Pennsylvania Checklist - Partnership Agreement

Description

The partnership agreement is the heart of the partnership, and it must be enforced as written, with very few exceptions. Partners' rights are determined by the partnership agreement. If the agreement is silent regarding a matter, the parties' rights are typically determined by the UPA.

How to fill out Checklist - Partnership Agreement?

Finding the appropriate legal document template can be challenging. Certainly, there are numerous layouts available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This platform offers a vast selection of templates, such as the Pennsylvania Checklist - Partnership Agreement, suitable for both business and personal purposes.

All forms are reviewed by professionals and comply with both federal and state regulations.

Once you are confident that the form is appropriate, click the Purchase now button to obtain it. Select the pricing plan you prefer and enter the required details. Create your account and complete your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, edit, print, and sign the received Pennsylvania Checklist - Partnership Agreement. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize this service to download professionally crafted documents that adhere to state requirements.

- If you are already a registered user, Log In to your account and click the Download button to obtain the Pennsylvania Checklist - Partnership Agreement.

- Use your account to browse the legal forms you have previously ordered.

- Go to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

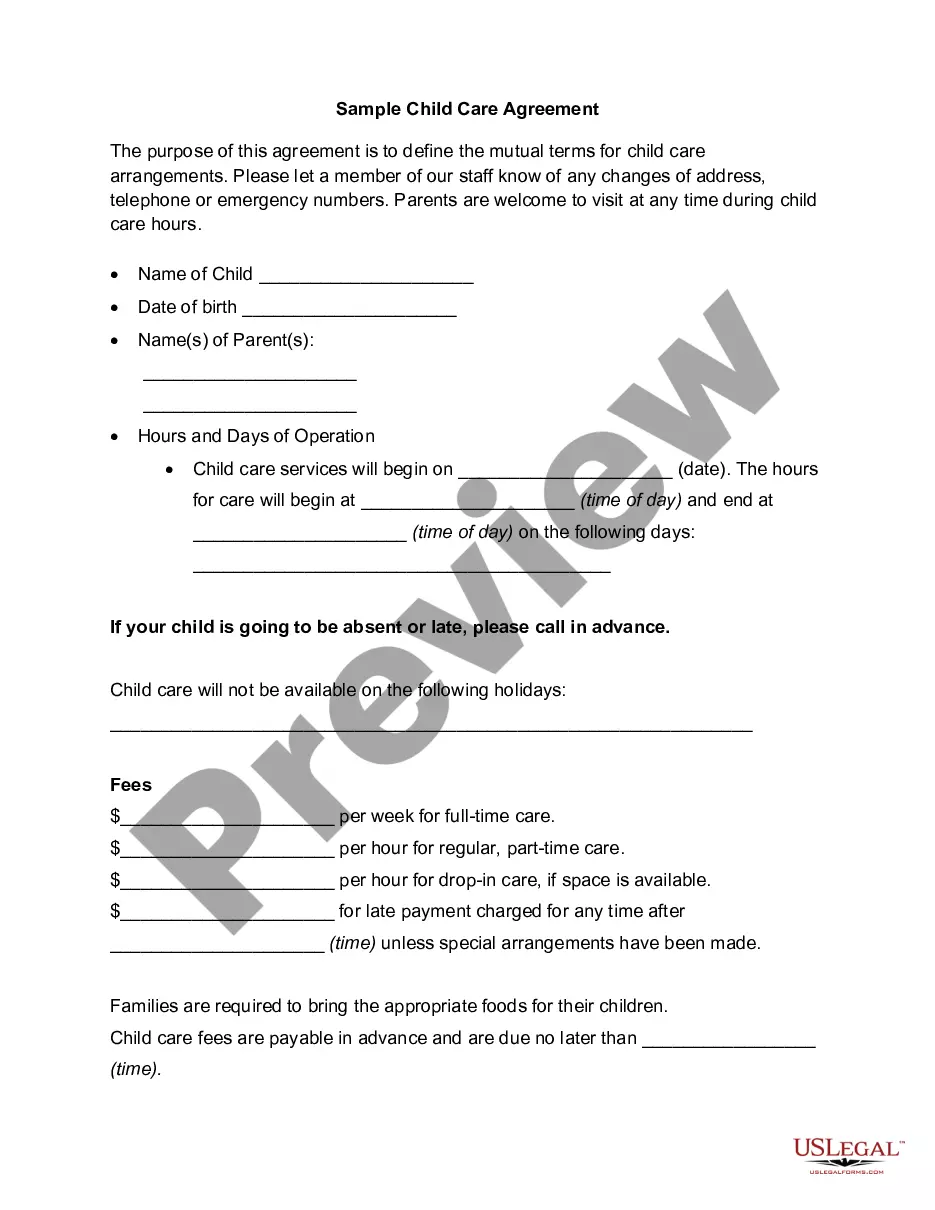

- First, ensure you have chosen the correct form for your city/state. You can view the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the right one.

Form popularity

FAQ

Forming a partnership in Pennsylvania requires you to follow several steps. First, choose a suitable business name and ensure it complies with state regulations. Next, outline your partnership agreement, paying attention to the Pennsylvania Checklist - Partnership Agreement to ensure comprehensive coverage of important topics. Finally, consider registering your partnership with the appropriate state departments.

Creating a partnership agreement sample involves drafting a document that outlines key elements of a partnership. Begin with the title and define the roles, responsibilities, and financial responsibilities of each partner. Ensure the sample addresses how decisions will be made and how disputes will be settled. The Pennsylvania Checklist - Partnership Agreement can be a valuable tool for structuring your sample properly.

