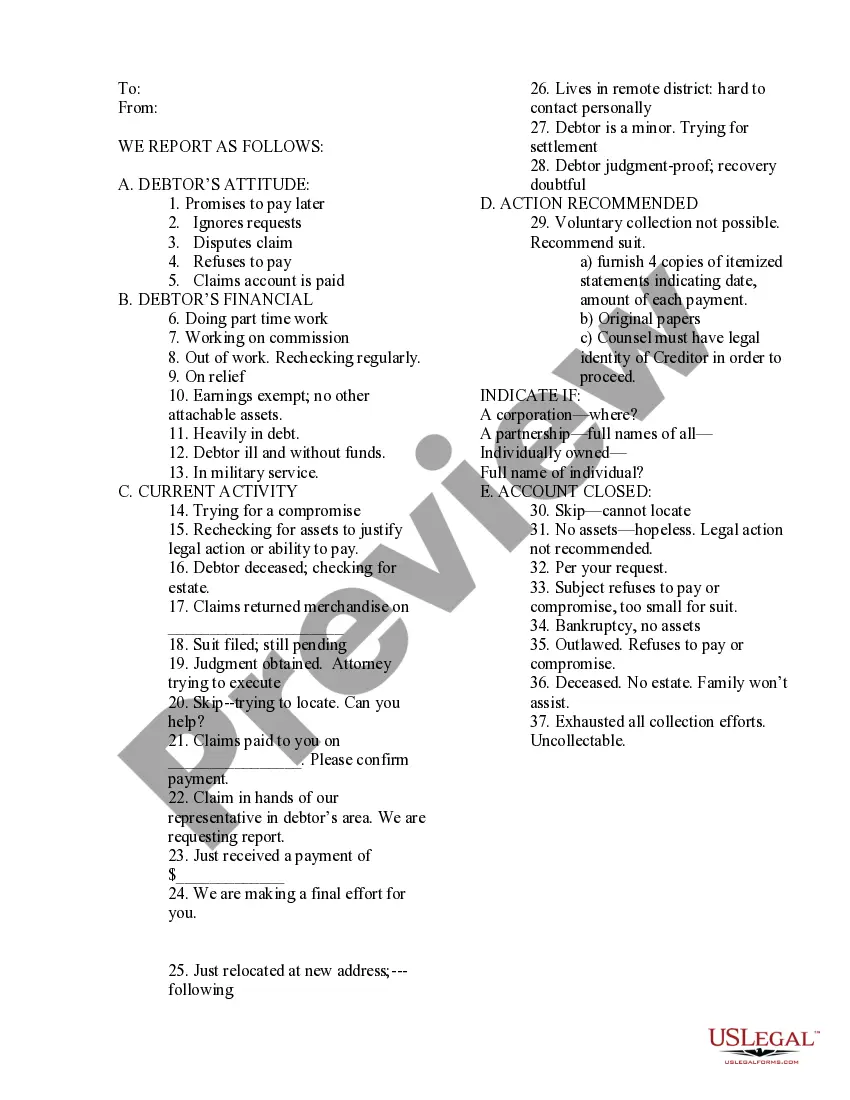

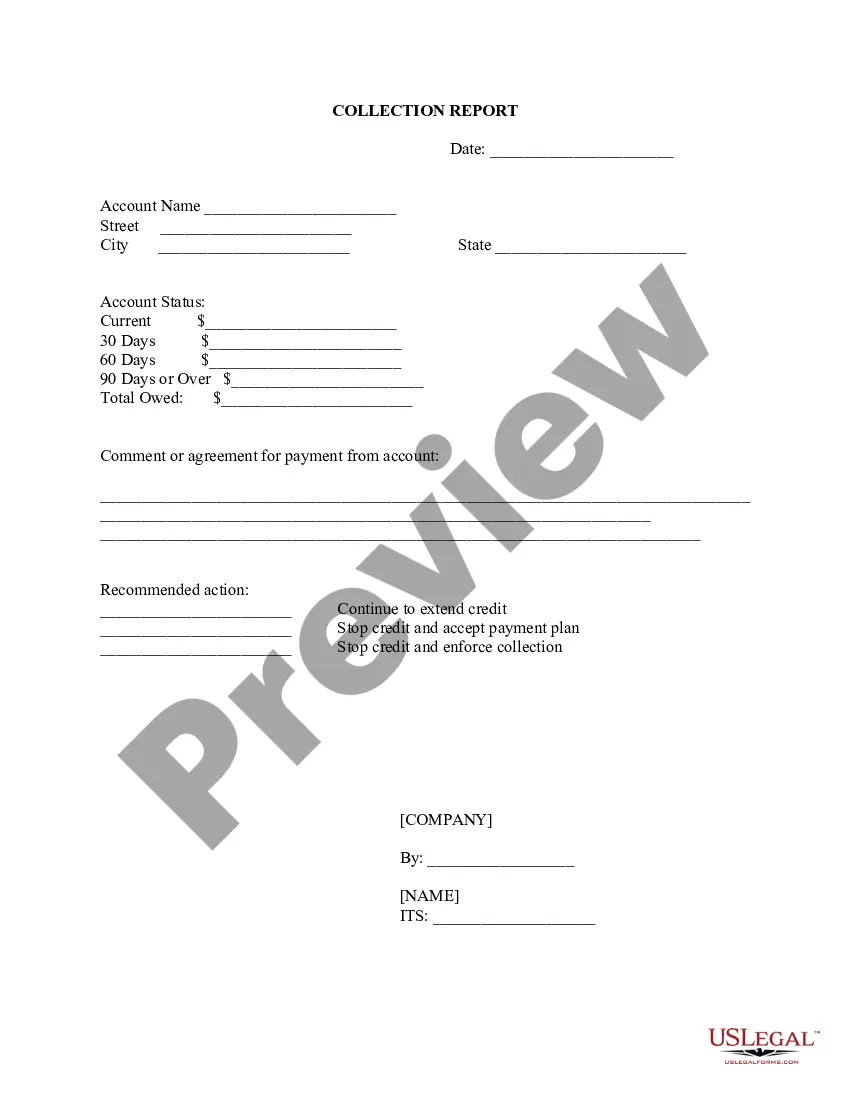

This is a form to track progress on a delinquent customer account and to record collection efforts.

Pennsylvania Delinquent Account Collection History

Description

How to fill out Delinquent Account Collection History?

Have you ever been in a location where you require documentation for possibly business or personal reasons almost daily.

There are numerous legal document forms available online, but finding ones you can rely on isn't easy.

US Legal Forms offers an extensive selection of form templates, such as the Pennsylvania Delinquent Account Collection History, designed to meet federal and state regulations.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete your purchase using PayPal or a credit card.

Choose a suitable file format and download your copy. Access all the forms you have purchased in the My documents section. You can obtain an additional copy of the Pennsylvania Delinquent Account Collection History anytime, if needed. Just select the desired form to download or print the template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides professionally created legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Delinquent Account Collection History template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Choose the form you need and ensure it corresponds to the correct city/region.

- Use the Preview button to review the form.

- Read the details to ensure you have selected the right form.

- If the form isn't what you're looking for, use the Search section to find the form that meets your needs and criteria.

- Once you locate the correct form, click Buy now.

