A Pennsylvania Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of Pennsylvania. This type of promissory note is commonly used when the borrower commits to repay the loan amount in fixed installment payments over a specified period, with a bank deposit serving as collateral to secure the loan. The Pennsylvania Installment Promissory Note with Bank Deposit as Collateral typically contains essential details such as the names and contact information of both parties (borrower and lender), the loan amount, interest rate, repayment schedule, and any additional terms and conditions agreed upon. This legally binding agreement provides protection for both the borrower and lender, ensuring that the loan is repaid as agreed. There may be different variations of Pennsylvania Installment Promissory Notes with Bank Deposit as Collateral, including: 1. Fixed-Term Installment Promissory Note: This type of promissory note specifies a predetermined loan term during which the borrower is obligated to make regular installment payments to repay the loan amount. The bank deposit serves as collateral and guarantees the lender's security in case of default. 2. Variable-Rate Installment Promissory Note: Unlike the fixed-term installment promissory note, this type of note features an interest rate that may fluctuate periodically based on certain factors such as market conditions. The borrower agrees to repay the loan amount in installments, with the bank deposit acting as collateral to secure the loan. 3. Secured Installment Promissory Note: In this variation, the borrower pledges a bank deposit as collateral to guarantee the repayment of the loan. This provides an additional layer of security for the lender, as they can use the deposited funds in case of default on the loan. 4. Balloon Payment Installment Promissory Note: This type of promissory note includes regular installment payments over the loan term, but with a final "balloon" payment that is typically larger than the previous installments. The bank deposit serves as collateral, and the borrower is required to repay the balance in full on or before the agreed-upon maturity date. It is crucial for both the borrower and lender to carefully review and understand the terms and conditions mentioned in the Pennsylvania Installment Promissory Note with Bank Deposit as Collateral. Consulting with a legal professional can be highly beneficial in drafting or reviewing such agreements to ensure compliance with Pennsylvania state laws and regulations.

Pennsylvania Installment Promissory Note with Bank Deposit as Collateral

Description

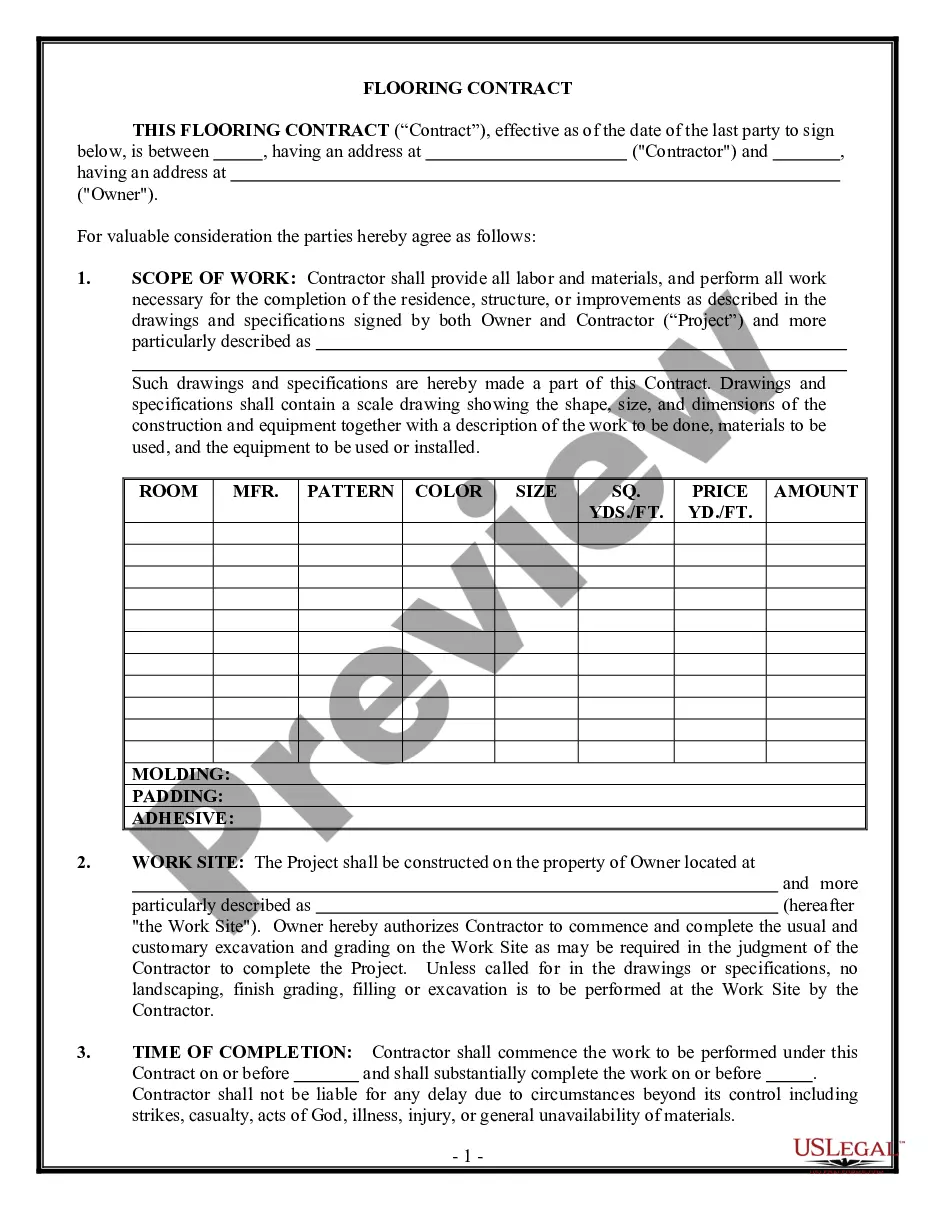

How to fill out Pennsylvania Installment Promissory Note With Bank Deposit As Collateral?

If you have to full, acquire, or print out lawful papers web templates, use US Legal Forms, the greatest assortment of lawful types, which can be found on the Internet. Utilize the site`s basic and hassle-free lookup to get the documents you need. A variety of web templates for business and person functions are sorted by classes and claims, or key phrases. Use US Legal Forms to get the Pennsylvania Installment Promissory Note with Bank Deposit as Collateral with a couple of mouse clicks.

Should you be currently a US Legal Forms consumer, log in in your accounts and click the Obtain button to find the Pennsylvania Installment Promissory Note with Bank Deposit as Collateral. You can even entry types you formerly saved within the My Forms tab of your accounts.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for the correct town/land.

- Step 2. Utilize the Review option to check out the form`s information. Never forget about to read the description.

- Step 3. Should you be not happy with the kind, utilize the Look for field at the top of the display screen to get other models in the lawful kind format.

- Step 4. Upon having located the shape you need, click on the Acquire now button. Pick the prices strategy you like and put your accreditations to sign up for the accounts.

- Step 5. Procedure the deal. You should use your bank card or PayPal accounts to complete the deal.

- Step 6. Pick the file format in the lawful kind and acquire it on the gadget.

- Step 7. Total, modify and print out or indication the Pennsylvania Installment Promissory Note with Bank Deposit as Collateral.

Each and every lawful papers format you purchase is your own for a long time. You might have acces to every single kind you saved inside your acccount. Go through the My Forms area and pick a kind to print out or acquire once again.

Compete and acquire, and print out the Pennsylvania Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms. There are thousands of skilled and condition-distinct types you can utilize for your business or person needs.