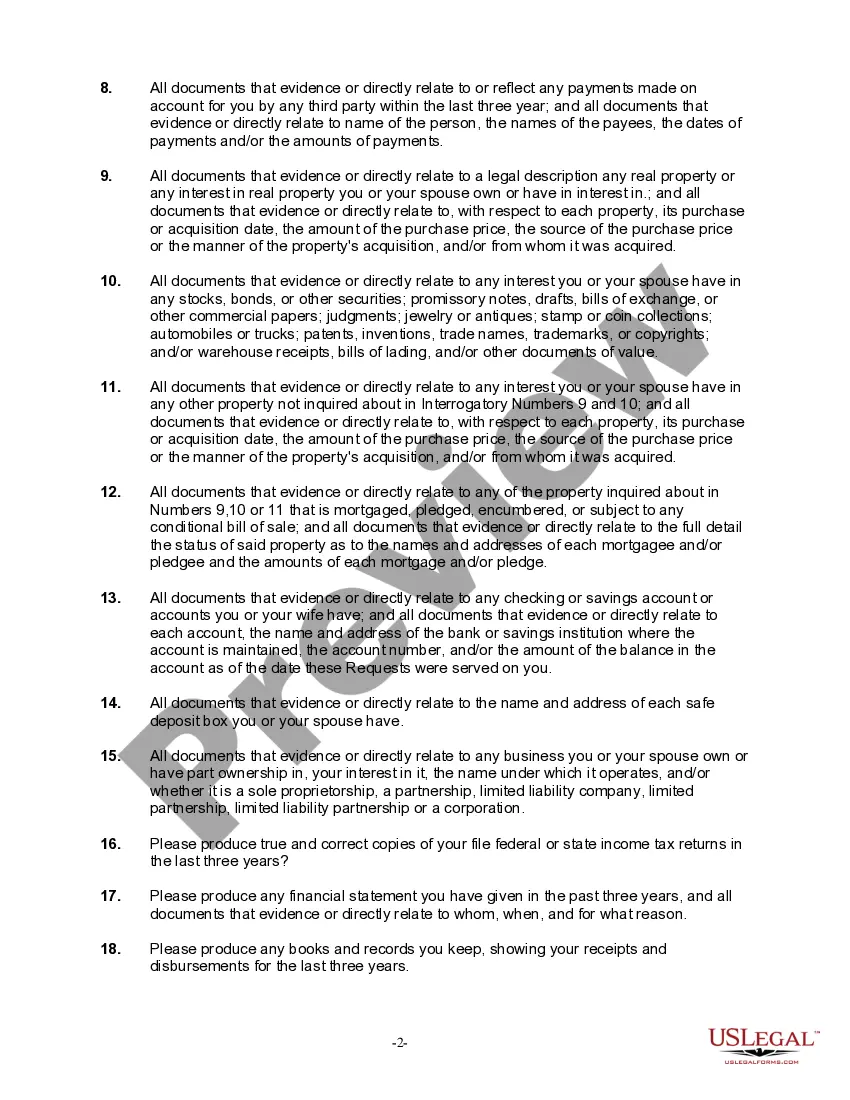

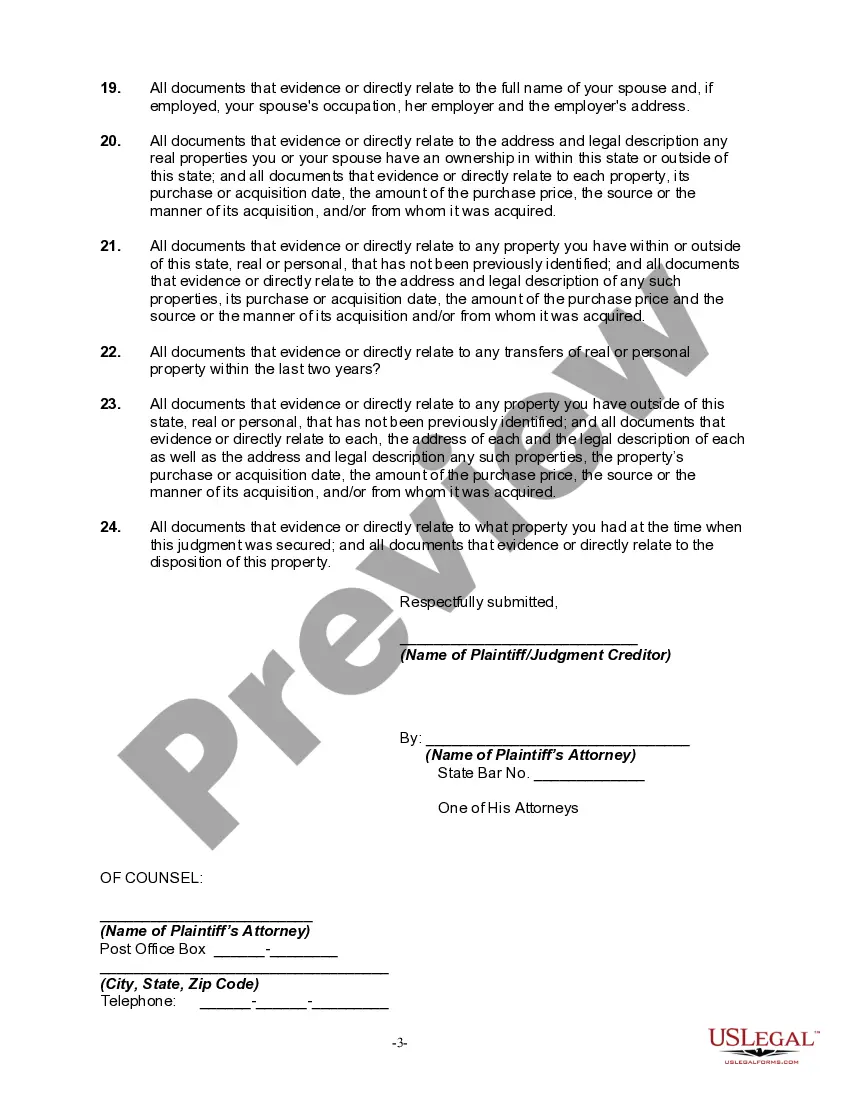

Rule 34 of the Federal Rules of Civil Procedure provides in part as follows:

A party may serve on any other party a request within the scope of Rule 26(b):

(1) to produce and permit the requesting party or its representative to inspect, copy, test, or sample the following items in the responding party's possession, custody, or control:

(A) any designated documents or electronically stored information - including writings, drawings, graphs, charts, photographs, sound recordings, images, and other data or data compilations - stored in any medium from which information can be obtained either directly or, if necessary, after translation by the responding party into a reasonably usable form; or

(B) any designated tangible things.

Rule 69 of the Federal Rules of Civil Procedure provides in part as follows:

In aid of the judgment or execution, the judgment creditor or a successor in interest whose interest appears of record may obtain discovery from any person - including the judgment debtor - as provided in these rules or by the procedure of the state where the court is located.

In aid of the judgment or execution, the judgment creditor or a successor in interest whose interest appears of record may obtain discovery from any person - including the judgment debtor - as provided in these rules or by the procedure of the state where the court is located.