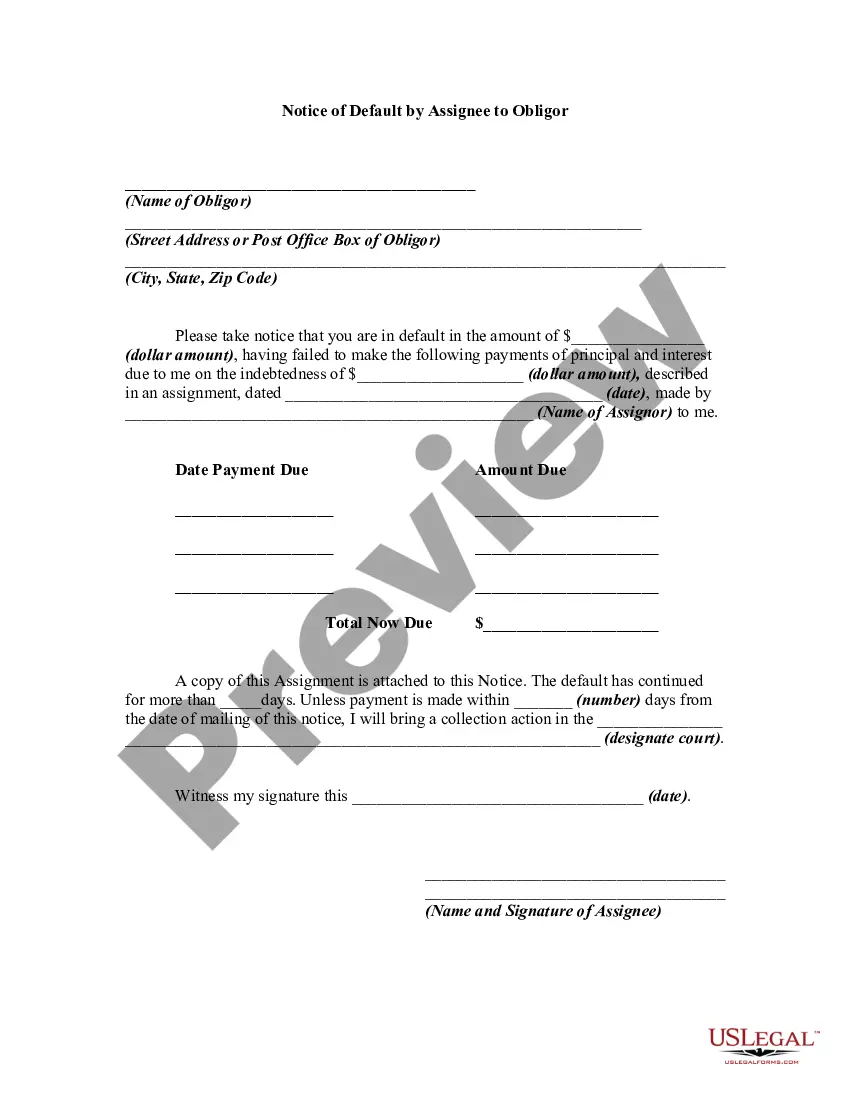

Pennsylvania Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Selecting the appropriate legal document template can be a challenge. Of course, there are numerous designs accessible online, but how can you determine the legal format you need.

Make use of the US Legal Forms website. This platform provides an extensive array of templates, including the Pennsylvania Notice of Default on Promissory Note Installment, suitable for both business and personal needs.

All templates are reviewed by experts and comply with federal and state regulations.

Once you verify that the form is appropriate, click the Buy Now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Pennsylvania Notice of Default on Promissory Note Installment. US Legal Forms is the largest collection of legal documents where you can find numerous document templates. Utilize the service to obtain professionally crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Pennsylvania Notice of Default on Promissory Note Installment.

- Use your account to search through the legal templates you have previously purchased.

- Visit the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are some basic steps to follow.

