Pennsylvania Sample Letter for Tax Clearance Letters is a document that serves as proof of a person or organization's compliance with Pennsylvania tax obligations. It is often required in various situations, such as when a business is transferring ownership, selling assets, dissolving, or merging. The Pennsylvania Department of Revenue provides templates for different types of Tax Clearance Letters to ensure clear communication and standardization. Let's explore the key types: 1. Business Transfer Tax Clearance Letter: This type of letter is used when a business is changing ownership, either through a sale or transfer. It demonstrates that the current owner has fulfilled their tax obligations, and the new owner will assume the responsibility for any outstanding taxes. This letter is important for legal and financial purposes, ensuring a smooth transition of ownership. 2. Asset Sale Tax Clearance Letter: When a business is selling its assets, especially in cases of substantial sales or liquidations, an Asset Sale Tax Clearance Letter is needed. It verifies that the current owner has satisfied tax liabilities related to the assets being sold. This allows the buyer to ensure the absence of any tax claims or pending obligations associated with the purchased assets. 3. Business Dissolution Tax Clearance Letter: In the event of a business dissolution, a Business Dissolution Tax Clearance Letter is required. It confirms that the entity has fulfilled its tax obligations up until the date of dissolution. The letter enables the dissolution process to conclude smoothly without any outstanding tax issues, protecting both the business and its owners from future liability concerns. 4. Merger or Acquisition Tax Clearance Letter: A Merger or Acquisition Tax Clearance Letter is crucial when two businesses merge or one acquires another. It certifies that both companies involved have complied with their respective tax responsibilities and have no pending liabilities. The letter ensures a seamless transition and minimizes any potential tax-related complications arising from the merger or acquisition. All the above letters should contain specific information to be deemed valid. This includes the taxpayer's identification details, a clear statement of compliance with Pennsylvania tax obligations, a summary of any outstanding tax liabilities, and contact information for the authorized representative. It is essential to use the provided sample letters by the Pennsylvania Department of Revenue to ensure accuracy and acceptance by relevant authorities. Obtaining the appropriate Pennsylvania Sample Letter for Tax Clearance Letters is crucial to demonstrate compliance and facilitate various business processes. It is recommended to consult with legal and tax professionals, as well as referring to the Pennsylvania Department of Revenue's website, for up-to-date information and guidance.

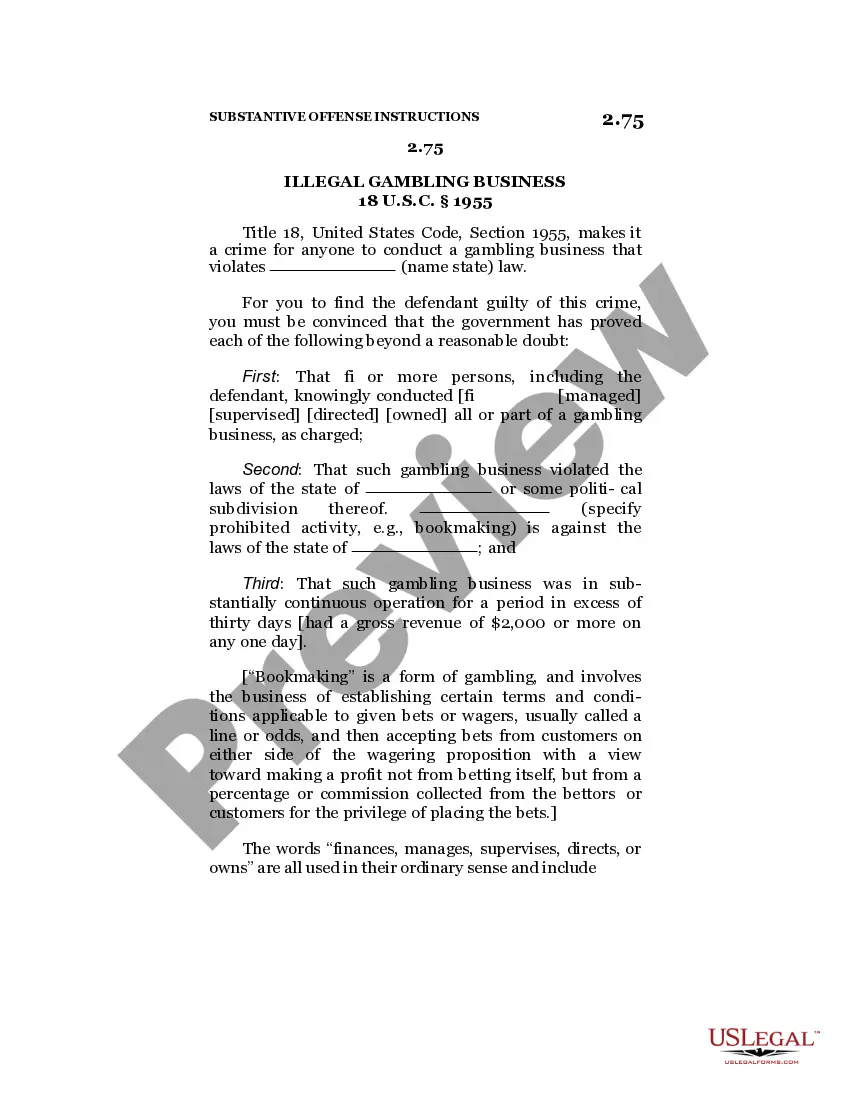

Pennsylvania Sample Letter for Tax Clearance Letters

Description

How to fill out Pennsylvania Sample Letter For Tax Clearance Letters?

Are you within a position where you need to have papers for either enterprise or person reasons virtually every day time? There are tons of legitimate document layouts available online, but finding versions you can rely on isn`t straightforward. US Legal Forms offers a large number of kind layouts, much like the Pennsylvania Sample Letter for Tax Clearance Letters, that happen to be written in order to meet state and federal requirements.

Should you be currently familiar with US Legal Forms site and possess a free account, merely log in. After that, you can down load the Pennsylvania Sample Letter for Tax Clearance Letters template.

If you do not provide an accounts and wish to begin using US Legal Forms, follow these steps:

- Discover the kind you require and make sure it is for the appropriate city/area.

- Make use of the Review option to analyze the form.

- Read the explanation to ensure that you have chosen the proper kind.

- If the kind isn`t what you`re looking for, utilize the Search field to obtain the kind that fits your needs and requirements.

- If you obtain the appropriate kind, click on Acquire now.

- Select the prices strategy you would like, complete the specified info to produce your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file format and down load your backup.

Get all of the document layouts you may have bought in the My Forms food selection. You can obtain a more backup of Pennsylvania Sample Letter for Tax Clearance Letters whenever, if necessary. Just go through the needed kind to down load or print out the document template.

Use US Legal Forms, probably the most extensive assortment of legitimate varieties, to save lots of time and prevent errors. The services offers expertly created legitimate document layouts that you can use for an array of reasons. Make a free account on US Legal Forms and begin generating your daily life easier.