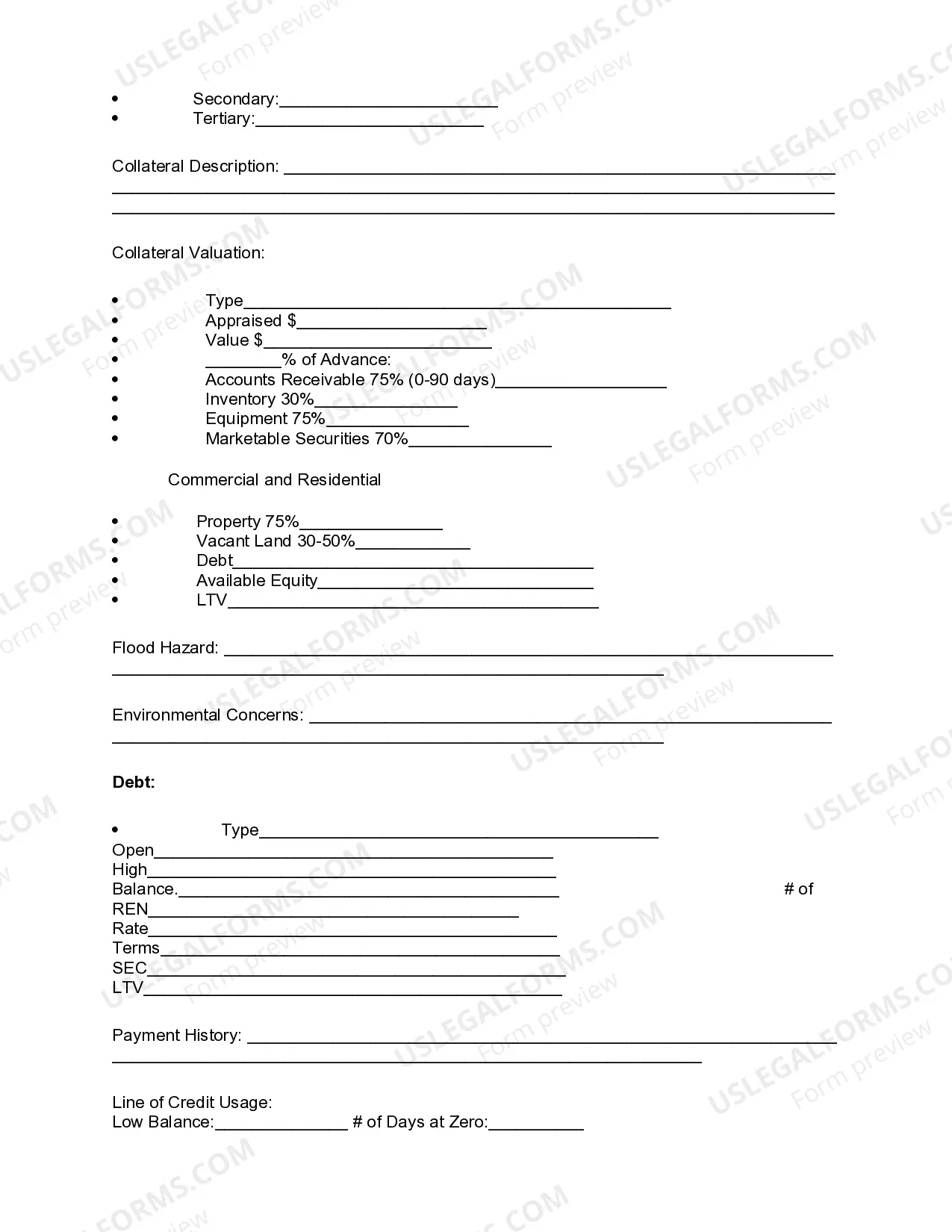

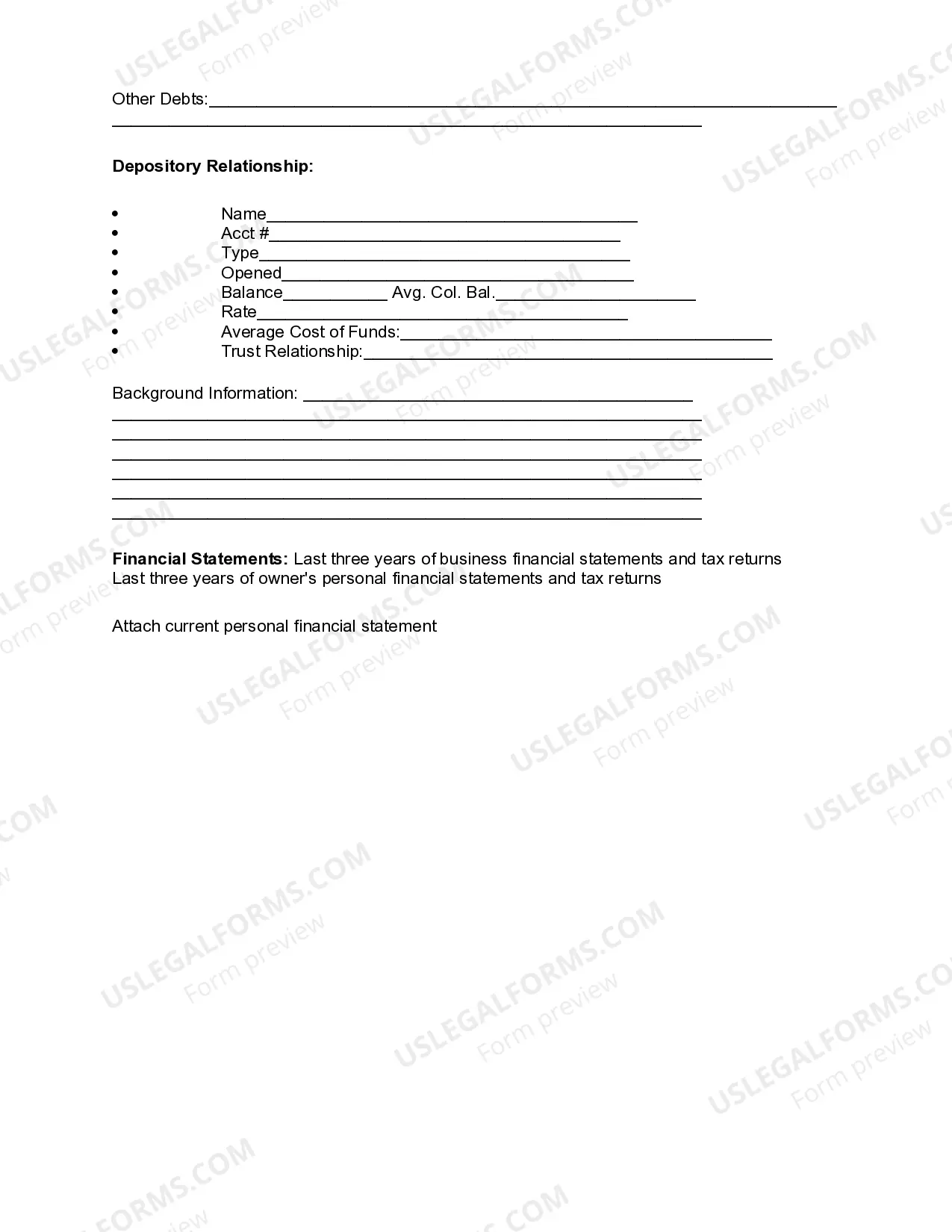

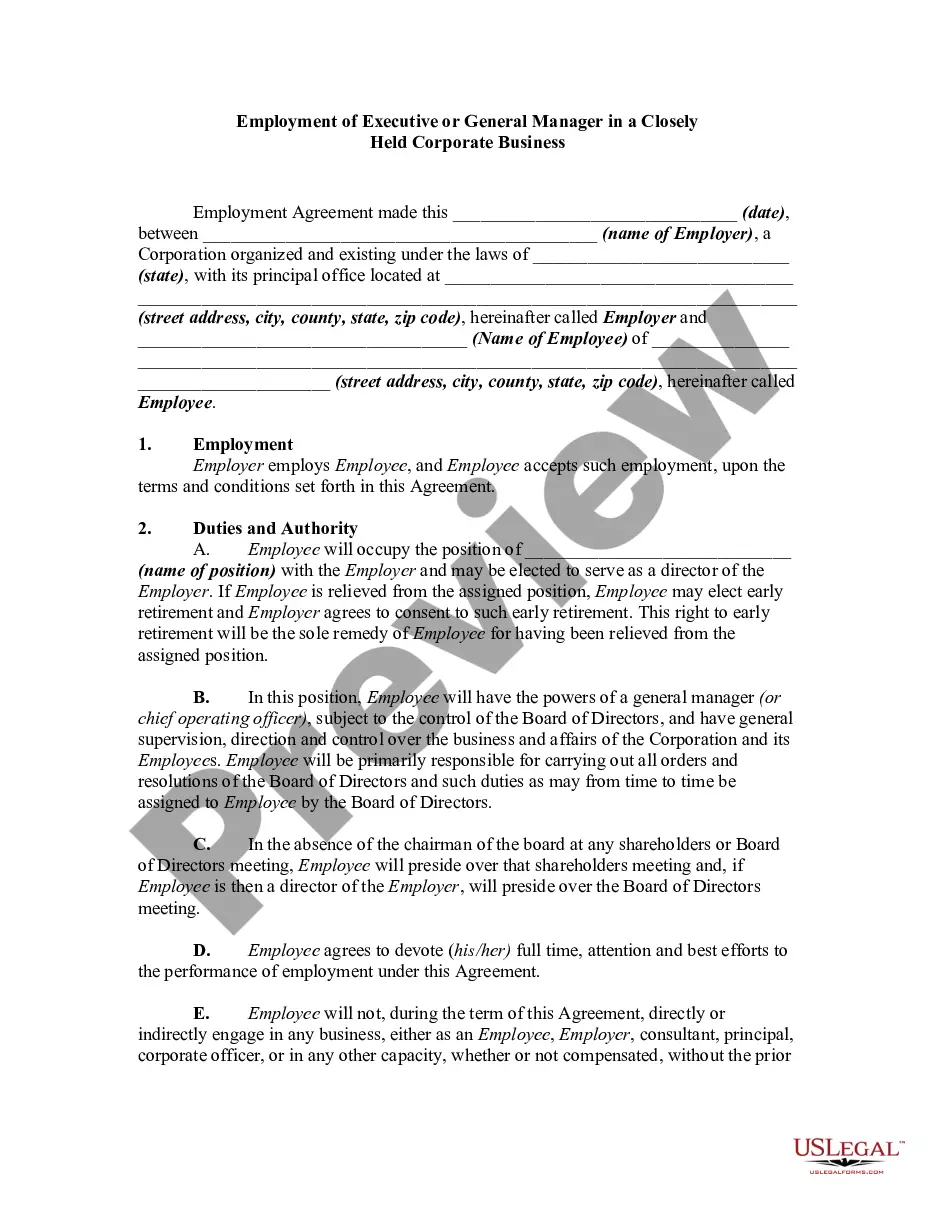

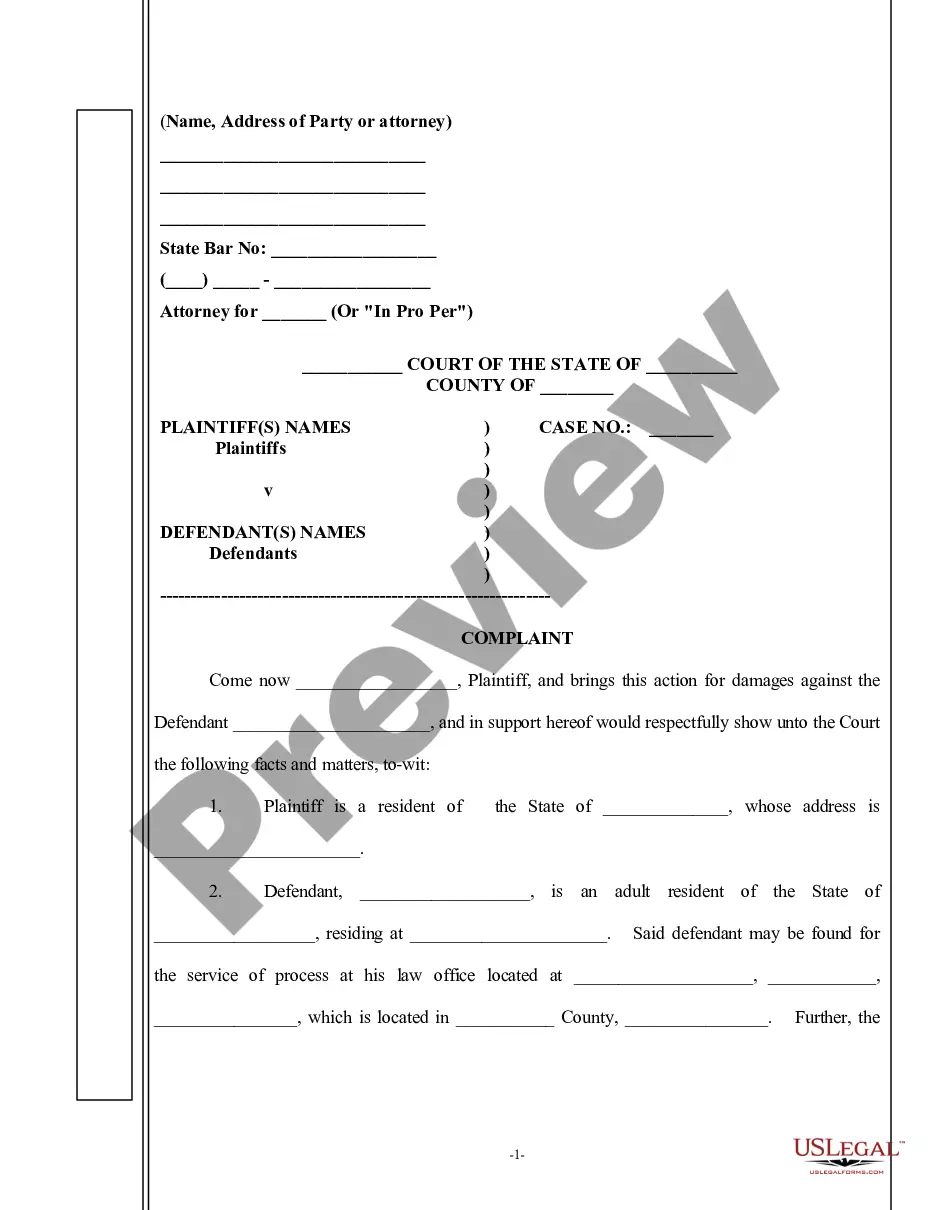

Pennsylvania Review of Loan Application: A Comprehensive Overview of the Loan Application Process in Pennsylvania is a state that follows specific regulations and procedures when it comes to reviewing loan applications. The Pennsylvania Review of Loan Application is a critical step for individuals and businesses seeking financial assistance. It ensures that the loan meets the necessary legal requirements, protects both the borrower and the lender, and ensures transparency in the lending process. The Pennsylvania Review of Loan Application involves a thorough examination of multiple aspects of the loan application, including the borrower's financial information, credit history, collateral, and