A Pennsylvania Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a legal arrangement that ensures the financial well-being of a wife and children after the death of the testator (person who creates the trust) in Pennsylvania. Here is a detailed description of this type of trust, along with the possible variations it might have: 1. Pennsylvania Testamentary Trust of the Residue of an Estate: This type of trust is established through the terms of a will and is created upon the death of the testator. It involves setting aside the remaining assets, also known as the residue, of the deceased person's estate. 2. For the Benefit of a Wife: The primary purpose of this trust is to provide financial support and security to the surviving wife. The trust can provide regular income, pay for healthcare expenses, or cover any other needs specified in the trust document. By placing assets in a trust, the wife will have access to them without directly owning them, which allows for asset protection and tax benefits. 3. With the Trust to Continue for the Benefit of Children after the Death of the Wife: This trust is structured to ensure that after the wife's passing, the remaining assets continue to be managed and distributed in accordance with the testator's instructions for the benefit of their children. The trust document outlines the terms and conditions under which the children will receive their shares. Possible variations or additional types of Pennsylvania Testamentary Trusts of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife may include: 1. Discretionary Trust: The trustee is provided with discretionary powers to distribute income and principal to the wife and children as needed, based on their circumstances and financial needs. This gives the trustee flexibility in managing the trust and adapting to changing circumstances over time. 2. Fixed Interest Trust: The trust could be structured to provide the wife with a fixed amount or percentage of income from the trust for her lifetime, with the remaining trust assets passing to the children upon her death. This provides the wife with a stable income source while preserving the principal for the children. 3. Support Trust: The trustee is instructed to make distributions from the trust for the wife's health, education, maintenance, and support. The trust may define the standards by which these distributions are made, ensuring the wife's essential needs are met while safeguarding the trust's assets for the benefit of the children. 4. Limited Power of Appointment Trust: The wife may be granted the power to appoint trust assets to specific individuals or entities within certain parameters. This allows her some control over the ultimate distribution of the trust while ensuring it benefits the children in accordance with the testator's intentions. It is crucial to consult an experienced estate planning attorney to determine the most appropriate type of trust and to ensure compliance with the specific laws and regulations in Pennsylvania. Creating a Pennsylvania Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife can provide peace of mind, protecting the financial future of both a surviving spouse and their children.

Pennsylvania Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Pennsylvania Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

Have you been in the place that you need to have papers for both company or individual purposes virtually every day time? There are a variety of authorized file web templates available on the Internet, but locating ones you can depend on isn`t easy. US Legal Forms offers a large number of type web templates, like the Pennsylvania Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, that happen to be created in order to meet federal and state demands.

When you are presently acquainted with US Legal Forms internet site and get a free account, basically log in. Following that, you can download the Pennsylvania Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife template.

Unless you have an account and wish to start using US Legal Forms, abide by these steps:

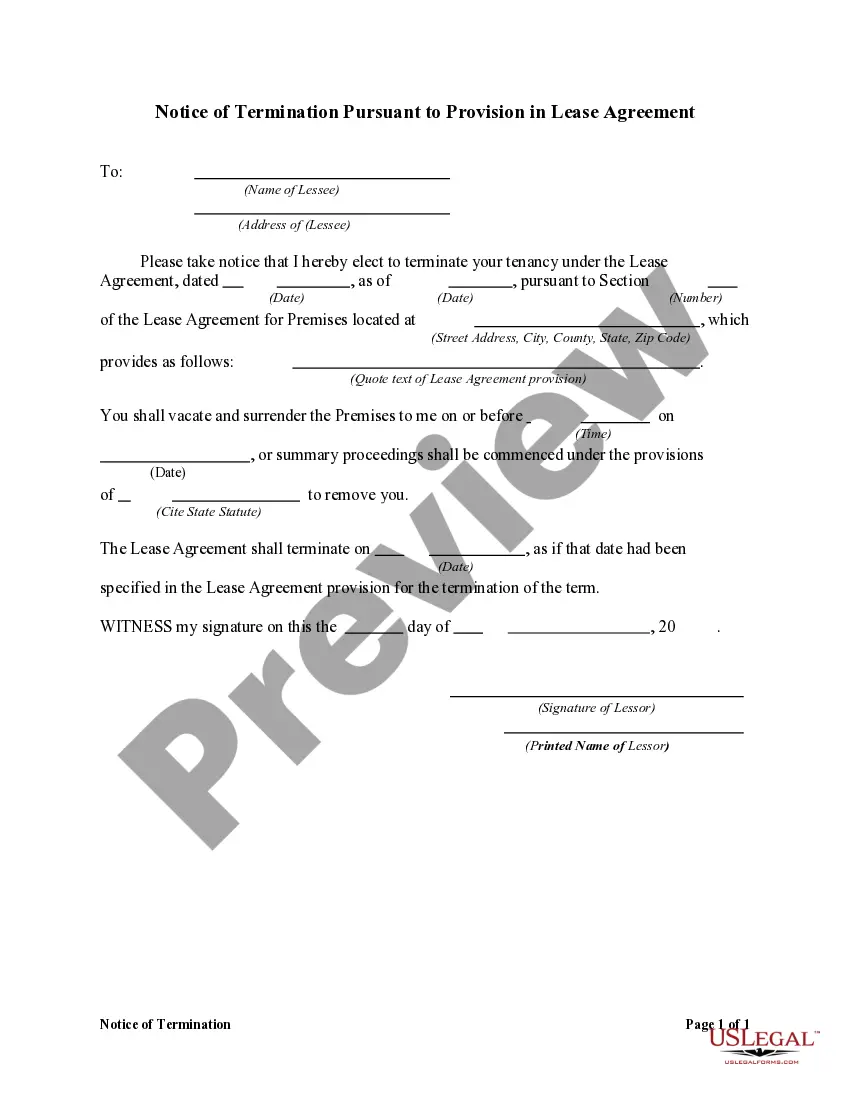

- Discover the type you require and make sure it is for your proper area/region.

- Make use of the Preview button to review the form.

- Look at the outline to ensure that you have selected the right type.

- In the event the type isn`t what you`re seeking, use the Lookup industry to obtain the type that meets your needs and demands.

- When you get the proper type, click on Purchase now.

- Pick the pricing strategy you desire, fill in the specified details to generate your bank account, and pay for the order using your PayPal or bank card.

- Pick a hassle-free file format and download your duplicate.

Locate all of the file web templates you might have bought in the My Forms food selection. You may get a further duplicate of Pennsylvania Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife whenever, if needed. Just go through the essential type to download or print the file template.

Use US Legal Forms, by far the most substantial selection of authorized types, to conserve some time and prevent errors. The service offers expertly produced authorized file web templates that you can use for an array of purposes. Produce a free account on US Legal Forms and start making your way of life easier.