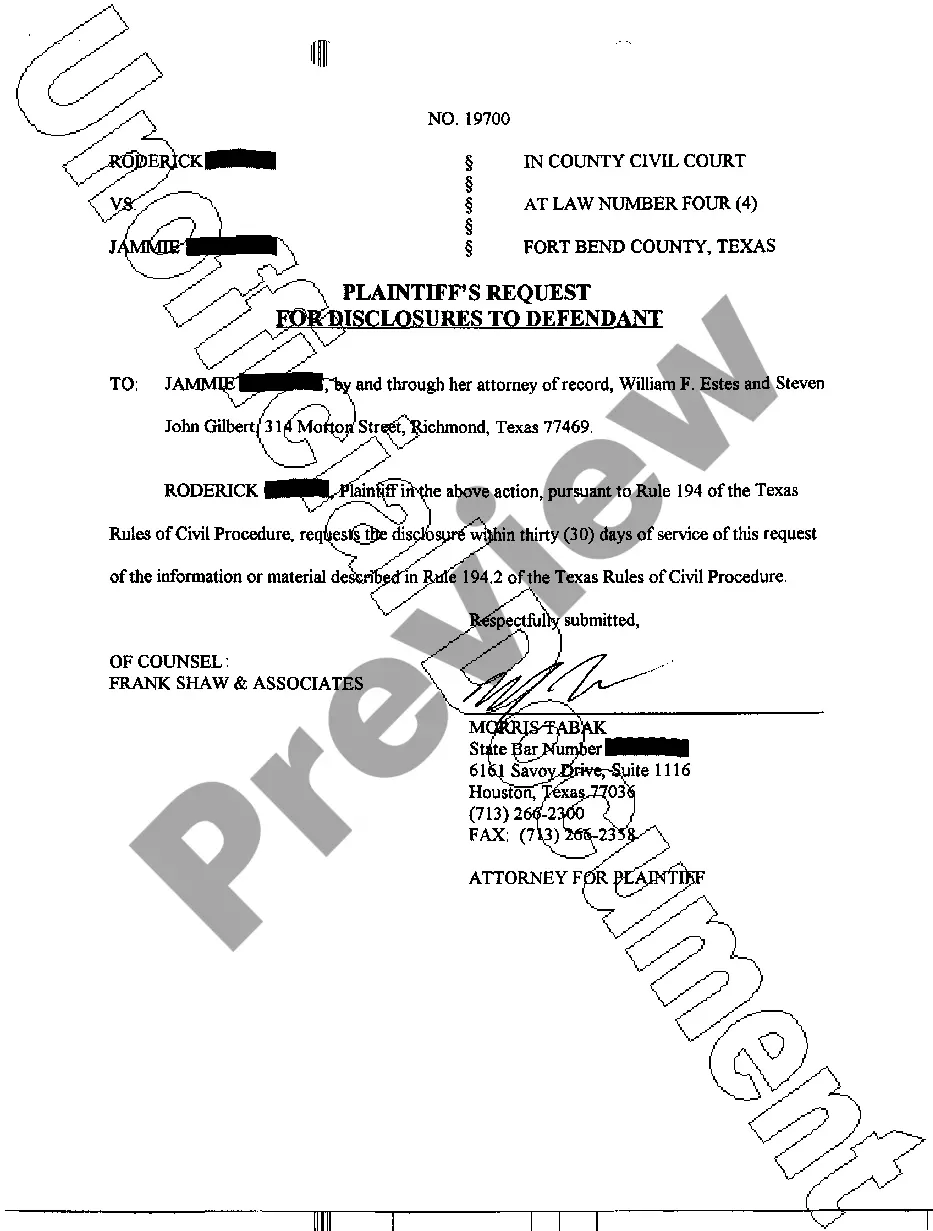

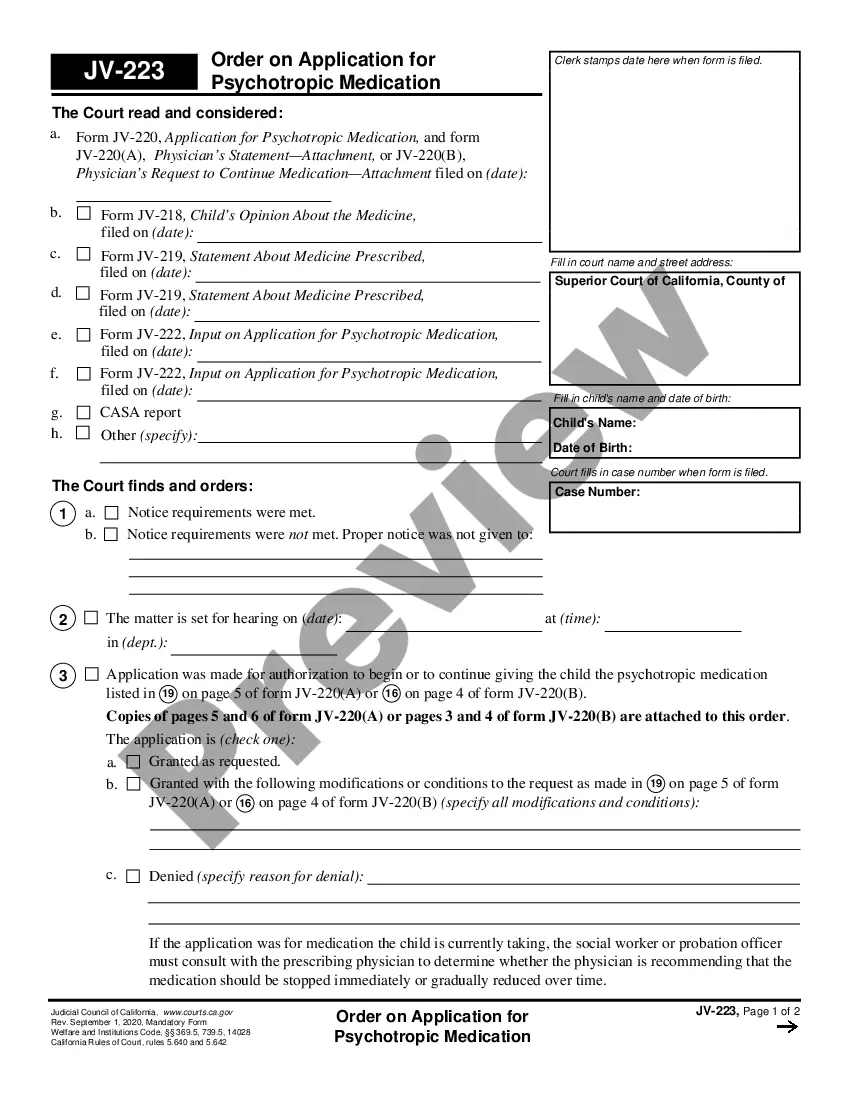

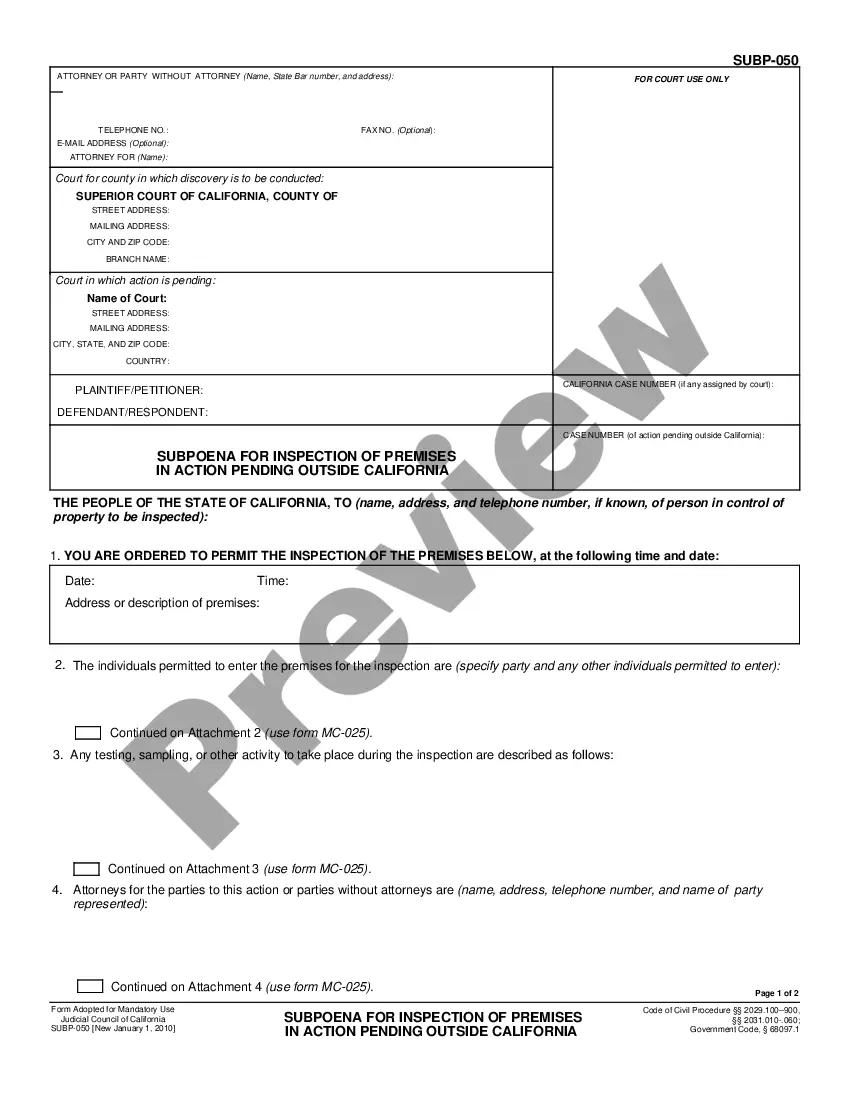

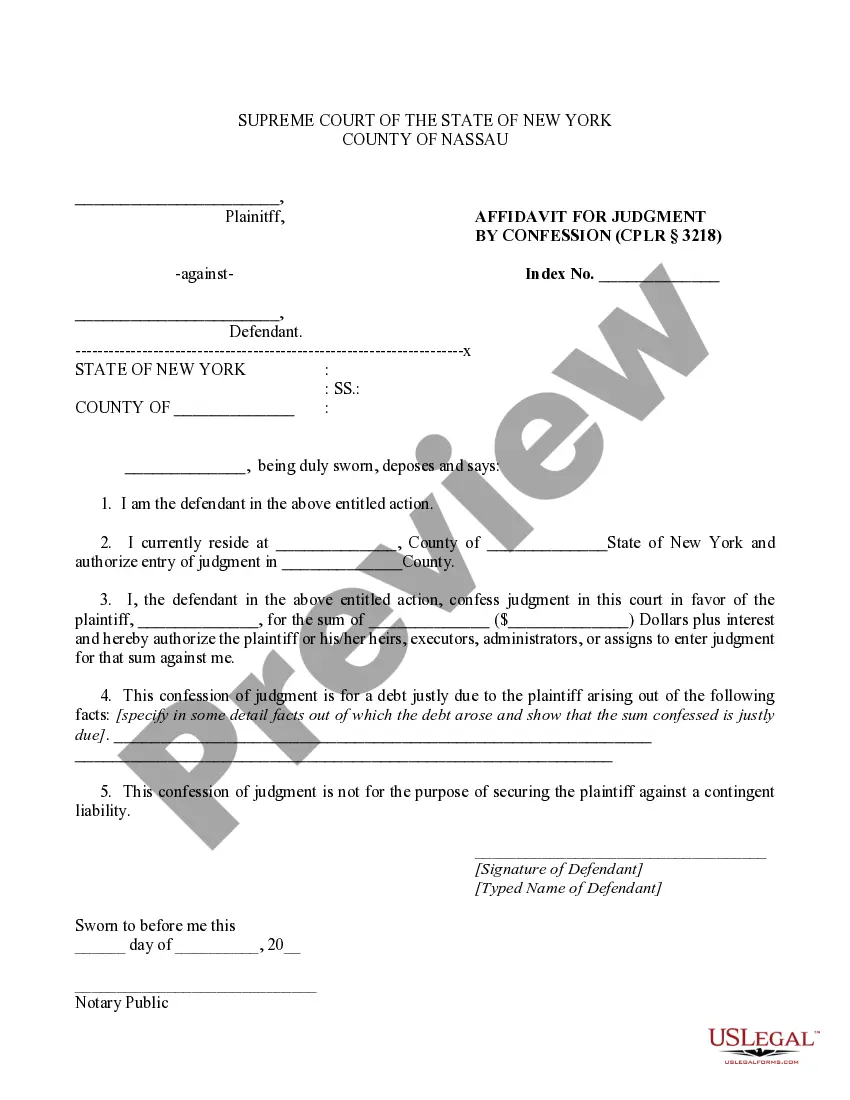

Title: Pennsylvania Sample Letter for Payment Schedule: Comprehensive Guide Introduction: Pennsylvania Sample Letter for Payment Schedule is a crucial tool utilized to outline and arrange payment terms in various business transactions. Whether you are a creditor, debtor, or involved in legal matters within the state of Pennsylvania, having a well-drafted payment schedule letter is essential. This comprehensive guide explores the importance, components, and different types of Pennsylvania Sample Letters for Payment Schedule, catering to diverse scenarios. Table of Contents: I. Importance of Pennsylvania Sample Letter for Payment Schedule II. Components of an Effective Payment Schedule Letter in Pennsylvania III. Different Types of Pennsylvania Sample Letters for Payment Schedule A. Personal Loan Payment Schedule Letter B. Debt Repayment Schedule Letter C. Installment Payment Schedule Letter D. Payment Plan Proposal Letter E. Legal Payment Schedule