the proposed loan agreement. It aims to assess the borrower's ability to repay the loan, the appropriateness of the loan terms, and the overall risk involved in granting the loan. Types of Pennsylvania Review of Loan Application: 1. Residential Mortgage Loan Application Review: This type of review is specific to individuals looking to secure a mortgage for purchasing a residential property in Pennsylvania. Lenders examine the borrower's credit score, income, employment history, debt-to-income ratio, and additional documentation. The review ensures that the borrower meets the standards set by federal and state mortgage regulations, such as the Truth in Lending Act and the Real Estate Settlement Procedures Act. 2. Small Business Loan Application Review: For entrepreneurs and small business owners seeking financial support in Pennsylvania, this review focuses on the specific requirements and financial information relevant to the business. Lenders evaluate the business's financial statements, cash flow projections, business plan, personal credit history, collateral, and other factors. The review ensures that the loan application complies with the state's lending laws, promotes responsible borrowing, and fosters economic growth. 3. Commercial Loan Application Review: This type of review applies to larger business entities or corporations seeking substantial loans for commercial purposes in Pennsylvania. Lenders scrutinize the borrower's financial statements, business credit history, market analysis, management team qualifications, and the potential collateral offered. The review ensures that the loan aligns with the borrower's business goals, demonstrates realistic growth opportunities, and complies with the state's lending regulations. During the Pennsylvania Review of Loan Application, lenders typically work hand in hand with borrowers to clarify any uncertainties, gather additional documentation, and assess potential risks. The review process may involve conducting a property appraisal, securing title insurance, verifying employment and income, and obtaining credit reports. The Pennsylvania Review of Loan Application aims to protect both lenders and borrowers by ensuring compliance with state and federal regulations, verifying the borrower's creditworthiness, and assessing the overall feasibility of the loan. It plays a crucial role in fostering responsible lending practices, mitigating potential risks, and enabling individuals and businesses to access the capital they need to achieve their goals while maintaining a sound financial system in Pennsylvania.

