Pennsylvania Independent Contractor Agreement with Church: A Comprehensive Guide for Contractors and Churches Keywords: Pennsylvania, independent contractor agreement, church, contractors, legal document, working relationship, services, compensation, non-employee, taxes, liability, termination. Introduction: The Pennsylvania Independent Contractor Agreement with a Church is a legally binding contract that outlines the terms and conditions of the working relationship between a contractor and a church. This agreement is crucial for maintaining clarity, protecting interests, and setting expectations for both parties involved. Let's explore the various aspects of this agreement and understand its importance. 1. Types of Pennsylvania Independent Contractor Agreements with Church: a) Service-Based Agreement: This agreement is used when a contractor provides specific services to the church, such as music performance, event planning, maintenance, or counseling services. b) Construction or Renovation Agreement: When a church undertakes construction, renovation, or repair projects, this agreement outlines the responsibilities, timelines, and payment terms for the contractor involved in the project. c) Design Agreement: This agreement is used when a contractor is hired by the church to develop architectural or interior designs for rebuilding or renovating the church premises. 2. Agreement Details: a) Parties Involved: Clearly identify the church and the contractor's full legal names, addresses, and contact details. b) Scope of Work: Describe in detail the services the contractor will provide, ensuring all specifics are clearly outlined. c) Compensation: Clearly state the agreed upon amount or how the contractor will be remunerated, whether it's a flat fee, hourly rate, or on a project basis. d) Payment Terms: Specify the payment schedule, method of payment, and any additional expenses or reimbursements the contractor is entitled to. e) Independent Contractor Status: Clearly assert that the contractor is considered a non-employee and will not be subject to taxes, benefits, or other employment privileges. f) Liability and Insurance: Define the responsibilities of both the contractor and the church in terms of liability, insurance coverage, and indemnification. g) Intellectual Property: Address the ownership and usage rights of any intellectual property created by the contractor during the engagement with the church. h) Confidentiality: Address the need for the contractor to maintain confidentiality regarding any confidential information obtained while working with the church. i) Termination: Specify the conditions under which either party can terminate the agreement and outline the notice period required. j) Governing Law: Clearly state that the agreement is governed by the laws of Pennsylvania. k) Entire Agreement: State that the written agreement represents the entire understanding between the contractor and the church, superseding any previous agreements. In conclusion, a Pennsylvania Independent Contractor Agreement with a Church is a critical legal document that helps establish clear expectations, responsibilities, and compensation terms for contractors working with churches. It ensures a smooth working relationship, protects both parties' interests, and provides a roadmap for resolving potential disputes. By utilizing this agreement, both the contractor and the church can work together harmoniously while adhering to legal obligations.

