Pennsylvania Membership Certificate of Nonprofit or Non Stock Corporation

Description

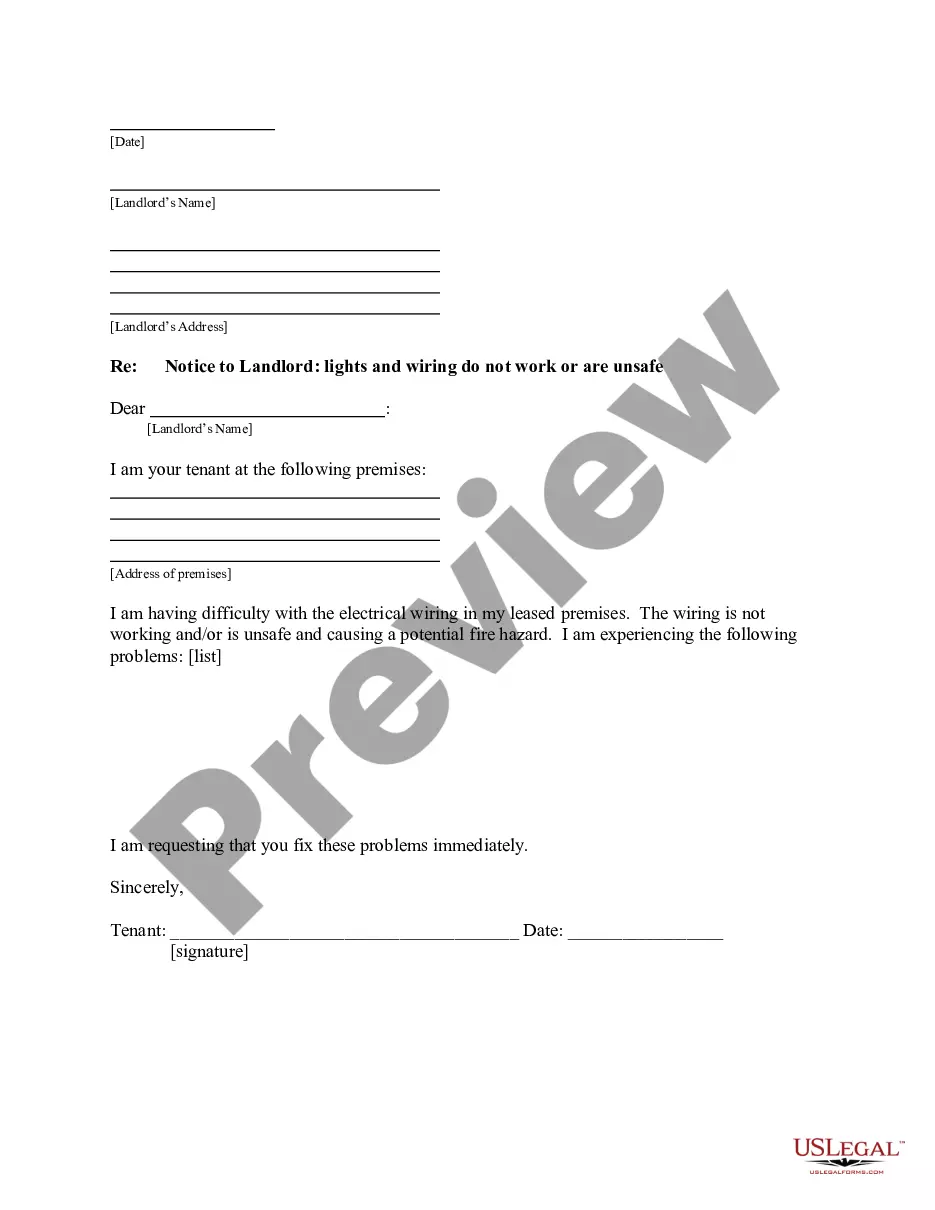

How to fill out Membership Certificate Of Nonprofit Or Non Stock Corporation?

US Legal Forms - one of several biggest libraries of legitimate types in the States - offers a variety of legitimate document templates you can obtain or print. Using the site, you can find a huge number of types for organization and personal reasons, sorted by types, states, or search phrases.You will find the most up-to-date variations of types like the Pennsylvania Membership Certificate of Nonprofit or Non Stock Corporation in seconds.

If you currently have a monthly subscription, log in and obtain Pennsylvania Membership Certificate of Nonprofit or Non Stock Corporation from the US Legal Forms local library. The Obtain switch will appear on every single type you perspective. You get access to all previously delivered electronically types in the My Forms tab of the account.

In order to use US Legal Forms for the first time, listed here are simple directions to help you get started out:

- Make sure you have chosen the best type for the town/region. Click the Preview switch to examine the form`s information. Browse the type description to ensure that you have selected the appropriate type.

- In the event the type doesn`t satisfy your needs, make use of the Research discipline on top of the screen to obtain the one that does.

- If you are satisfied with the form, affirm your selection by visiting the Acquire now switch. Then, select the pricing program you favor and provide your qualifications to register for an account.

- Procedure the transaction. Make use of your bank card or PayPal account to finish the transaction.

- Choose the structure and obtain the form on your own device.

- Make modifications. Fill up, edit and print and indication the delivered electronically Pennsylvania Membership Certificate of Nonprofit or Non Stock Corporation.

Every single template you included with your bank account does not have an expiration date and is also your own forever. So, if you would like obtain or print another copy, just check out the My Forms portion and then click on the type you require.

Obtain access to the Pennsylvania Membership Certificate of Nonprofit or Non Stock Corporation with US Legal Forms, one of the most comprehensive local library of legitimate document templates. Use a huge number of expert and state-particular templates that meet your company or personal needs and needs.

Form popularity

FAQ

Disadvantages of forming a nonprofit corporation Expenses. Forming a statutory nonprofit company requires filing documents with the state business entity filing office - which means filing fees. ... Ongoing compliance obligations. ... Management oversight. ... No lobbying or political campaigning.

At least one person on the board is required for a nonprofit in Pennsylvania. However, it's better to have a minimum of three directors to handle the senior responsibilities in a board (chair, secretary, and treasurer).

Another difference between non-profit corporations and benefit corporations is that the stock certificates of the latter must be clearly marked with the words ?Benefit Corporation.? A non-profit company has no shareholders and therefore no stock certificates.

A prudent way to serve as fiduciaries of a nonprofit's assets may be to invest some portion of the nonprofit's cash in investment vehicles such as stocks and bonds, money market funds, CDs, and other financial instruments.

?Non-stock corporation? refers to a type of legal entity filed with the Secretary of State. A ?non-profit? organization refers to a non-stock corporation that has obtained a tax determination letter from the IRS. Here we sort through these two loaded terms and decipher what they mean, and how they work together.

6 Best Ways to Check Nonprofit Status Ask the charity. As a donor or foundation, the first step to check a nonprofit's status is to ask the charity. ... Internal Revenue Service (IRS) ... GuideStar. ... Charity Navigator. ... Better Business Bureau's Wise Charity Alliance (BBB) ... Checking a church status.

Membership Nonprofits In a membership nonprofit, individuals who support the nonprofit can join the organization as members and become part of the decision-making process. Nonprofit members can elect and vote for new board members and suggest changes to the nonprofit's bylaws.

Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders. But nonprofit organizations do not issue stock or pay dividends.