Pennsylvania Review of Loan Application

Description

How to fill out Pennsylvania Review Of Loan Application?

If you wish to comprehensive, acquire, or print lawful file templates, use US Legal Forms, the greatest collection of lawful varieties, which can be found on the web. Make use of the site`s simple and easy hassle-free research to find the paperwork you will need. Numerous templates for company and person uses are sorted by categories and states, or keywords. Use US Legal Forms to find the Pennsylvania Review of Loan Application with a handful of click throughs.

Should you be already a US Legal Forms consumer, log in to your accounts and click the Down load button to get the Pennsylvania Review of Loan Application. Also you can entry varieties you earlier saved from the My Forms tab of the accounts.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for that right area/country.

- Step 2. Make use of the Review method to check out the form`s articles. Never forget about to read the outline.

- Step 3. Should you be not happy together with the kind, use the Research area on top of the screen to locate other variations from the lawful kind design.

- Step 4. After you have identified the form you will need, click on the Purchase now button. Pick the prices plan you choose and put your qualifications to register for the accounts.

- Step 5. Process the transaction. You should use your charge card or PayPal accounts to complete the transaction.

- Step 6. Find the structure from the lawful kind and acquire it on the gadget.

- Step 7. Complete, edit and print or indication the Pennsylvania Review of Loan Application.

Every single lawful file design you get is the one you have eternally. You have acces to each kind you saved inside your acccount. Click on the My Forms area and choose a kind to print or acquire once more.

Remain competitive and acquire, and print the Pennsylvania Review of Loan Application with US Legal Forms. There are thousands of professional and status-specific varieties you may use for your personal company or person needs.

Form popularity

FAQ

Loan application volume (how many mortgages a lender is processing at once) The complexity of your loan profile (for example, someone with issues in their credit history might take longer to approve than someone with an ultra-clean credit report)

Generally, there are two types of loan reviews: The first is a compliance review, in which the goal is to make sure all regulatory requirements have been met and the associated documentation is complete and in order. The second?and more common?type of review is for safety and soundness.

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: ? Assesses individual loans, including repayment risks.

When a loan application is under review or pending approval from a lender, it means that the lender is evaluating the borrower's creditworthiness and financial situation to determine whether they are eligible for a loan.

Typically, a loan review is conducted on commercial loan files, either internally by bank or credit union staff, or by hired third-party auditors. These investigators check for completeness of loan documentation and/or evaluate loan performance.

Getting approved for a personal loan generally takes anywhere from one day to one week. As we mentioned above, how long it takes for a personal loan to go through depends on several factors, like your credit score. However, one of the primary factors that will affect your approval time is where you get your loan from.

If your information is complete, it may take up to 4 to 6 weeks for PHEAA to verify or determine your eligibility. Student information is processed in order of date received.

A credit review?also known as account monitoring or account review inquiry?is a periodic assessment of an individual's or business's credit profile. Creditors?such as banks, financial services institutions, credit bureaus, settlement companies, and credit counselors?may conduct credit reviews.