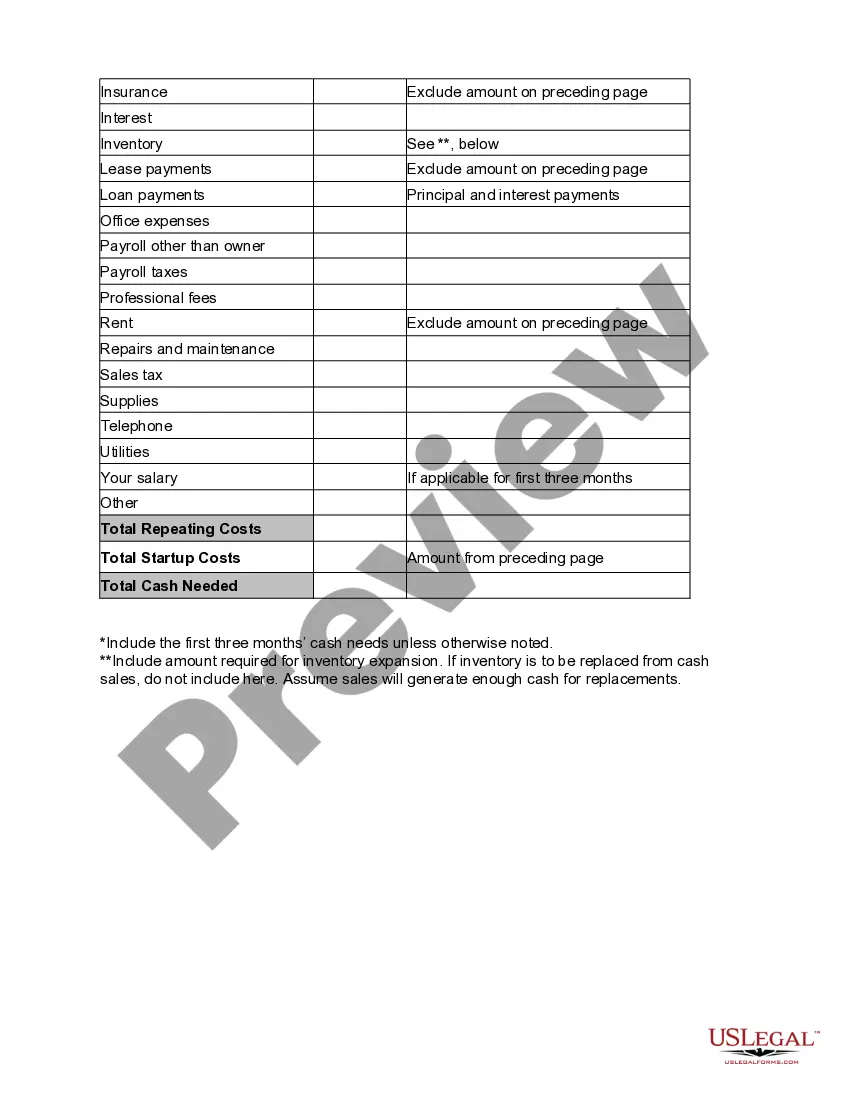

Pennsylvania Startup Costs Worksheet is a comprehensive tool designed to assist entrepreneurs and small business owners in calculating and estimating the initial expenses required to launch a new business venture in the state of Pennsylvania. This worksheet acts as a guide, helping individuals to meticulously plan and budget their startup costs, thereby ensuring financial preparedness and reducing the chance of unexpected expenses down the line. The Pennsylvania Startup Costs Worksheet covers various categories of expenses commonly associated with starting a business, including one-time costs and ongoing expenses. It provides clear instructions and sections for entrepreneurs to document and organize their financial obligations. By utilizing this worksheet, business owners can gain a detailed understanding of the financial commitment required to carry out their entrepreneurial vision successfully. Listed below are some key features and categories one may find in a Pennsylvania Startup Costs Worksheet: 1. Legal and Licensing Fees: This section encompasses the costs associated with obtaining necessary permits, licenses, and legal documentation required to operate a business legally in Pennsylvania. 2. Facility and Equipment Expenses: Entrepreneurs can estimate the costs linked to acquiring, leasing, or renovating a physical location for their business. It also includes equipment purchases, such as machinery, technology, furniture, fixtures, and signage. 3. Initial Inventory or Supplies: Startups dealing with product-based businesses can assess the costs of obtaining the initial stock or supplies necessary to begin operations. This category can vary depending on the nature of the business. 4. Marketing and Advertising: This section enables entrepreneurs to allocate resources for promoting their business through various marketing channels, including online advertising, print media, social media campaigns, and other promotional activities. 5. Insurance: Entrepreneurs need to account for insurance coverage tailored to their specific industry or business needs. This section helps in estimating the costs associated with general liability insurance, property insurance, worker's compensation, and other relevant policies. 6. Professional Services: This category allows entrepreneurs to budget for professional assistance, such as legal counsel, accounting services, graphic design, website development, or any other professional services required during the startup phase. 7. Utilities and Operational Expenses: Entrepreneurs can calculate the ongoing costs of utilities, rent, lease payments, internet services, telephone lines, and other operational expenses that recur on a monthly or annual basis. 8. Employee Related Costs: If the business intends to hire employees, this section assists in estimating costs associated with salaries, wages, benefits, taxes, and any qualified retirement plans provided to the workforce. It's important to note that several variations or specific editions of the Pennsylvania Startup Costs Worksheet may exist, tailored to different industries or business types. For example, there might be specific worksheets for retail businesses, restaurants, service-based ventures, or manufacturing operations. These specialized worksheets may include additional categories or considerations relevant to the specific industry, ensuring accurate financial planning to suit unique business models. Overall, the Pennsylvania Startup Costs Worksheet is an indispensable tool for entrepreneurs embarking on their business journey in Pennsylvania. By providing a structured format to determine startup expenses, it aids in financial decision-making, fosters strategic planning, and contributes to the overall success of the business from its inception.

Pennsylvania Startup Costs Worksheet

Description

How to fill out Pennsylvania Startup Costs Worksheet?

Are you presently in the place that you will need papers for both company or personal functions virtually every day? There are tons of legal record layouts available online, but locating types you can rely on isn`t straightforward. US Legal Forms delivers 1000s of develop layouts, much like the Pennsylvania Startup Costs Worksheet, which are created in order to meet federal and state demands.

In case you are previously familiar with US Legal Forms web site and possess a merchant account, merely log in. Next, you can acquire the Pennsylvania Startup Costs Worksheet web template.

Unless you have an profile and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you need and ensure it is for that appropriate area/area.

- Make use of the Review option to check the shape.

- See the information to actually have selected the correct develop.

- In the event the develop isn`t what you are seeking, take advantage of the Search industry to get the develop that fits your needs and demands.

- When you discover the appropriate develop, click on Buy now.

- Opt for the rates plan you want, submit the specified information to make your account, and pay money for your order using your PayPal or charge card.

- Pick a practical document formatting and acquire your duplicate.

Discover every one of the record layouts you have purchased in the My Forms food selection. You can aquire a extra duplicate of Pennsylvania Startup Costs Worksheet whenever, if necessary. Just click the essential develop to acquire or produce the record web template.

Use US Legal Forms, the most considerable assortment of legal kinds, to conserve time as well as steer clear of errors. The service delivers skillfully manufactured legal record layouts which can be used for a selection of functions. Produce a merchant account on US Legal Forms and start generating your life easier.