Pennsylvania Verification of Employment

Description

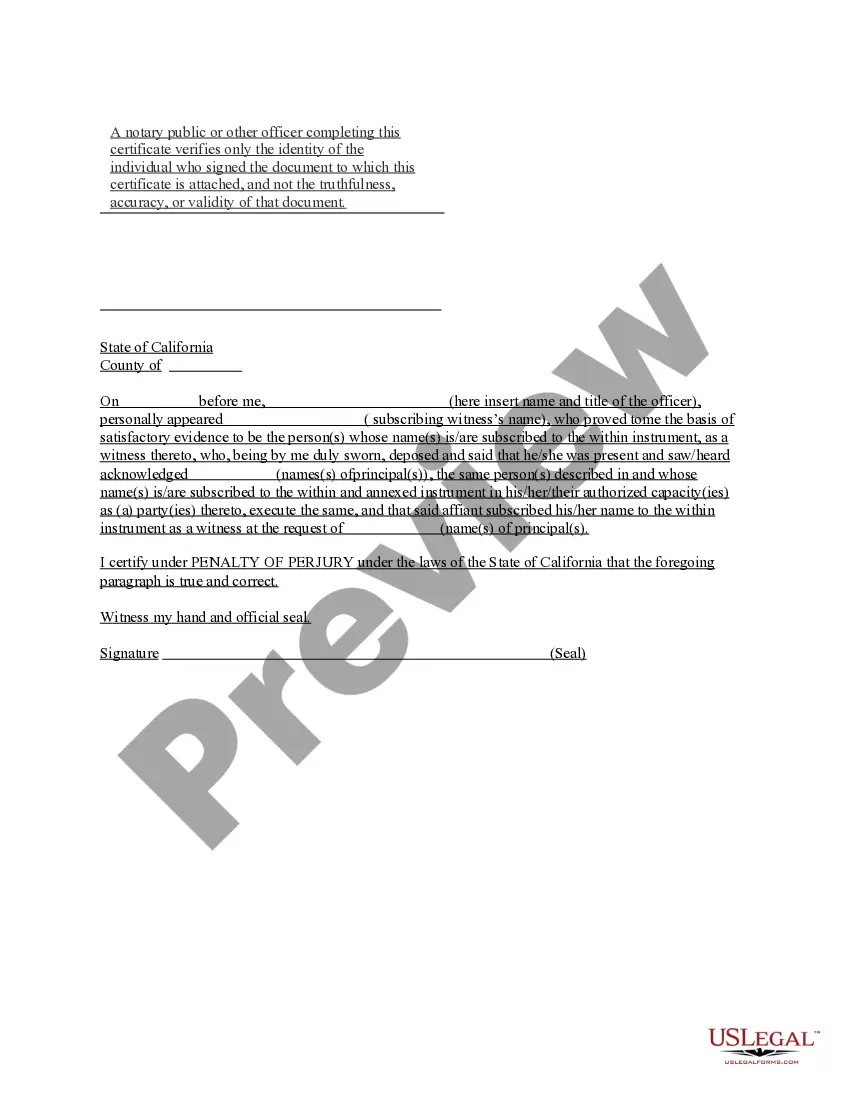

How to fill out Verification Of Employment?

It is feasible to spend time online looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of valid forms that can be reviewed by professionals.

You can easily obtain or print the Pennsylvania Verification of Employment from my service.

If you wish to obtain another version of your form, use the Search field to locate the template that fits your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can complete, edit, print, or sign the Pennsylvania Verification of Employment.

- Every valid document template you obtain is yours indefinitely.

- To retrieve an additional copy of the acquired form, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for your state/city of choice.

- Review the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

To check e-verified companies in the USA, you can visit the official E-Verify website, which provides a list of employers participating in the program. This resource is valuable for verifying employment eligibility and understanding the Pennsylvania verification of employment practices. Additionally, using services like uslegalforms can simplify the search process, ensuring you find accurate information efficiently.

Yes, Pennsylvania requires e-Verify for certain employers, especially those working with state contracts. E-Verify is a federal program that confirms employee work eligibility. Employers should ensure compliance with both state and federal employment verification regulations. For assistance in navigating these requirements, US Legal Forms offers comprehensive guides.

The most common proof of employment is an employment verification letter from an employer that includes the employee's dates of employment, job title, and salary. It's also often called a "letter of employment," a "job verification letter," or a "proof of employment letter."

Pay stubs and W-2 forms are commonly used as proof of employment.Your employer may write a verification letter or use an automated verification service to confirm your job title, employment history, and salary information.More items...?29-May-2020

If a person is concerned that a background checker's failure to corroborate his dates of employment will harm his application, then he may wish to provide additional documentation that can help verify. The person could provide tax forms that listed the company as his employer, as well as pay stubs.

How to Request the LetterAsk your supervisor or manager. This is often the easiest way to request the letter.Contact Human Resources.Get a template from the company or organization requesting the letter.Use an employment verification service.

Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens.

Our legal friends at Avvo.com were gracious enough to post this question to some attorneys to confirm that, Yes, the employer can refuse as there is no law that requires an employer to verify your employment.

Those requesting employment or salary verification may access THE WORK NUMBER® online at using DOL's code: 10915. You may also contact the service directly via phone at: 1-800-367-5690.

If you suspect the background check has been unable to verify dates of employment for a certain employer, contact the background check company and ask what you can do to facilitate the process. They may ask for additional information, ask you to contact the employer directly, or request copies of your W-2s.