Pennsylvania Location Worksheet

Description

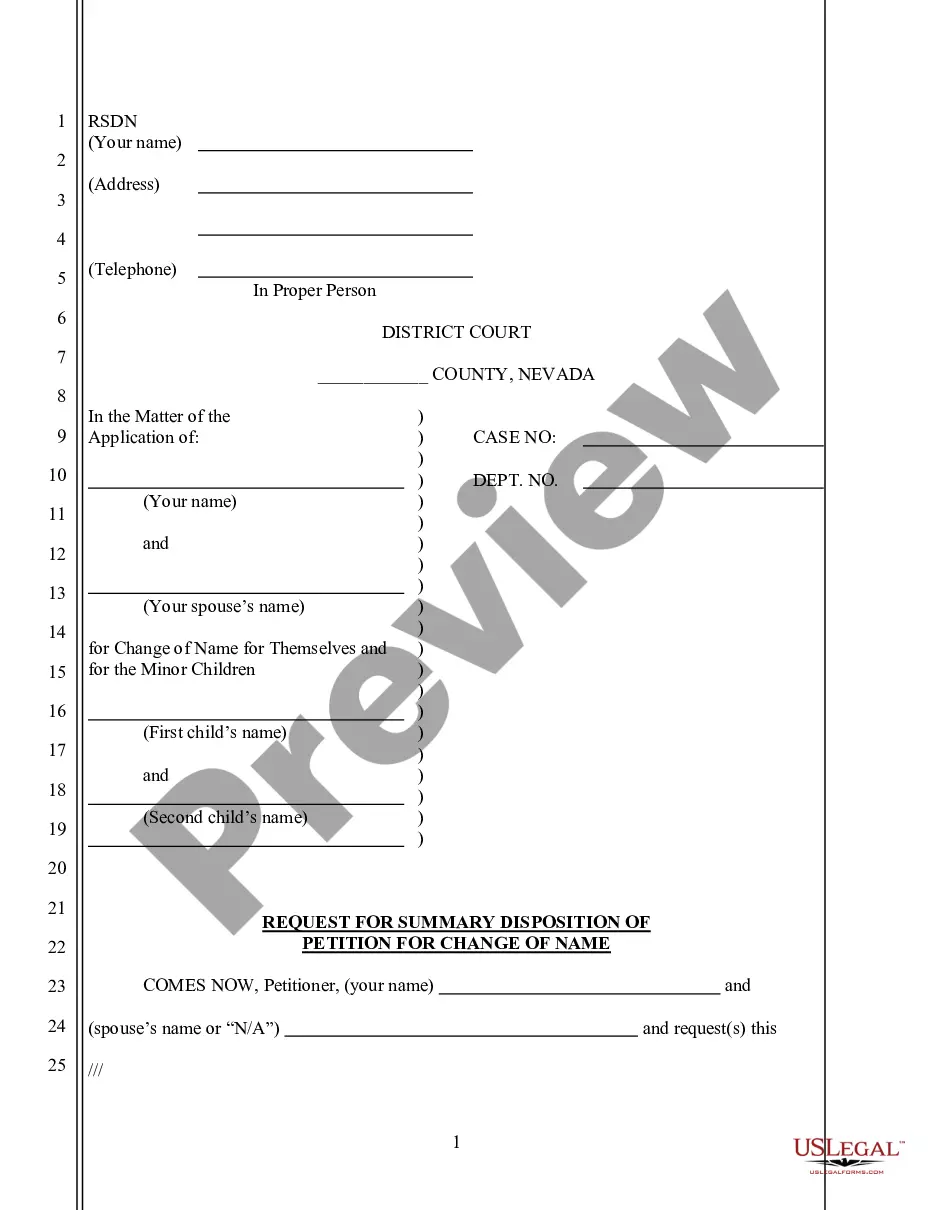

How to fill out Location Worksheet?

Are you currently in a situation where you require documents for either professional or personal purposes on a daily basis? There are numerous authentic document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of document templates, such as the Pennsylvania Location Worksheet, that are tailored to meet state and federal requirements.

If you are familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Pennsylvania Location Worksheet template.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Pennsylvania Location Worksheet at any time if needed. Just select the necessary form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Acquire the form you need and ensure it is for your specific city/region.

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the correct form, click on Buy now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Forgetting to file local taxes in Pennsylvania can lead to penalties and interest on the amount owed. It's important to file as soon as you realize the mistake to minimize potential consequences. Using resources like the Pennsylvania Location Worksheet simplifies determining what you owe and helps ensure compliance. If needed, consider seeking assistance from professionals who can guide you through the corrective process.

In Pennsylvania, local income tax usually depends on where you work, not where you live. However, many municipalities impose their taxes, which can create confusion. To navigate this complexity, the Pennsylvania Location Worksheet is a valuable tool to help you understand your specific local tax obligations. Always ensure you're aware of taxes in both locations to avoid any surprises.

Filing your PA state taxes on myPATH is a straightforward process. First, create an account or log in to the myPATH system. You'll be guided through filing your PA-40 form and can utilize the Pennsylvania Location Worksheet to help identify your local tax rate easily. This simplifies your filing experience, helping you stay organized and accurate.

The PA-40 form is Pennsylvania's individual income tax return, essential for residents and part-year residents. This form allows you to report your income, claim deductions, and calculate your tax due. As you prepare your taxes, you might find the Pennsylvania Location Worksheet helpful for determining your local tax obligations. Using the correct form ensures you remain compliant with state regulations.

The PA Local Services Tax (LST) is primarily based on where you work, not where you live. If you work in a municipality that imposes this tax, you are responsible for the tax, regardless of your residency. It is crucial to understand your local tax jurisdiction to avoid underpayment. The Pennsylvania Location Worksheet can assist you in navigating these tax responsibilities effectively.

When writing Pennsylvania, you should begin with a capital 'P' and 'A' to denote its official state abbreviation. Additionally, ensure to follow standard grammar rules and format it appropriately within your context. Whether you are drafting a formal document or addressing a letter, clarity is key. The Pennsylvania Location Worksheet can also provide essential information about localities within the state.

Failing to file local taxes in Pennsylvania could result in penalties and interest on unpaid taxes. Local jurisdictions in PA take tax compliance seriously, and you may face collection actions if you ignore your obligations. It is vital to file your returns, even if you owe no taxes, to avoid complications. Utilizing the Pennsylvania Location Worksheet can help clarify what you owe and ensure you stay compliant.

To fill out the PA W-2 Reconciliation Worksheet, start by gathering all your W-2 forms from employers. Enter your total wages and withholdings as indicated on these forms. Ensure accuracy in reporting your local income taxes, as this worksheet is essential for reconciling any discrepancies. The Pennsylvania Location Worksheet will guide you through the process, making it easier to understand your local tax obligations.