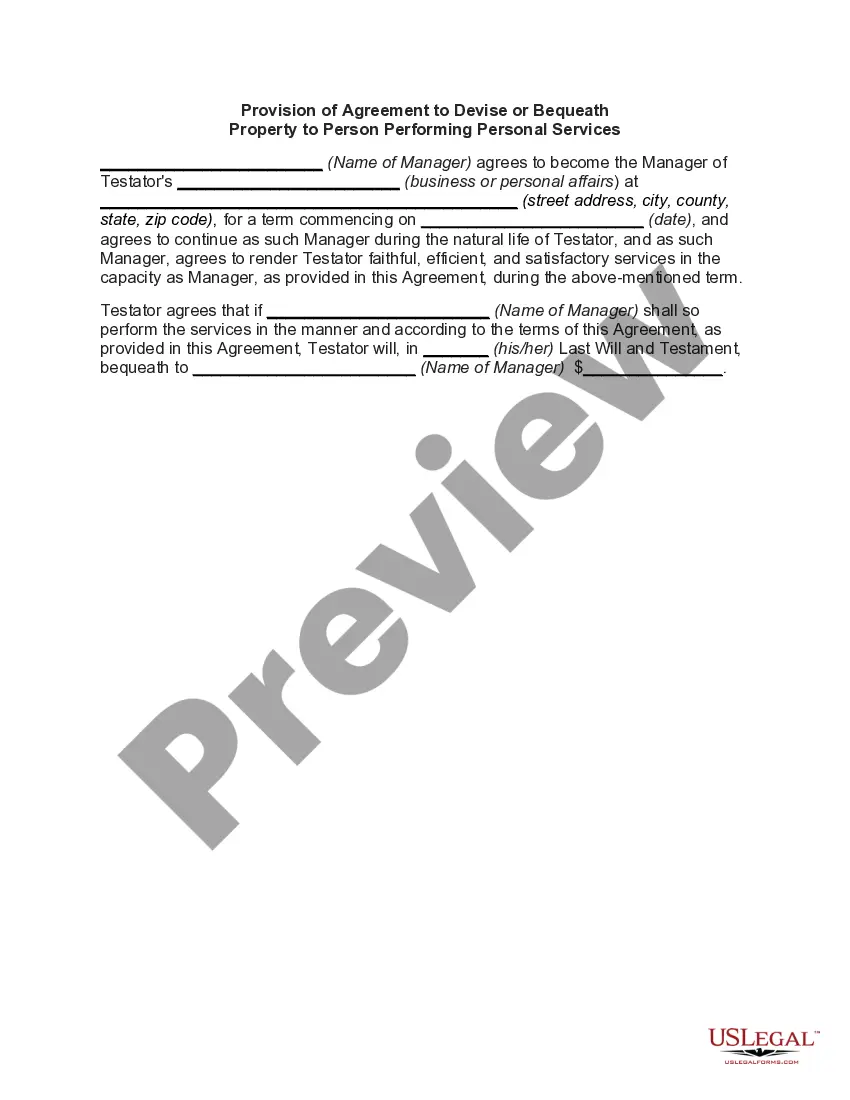

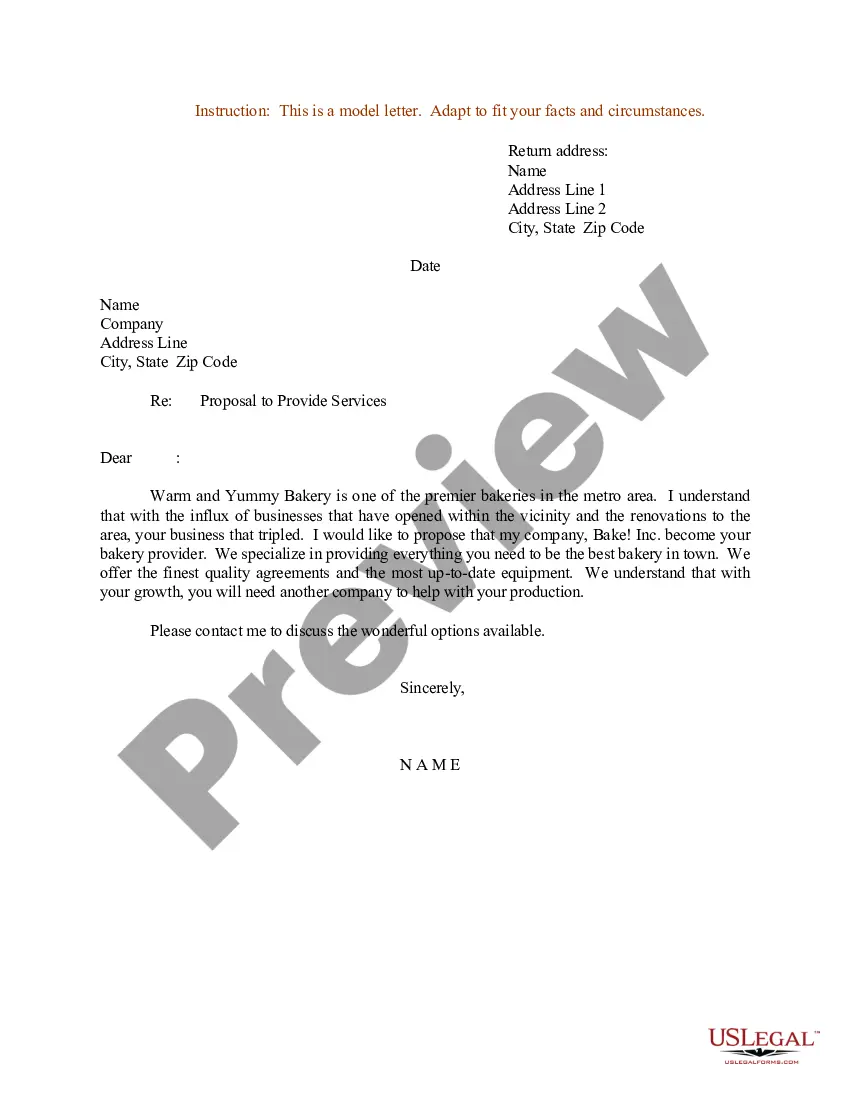

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and check the form details to confirm it is right for you.

- If the form does not meet your needs, utilize the Search section to find the suitable form.

Form popularity

FAQ

To write a Pennsylvania Notice of Default on Promissory Note Installment, start by clearly stating the parties involved and the specifics of the promissory note. Include the date of the note, the amount due, and the payment schedule. Next, indicate that the debtor has defaulted on the payment agreement, allowing them an opportunity to rectify the situation. For a professional touch and to ensure compliance, consider using platforms like US Legal Forms, which provide templates tailored for these legal documents.

To legally enforce a promissory note, start by ensuring the document is valid and contains all necessary elements. If the borrower defaults, you may issue a Pennsylvania Notice of Default on Promissory Note Installment as a preliminary step. If resolution is not achieved, consider filing a lawsuit in a relevant court. Engaging a legal professional can guide you through the enforcement process and protect your rights.

A notice of default on a promissory note is a formal document that informs the borrower of their failure to meet the payment terms agreed upon. This notice outlines the details of the default, including any missed payments and potential consequences. Issuing a Pennsylvania Notice of Default on Promissory Note Installment is an essential step toward recovering the owed amount. It also provides the borrower with a chance to rectify the situation before further actions are taken.

If someone defaults on a promissory note, it's important to act promptly. Begin by communicating with the borrower to discuss the situation and determine if a resolution is possible. Additionally, issuing a Pennsylvania Notice of Default on Promissory Note Installment can help formalize the default. Explore your legal options for enforcement, including seeking professional advice.

If someone defaults on a promissory note, the lender will likely initiate steps to recover the outstanding balance. This may involve sending a Pennsylvania Notice of Default on Promissory Note Installment, which serves as a formal notification of the default status. Delaying response to the notice can lead to further legal actions, making it crucial to address the situation promptly and explore potential remedies.

Remedies for default on a promissory note can include monetary damages, collection of the remaining balance, or acceleration of the total due amount. The lender may also choose to renegotiate the terms of the agreement or pursue legal action to recover the debt. Utilizing a Pennsylvania Notice of Default on Promissory Note Installment effectively can help guide you through the available options and facilitate a resolution.

When you default on a promissory note, the lender typically has the right to take legal action to recover the owed amount. This could include filing a claim to enforce the terms of the note or initiating debt collection procedures. In Pennsylvania, a Notice of Default on Promissory Note Installment is often issued to formally warn you of the outstanding debt, allowing a window for resolution before further action.