Letter IV. How to Draft an Effective Pennsylvania Sample Letter for Payment Schedule A. Gather and Organize Relevant Information B. Create a Clear and Concise Introduction C. Outline the Payment Terms and Amount Due D. Mention Consequences of Non-Payment E. Include Contact Information for Future Communication V. Tips for Effective Pennsylvania Sample Letter for Payment Schedule VI. Conclusion I. Importance of Pennsylvania Sample Letter for Payment Schedule: A payment schedule letter serves as a written agreement between two parties, ensuring transparency and clarity regarding payment obligations. It helps establish expectations, avoid confusion or disputes, and serves as evidence in case of legal proceedings. II. Components of an Effective Payment Schedule Letter in Pennsylvania: — Header: Date, Creditor's Name, Creditor's Address, Debtor's Name, Debtor's Address — Salutation: Greeting to the recipient (e.g., "Dear [Creditor/Debtor's Name],") — Introduction: Clearly state the purpose of the letter and the specific payment schedule. — Payment Terms: Enumerate the payment schedule, including due dates, payment amounts, and payment methods. — Consequences of Non-payment: Detail the consequences or penalties for failing to make timely payments. — Contact Information: Creditor's contact details for clarification, queries, or any necessary correspondence. — Closing: Closing remarks, professional sign-off. III. Different Types of Pennsylvania Sample Letters for Payment Schedule: A. Personal Loan Payment Schedule Letter: This type of letter is used when providing loan funds to individuals. It outlines the repayment plan, interest rates, and penalties for late payments. B. Debt Repayment Schedule Letter: It addresses situations where individuals or entities owe debts to a creditor. The letter outlines the agreed-upon payment plan to clear the outstanding debt. C. Installment Payment Schedule Letter: This letter specifies the payment schedule for goods or services purchased through installments, ensuring clarity regarding due dates and amounts. D. Payment Plan Proposal Letter: This letter is sent by debtors proposing a mutually agreed-upon repayment plan, providing options to settle outstanding debts partially or over an extended period. E. Legal Payment Schedule Letter: Used in legal matters, this letter is sent from one party to the other, outlining payments due as part of a legal settlement, court judgment, or agreed-upon terms. IV. How to Draft an Effective Pennsylvania Sample Letter for Payment Schedule: This section details key steps to follow when drafting a payment schedule letter in Pennsylvania. V. Tips for Effective Pennsylvania Sample Letter for Payment Schedule: — Use clear and concise language— - Maintain a professional tone throughout the letter. — Double-check all the information provided for accuracy. — Consider seeking legal advice for complex matters. — Keep a record of all correspondence related to the payment schedule. Conclusion: Pennsylvania Sample Letter for Payment Schedule is a necessary tool in various financial transactions. By understanding its significance, components, and types, one can ensure both creditors and debtors have a fair and transparent payment plan. Customizing these letters according to specific scenarios and following effective drafting techniques is essential for a successful financial agreement.