Pennsylvania Independent Contractor Agreement with Church

Description

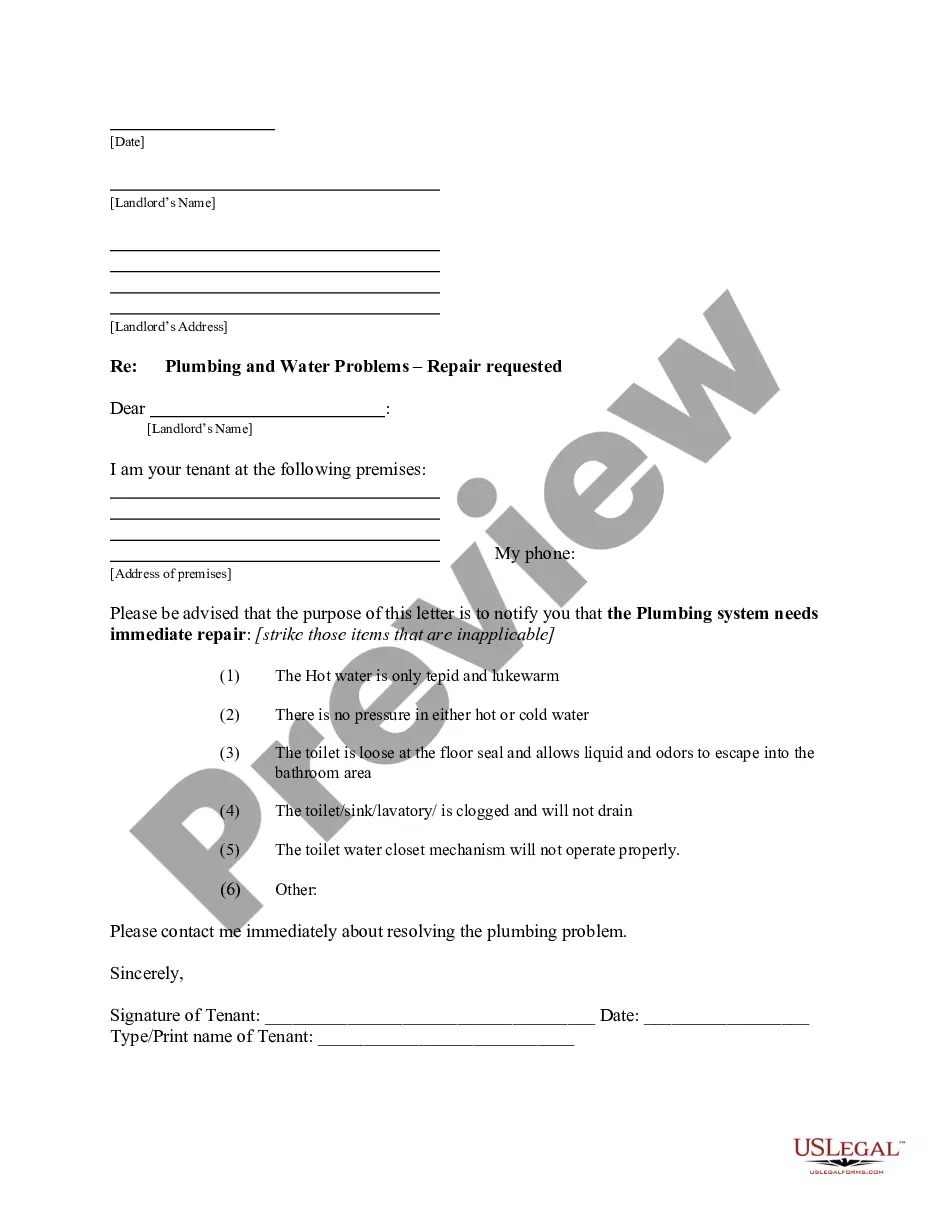

How to fill out Pennsylvania Independent Contractor Agreement With Church?

US Legal Forms - one of several most significant libraries of authorized kinds in the USA - offers a variety of authorized document web templates you can down load or print. Making use of the internet site, you may get 1000s of kinds for enterprise and specific reasons, sorted by types, says, or keywords and phrases.You can get the most up-to-date versions of kinds much like the Pennsylvania Independent Contractor Agreement with Church in seconds.

If you already possess a monthly subscription, log in and down load Pennsylvania Independent Contractor Agreement with Church from your US Legal Forms collection. The Down load key can look on every kind you see. You have access to all in the past acquired kinds inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms initially, listed below are basic guidelines to obtain began:

- Be sure you have picked the right kind for your personal city/state. Click the Preview key to analyze the form`s information. See the kind explanation to ensure that you have selected the appropriate kind.

- In case the kind does not suit your demands, make use of the Lookup area towards the top of the monitor to get the one that does.

- In case you are happy with the shape, affirm your selection by visiting the Acquire now key. Then, select the pricing strategy you want and give your qualifications to register for the bank account.

- Method the purchase. Use your bank card or PayPal bank account to complete the purchase.

- Choose the format and down load the shape on the product.

- Make changes. Fill out, change and print and indication the acquired Pennsylvania Independent Contractor Agreement with Church.

Each and every web template you included in your bank account does not have an expiry particular date and is also your own property forever. So, if you would like down load or print another duplicate, just proceed to the My Forms section and then click in the kind you need.

Get access to the Pennsylvania Independent Contractor Agreement with Church with US Legal Forms, probably the most substantial collection of authorized document web templates. Use 1000s of professional and state-certain web templates that meet your organization or specific demands and demands.

Form popularity

FAQ

Other professions within health care are NOT exempt from AB 5 and therefore must meet the law's stated criteria in order to be appropriately classified as independent contractors, such as: nurse practitioners. physician assistants.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.