Filling out a partnership form involves accurately entering essential information. Start with the names and addresses of the partners, followed by details about the business operations and financial arrangements. Make sure to clarify each partner's responsibilities and how disputes will be resolved. To assist you in this process, refer to the Pennsylvania Checklist - Partnership Agreement.

Writing a simple partnership agreement starts by clearly stating the partnership's purpose and structure. Use straightforward language to outline the roles of each partner, how profits will be shared, and how decisions will be made. Avoid jargon to ensure all parties understand the document. The Pennsylvania Checklist - Partnership Agreement can guide you in crafting a straightforward yet effective agreement.

A comprehensive partnership agreement should include several key elements. Identify the names of the partners, the business name, and the nature of the partnership. Additionally, address profit distribution, decision-making processes, and procedures for new partners joining or existing partners leaving. The Pennsylvania Checklist - Partnership Agreement simplifies this by ensuring you do not miss any critical components.

Filling out a partnership agreement requires attention to detail and clarity. Begin by entering basic information such as the names, addresses, and roles of each partner. Next, populate sections that address financial details, operational processes, and withdrawal procedures. The Pennsylvania Checklist - Partnership Agreement can streamline this process by providing necessary fields you may need to include.

To write a 50/50 partnership agreement, start by clearly stating the equal ownership structure. Discuss how profits and responsibilities will be shared equally between the partners. It is also important to specify how decisions will be made and how conflicts will be resolved. Utilizing the Pennsylvania Checklist - Partnership Agreement can help ensure all crucial topics are addressed.

Completing a partnership agreement involves several key steps. First, define the partnership structure, including the roles of each partner. Then, outline the terms regarding profit sharing, decision-making, and dispute resolution. Finally, use the Pennsylvania Checklist - Partnership Agreement to ensure you cover all necessary components.

Limited partnerships in Pennsylvania are not exempt from registration. In fact, they must file registration documents with the state to operate legally. The Pennsylvania Checklist - Partnership Agreement can provide guidance on the necessary steps and legal requirements for your limited partnership registration.

Yes, Pennsylvania recognizes domestic partnerships, offering legal rights to partners living together. However, the legal framework can differ compared to traditional marriage. If you are considering a domestic partnership, refer to the Pennsylvania Checklist - Partnership Agreement to understand your rights and obligations within this arrangement.