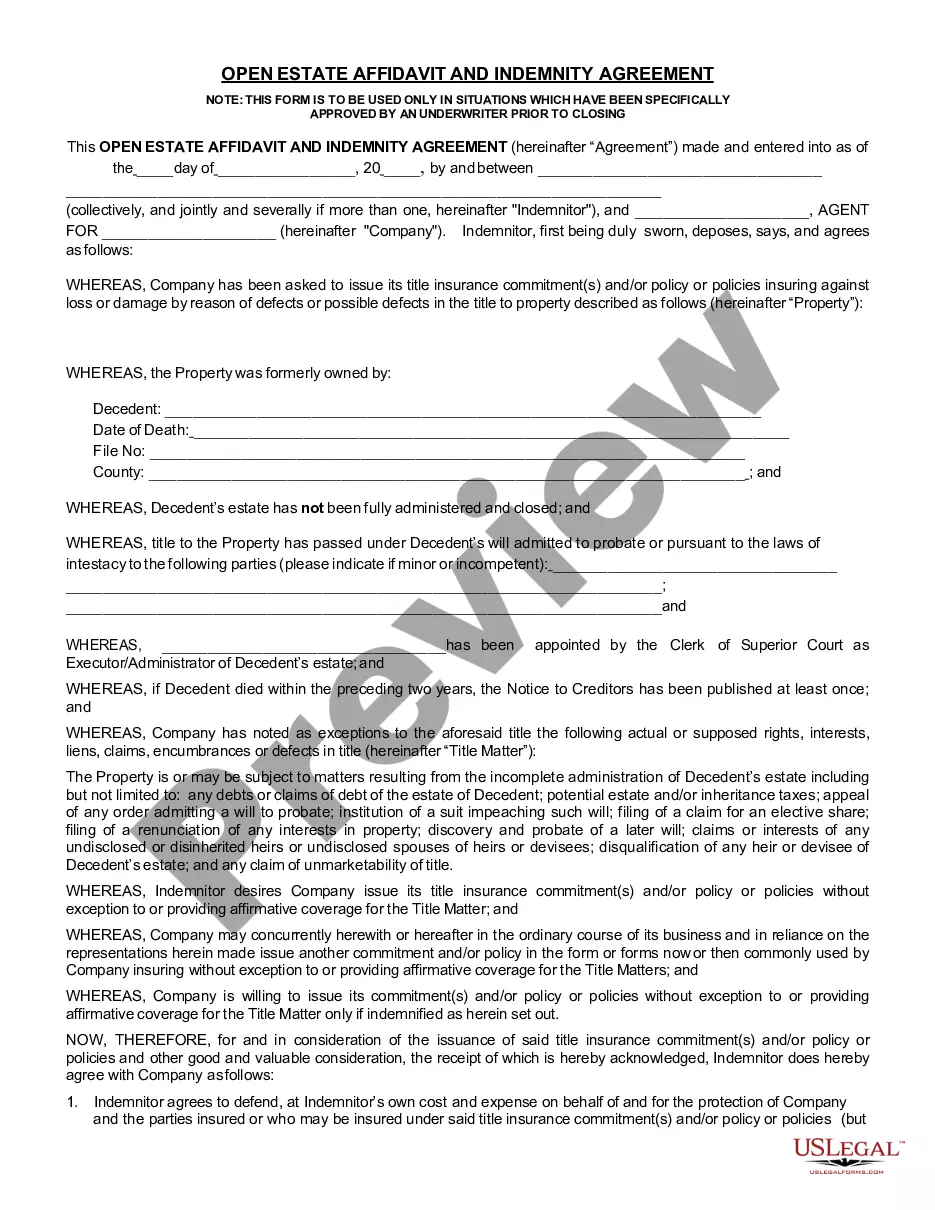

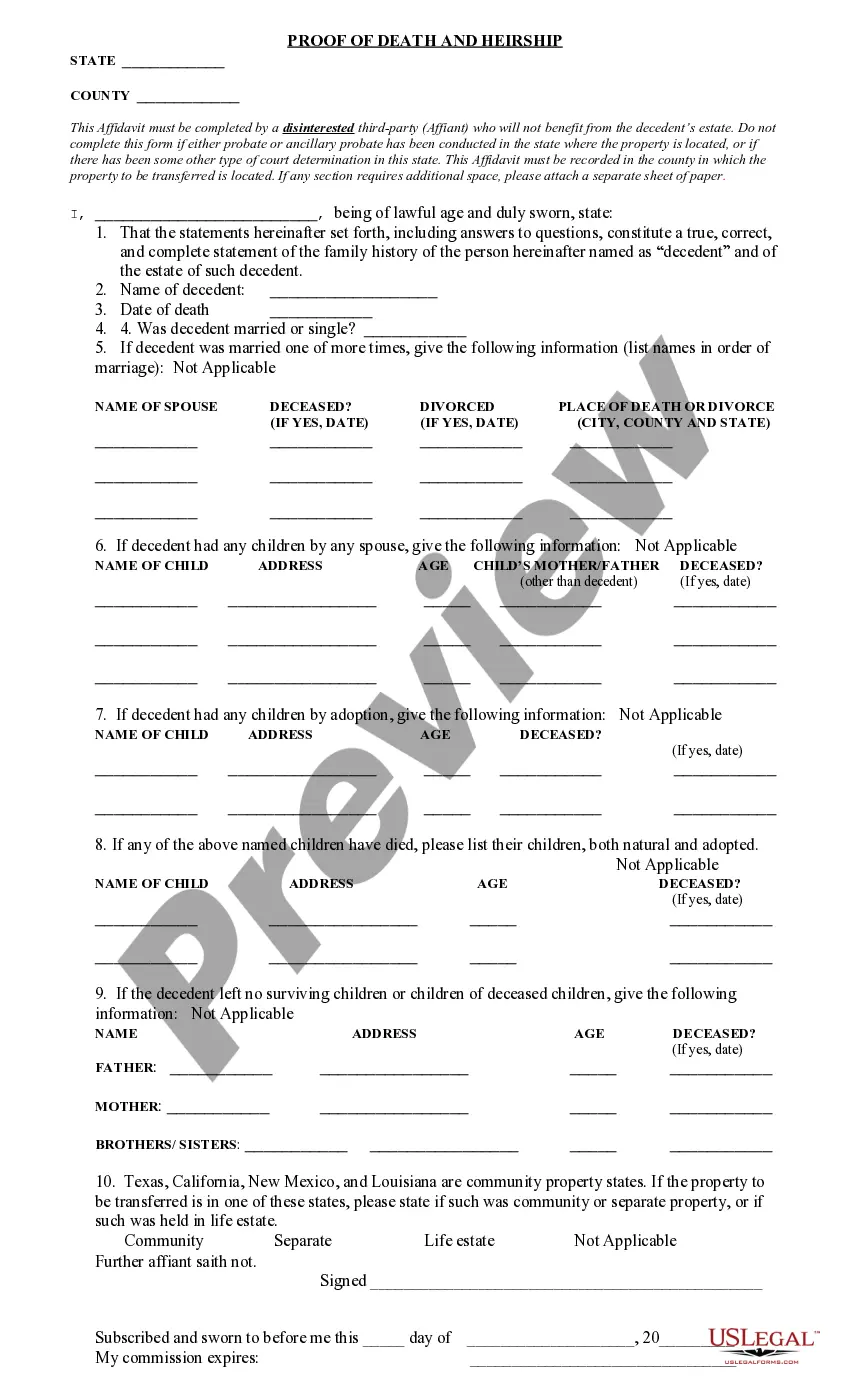

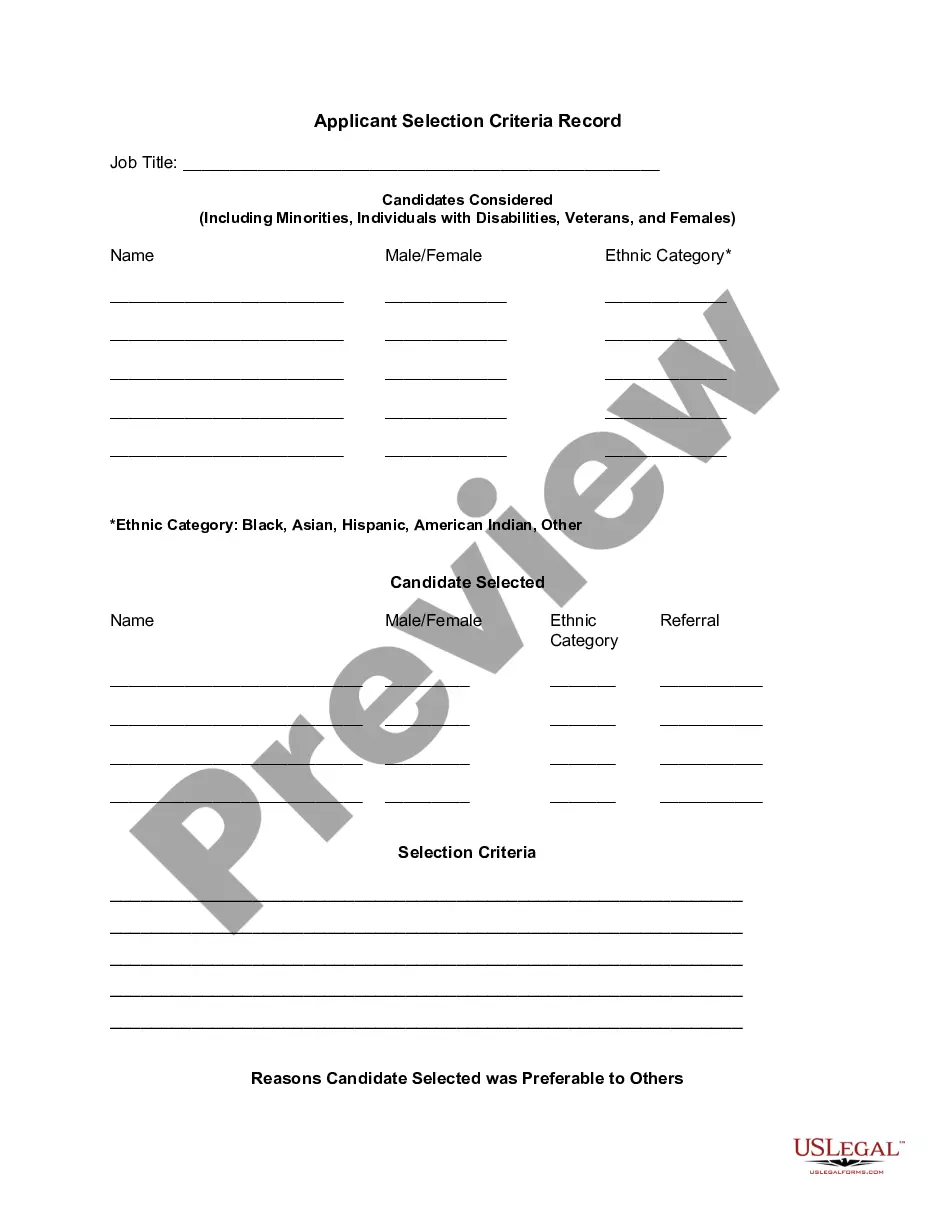

Have you been within a situation that you need to have files for either company or person reasons almost every time? There are tons of legitimate papers templates available on the Internet, but locating versions you can rely on is not straightforward. US Legal Forms provides a large number of kind templates, just like the Pennsylvania Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement, which can be published in order to meet federal and state demands.

If you are previously informed about US Legal Forms internet site and possess your account, just log in. Next, you are able to down load the Pennsylvania Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement web template.

Should you not provide an account and wish to begin using US Legal Forms, follow these steps:

- Discover the kind you require and make sure it is for the appropriate town/region.

- Use the Review option to analyze the form.

- Browse the explanation to ensure that you have chosen the appropriate kind.

- In case the kind is not what you are looking for, utilize the Search field to find the kind that suits you and demands.

- When you find the appropriate kind, just click Acquire now.

- Select the prices plan you would like, complete the necessary info to produce your account, and pay for the order using your PayPal or Visa or Mastercard.

- Decide on a handy document file format and down load your backup.

Find all of the papers templates you may have bought in the My Forms food selection. You can get a more backup of Pennsylvania Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement any time, if required. Just click on the essential kind to down load or print out the papers web template.

Use US Legal Forms, by far the most substantial collection of legitimate kinds, to save lots of some time and avoid faults. The support provides appropriately created legitimate papers templates that can be used for a selection of reasons. Create your account on US Legal Forms and start producing your daily life a little easier.