format of the legitimate kind and acquire it on your system.

- Step 7. Comprehensive, edit and print out or indicator the Pennsylvania Commercial Watercraft Rental Insurance Application.

Each and every legitimate document format you acquire is the one you have permanently. You have acces to each kind you acquired in your acccount. Click on the My Forms segment and decide on a kind to print out or acquire once more.

Remain competitive and acquire, and print out the Pennsylvania Commercial Watercraft Rental Insurance Application with US Legal Forms. There are many professional and status-specific types you can use for your personal enterprise or individual demands.

Form popularity

FAQ

Pennsylvania law doesn't mandate boat insurance for boaters. However, some marinas won't allow you to dock unless you provide proof of insurance. If you choose to finance your boat, you might be required to carry a specific amount of coverage until your loan is paid off.

Wreckage removal and fuel spill coverages are automatically included in every Progressive boat insurance policy. If your boat sinks or you're responsible for a fuel spill, we cover the bills all the way up to your policy's property damage liability limits. We only remove your sunken boat if it's legally required.

Only a title owner of the boat can purchase a boat insurance policy. If the boat is not insured in the name of the title owner then no coverage is on the boat.

Boat insurance isn't mandated by law in the state of New Jersey. However, you may want to consider a boat insurance policy before you take your boat or personal watercraft out on the water. While the boating season in the Garden State may be short, the list of available coverages is quite long.

If your company relies on the transit of goods by sea, air, land, or rail, you could face significant financial loss if your goods are damaged or lost whilst in transit. If your business regularly sends or receives goods, then you should seriously consider an Annual Marine Cargo Insurance policy.