Form popularity

FAQ

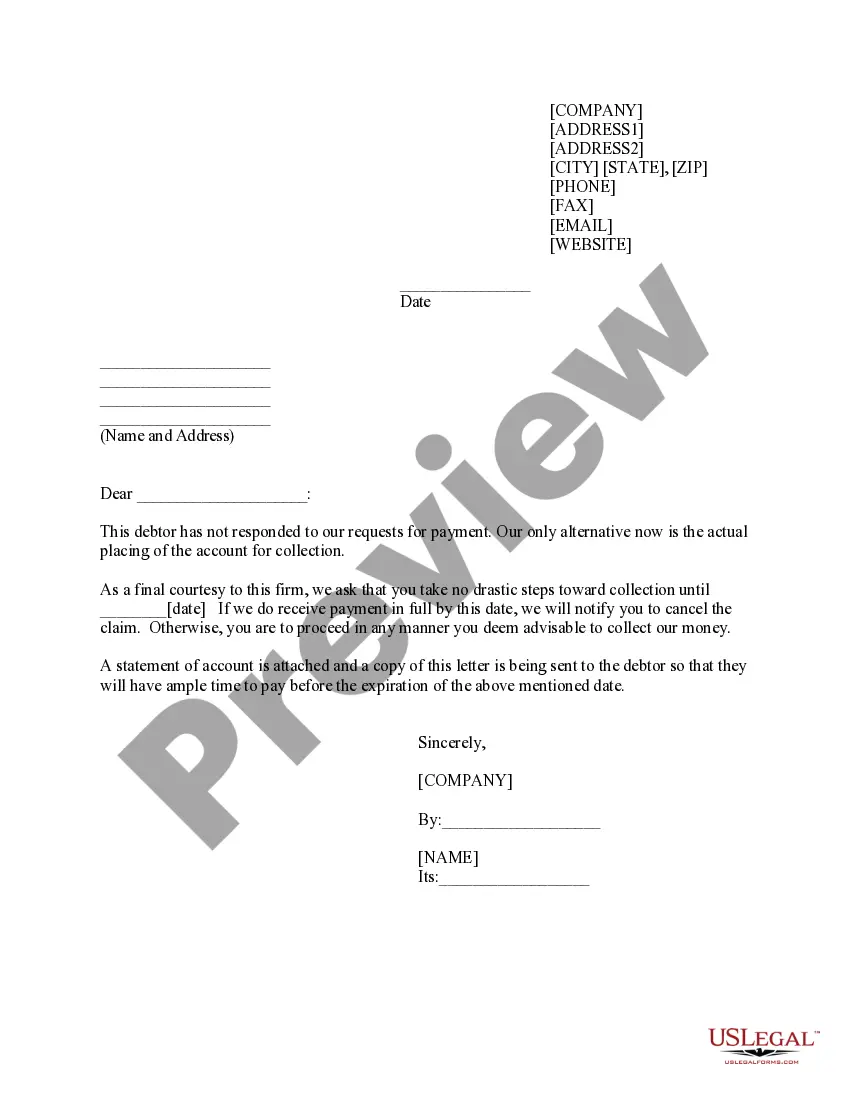

To collect debt in Pennsylvania, start by understanding state laws regarding debt collection practices. You may need to send formal collection letters and keep detailed records of all communications with the debtor. If required, filing a lawsuit can be a last resort, and platforms like US Legal Forms can assist you with the necessary legal documentation. This approach ensures compliance and protects your rights in light of Pennsylvania delinquent account collection history.

The 777 rule refers to guidelines that debt collectors must follow to protect consumer rights. Under this rule, a collector must provide clear information about the debt during communication and desist from making repeated calls that may be considered harassment. Understanding the 777 rule is crucial for anyone involved in collecting debts in Pennsylvania, as adhering to it can prevent legal complications in your Pennsylvania delinquent account collection history.

Filing a lien on a property in Pennsylvania requires a few steps to ensure proper documentation. Firstly, you must create a notice that details the amount owed and the property involved. Once this is completed, you will need to file the lien with the county's prothonotary. Using services like US Legal Forms can streamline this process and help you in maintaining compliance with Pennsylvania delinquent account collection history requirements.

When it comes to Pennsylvania delinquent account collection history, it is essential to follow legal methods. Collectors can send written requests for payment, negotiate repayment plans, and, if necessary, take the matter to court. Additionally, hiring a licensed collection agency can help ensure compliance with state and federal laws during this process.

In Pennsylvania, a debt typically becomes uncollectible after the statute of limitations ends, which is four years for most types of debt. After this period, while the debt still exists, collectors cannot legally sue you for payment. Being aware of this timeline can empower you to manage your Pennsylvania Delinquent Account Collection History more effectively and reduce your stress regarding old debts.

To identify your delinquent accounts, start by accessing your credit report using reliable services. Many platforms provide a comprehensive view of your credit history, including accounts marked as delinquent. If you prefer a more detailed approach, contacting creditors directly can uncover additional information about your Pennsylvania Delinquent Account Collection History.

In Pennsylvania, the statute of limitations for most debts is four years. This means a creditor or debt collector can only legally pursue collection through the courts within that time frame. After this period, the debt becomes more challenging to enforce in court. Understanding this statute can be crucial for managing your Pennsylvania Delinquent Account Collection History effectively.

Sending an account to collections can be a worthwhile effort if the debt is significant and other collection methods have failed. It allows you to regain lost revenue while preserving your relationship with the client, should you pursue amicable resolutions later. However, weigh the costs against the potential recovery when considering Pennsylvania Delinquent Account Collection History for your case. Utilizing specialized legal services can provide valuable insights to make this decision easier.

In Pennsylvania, debt collectors can pursue old debt for up to four years. This timeframe begins from the time of the last payment or the last acknowledgment of the debt by the debtor. It's essential to be aware of this statute of limitations when considering your rights and options in Pennsylvania Delinquent Account Collection History. Understanding these timelines can help you take timely and appropriate action.

In Pennsylvania, certain types of income and property may be exempt from debt collection. For instance, public benefits, social security, and retirement accounts often enjoy protection. Knowing these exemptions helps creditors understand what can be pursued and what cannot. This knowledge is crucial when dealing with delinquent accounts in Pennsylvania, allowing you to better assess your options.