Pennsylvania Partnership Agreement for Development of Real Property

Description

How to fill out Partnership Agreement For Development Of Real Property?

If you wish to gather, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the website's straightforward and user-friendly search to locate the documents you require. Various templates for business and personal uses are organized by categories and states, or by keywords.

Utilize US Legal Forms to obtain the Pennsylvania Partnership Agreement for Development of Real Property in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account.

Navigate to the My documents section and select a form to print or download again. Complete and obtain, and print the Pennsylvania Partnership Agreement for Development of Real Property with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to find the Pennsylvania Partnership Agreement for Development of Real Property.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to view the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose your desired payment plan and enter your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Pennsylvania Partnership Agreement for Development of Real Property.

Form popularity

FAQ

A real estate partnership is formed by two or more investors who combine their capital and expertise to purchase, develop, or lease property. Also known as a real estate limited partnership (RELP), the partnership agreement can require each investor to be actively involved in the partnership as equal members.

How to form a partnership: 10 steps to successChoose your partners.Determine your type of partnership.Come up with a name for your partnership.Register the partnership.Determine tax obligations.Apply for an EIN and tax ID numbers.Establish a partnership agreement.Obtain licenses and permits, if applicable.More items...?16-Oct-2020

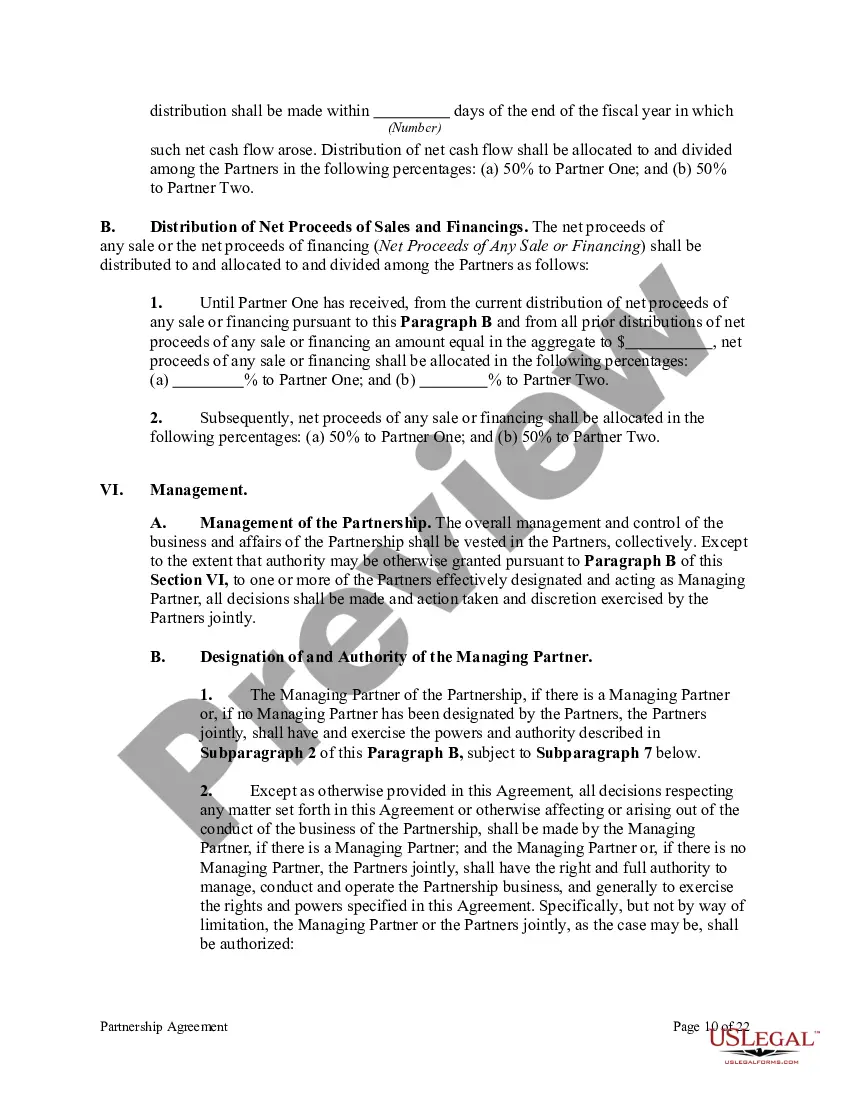

A partnership agreement is a legal document that dictates how a small for-profit business will operate under two or more people. The agreement lays out the responsibilities of each partner in the business, how much of the business each partner owns, and how much profit and loss each partner is responsible for.

Real property means messuages, lands, tenements, real estate, buildings, parts thereof or any estate or interest therein and shall include any personalty on real property which is demised with the real property.

To form a partnership in Pennsylvania, you should take the following steps:Choose a business name.File a fictitious business name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

A Partnership Agreement is a contract between two or more business partners. The partners use the agreement to outline their rights responsibilities, and profit and loss distribution.

A real estate partnership is formed by two or more investors who combine their capital and expertise to purchase, develop, or lease property. Also known as a real estate limited partnership (RELP), the partnership agreement can require each investor to be actively involved in the partnership as equal members.

To create your Partnership Agreement, you should include the following things in your contract:Partnership start date, address, name, and purpose.Contact information and duties for each general partner.Description of partner capital contributions.Profit and loss distribution (equal share or fixed per cent)More items...

A partnership agreement is the legal document that dictates the way a business is run and details the relationship between each partner.

What Should a Real Estate Partnership Agreement Include?Management of the Company. LLCs are usually either member-managed by all the equity holders of the business, or the LLC is manager-managed.Ownership Interest.Profit/Loss Allocations.Transfer Restrictions.Dispute Resolution.Voting.