Pennsylvania Sample Letter for Payment Schedule

Description

How to fill out Pennsylvania Sample Letter For Payment Schedule?

If you want to total, download, or printing legitimate papers web templates, use US Legal Forms, the biggest variety of legitimate varieties, that can be found online. Make use of the site`s easy and hassle-free research to discover the paperwork you need. Numerous web templates for company and personal reasons are sorted by groups and says, or keywords and phrases. Use US Legal Forms to discover the Pennsylvania Sample Letter for Payment Schedule in a couple of clicks.

Should you be presently a US Legal Forms client, log in for your bank account and click on the Down load switch to have the Pennsylvania Sample Letter for Payment Schedule. You can even entry varieties you formerly downloaded inside the My Forms tab of your own bank account.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape to the appropriate town/land.

- Step 2. Use the Preview solution to check out the form`s content material. Never forget to read the explanation.

- Step 3. Should you be not happy using the type, take advantage of the Lookup industry towards the top of the display screen to get other models of the legitimate type format.

- Step 4. When you have found the shape you need, go through the Get now switch. Pick the rates strategy you like and add your accreditations to register on an bank account.

- Step 5. Procedure the deal. You may use your credit card or PayPal bank account to finish the deal.

- Step 6. Find the structure of the legitimate type and download it on your device.

- Step 7. Comprehensive, change and printing or indicator the Pennsylvania Sample Letter for Payment Schedule.

Every legitimate papers format you purchase is your own for a long time. You may have acces to each type you downloaded in your acccount. Click the My Forms section and choose a type to printing or download once more.

Compete and download, and printing the Pennsylvania Sample Letter for Payment Schedule with US Legal Forms. There are thousands of skilled and state-specific varieties you can use for your personal company or personal requirements.

Form popularity

FAQ

In place of my regular monthly payment of $__________due on the__________________________. I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible.

In place of my regular monthly payment of $__________due on the__________________________. I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible.

A letter of demand is a demand for payment from a debtor or defendant. It is usually the first step in a legal dispute case. A letter of demand will outline the breaches of the law, foreshadow the legal action and consequences of not paying.

This amount was due for payment on . Recently have come into financial hardship due to and so wish to pay off the debt in instalments. contacting you in good faith so as to demonstrate intention of paying this debt and hope that both of us can reach an agreement.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

I have taken a careful look at my financial situation. I have set up a realistic minimum budget for my living expenses and have developed a debt repayment program. I am hoping you will accept a reduced payment of per month. Amounts will be increased as soon as possible until the debt is totally paid.

Contact your creditors by phone, email or letter to tell them about your situation and to make an offer to pay the amount you can afford. It's recommended to send a written copy even if you come to agreement over the phone. Use our template letter for your creditors to contact them about debt repayment plans.