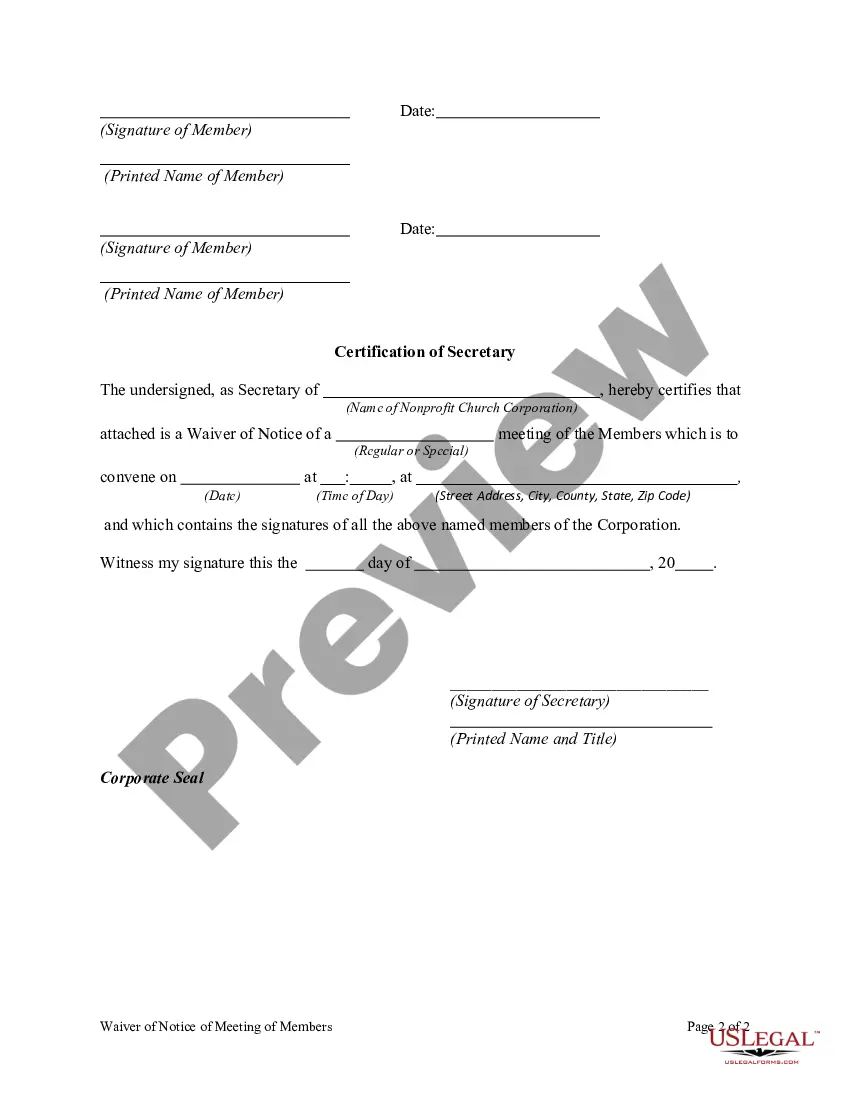

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Pennsylvania Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

It is feasible to dedicate hours online searching for the legal form template that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can easily obtain or print the Pennsylvania Waiver of Notice of Meeting of members of a Nonprofit Church Corporation from our service.

If available, utilize the Preview button to view the form template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Afterwards, you can complete, modify, print, or sign the Pennsylvania Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

- Each legal form template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased document, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct form template for the region/area you choose.

- Check the form description to confirm you have selected the right document.

Form popularity

FAQ

'Notice of presentation waived' indicates that members agree to proceed with a meeting or presentation without prior notification. In the context of a Pennsylvania Waiver of Notice of Meeting of members of a Nonprofit Church Corporation, this signifies that members are aware of the meeting's purpose and agree to engage without formal notification. This can enhance operational fluidity and foster an environment where spontaneous discussions can occur.

To dissolve a nonprofit organization in Pennsylvania, you must first obtain approval from your board and members. After that, you must file a Certificate of Dissolution with the Department of State. Remember that if a Pennsylvania Waiver of Notice of Meeting of members of a Nonprofit Church Corporation was in place, it may affect certain decision-making processes during dissolution. Utilizing platforms like USLegalForms can simplify this process, guiding you through the necessary steps.

Indeed, a nonprofit organization can deny membership based on its established criteria within its bylaws. This feature allows nonprofits to protect their integrity by selecting members aligned with their mission. Leveraging the Pennsylvania Waiver of Notice of Meeting of members of a Nonprofit Church Corporation ensures that membership protocols are consistently followed.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

The IRS prohibits any board member or employee from receiving "profits" from a nonprofit organization. There are stiff penalties for doing so. That said, you can close down your nonprofit organization or consider transferring it to another Nonprofit. Valuable time, energy and funds were expended to start the Nonprofit.

All nonprofit organizations need a board. Although the specific responsibilities may vary due to mission focus and different phases of an organization's existence, the basic role and purpose of all nonprofit boards remain the same.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

With the resolution in hand, California law provides for voluntary dissolution in one of three ways:by majority approval of your nonprofit's members.by action of your directors followed by a vote or other consent of the members; or.if your nonprofit does not have members, by a vote of the directors.

You'll want to identify at least three board members to meet IRS requirements. Pennsylvania law requires every nonprofit corporation to have a President, Treasurer, and Secretary (i.e. officers who perform comparable duties) and a single person may hold all three offices.