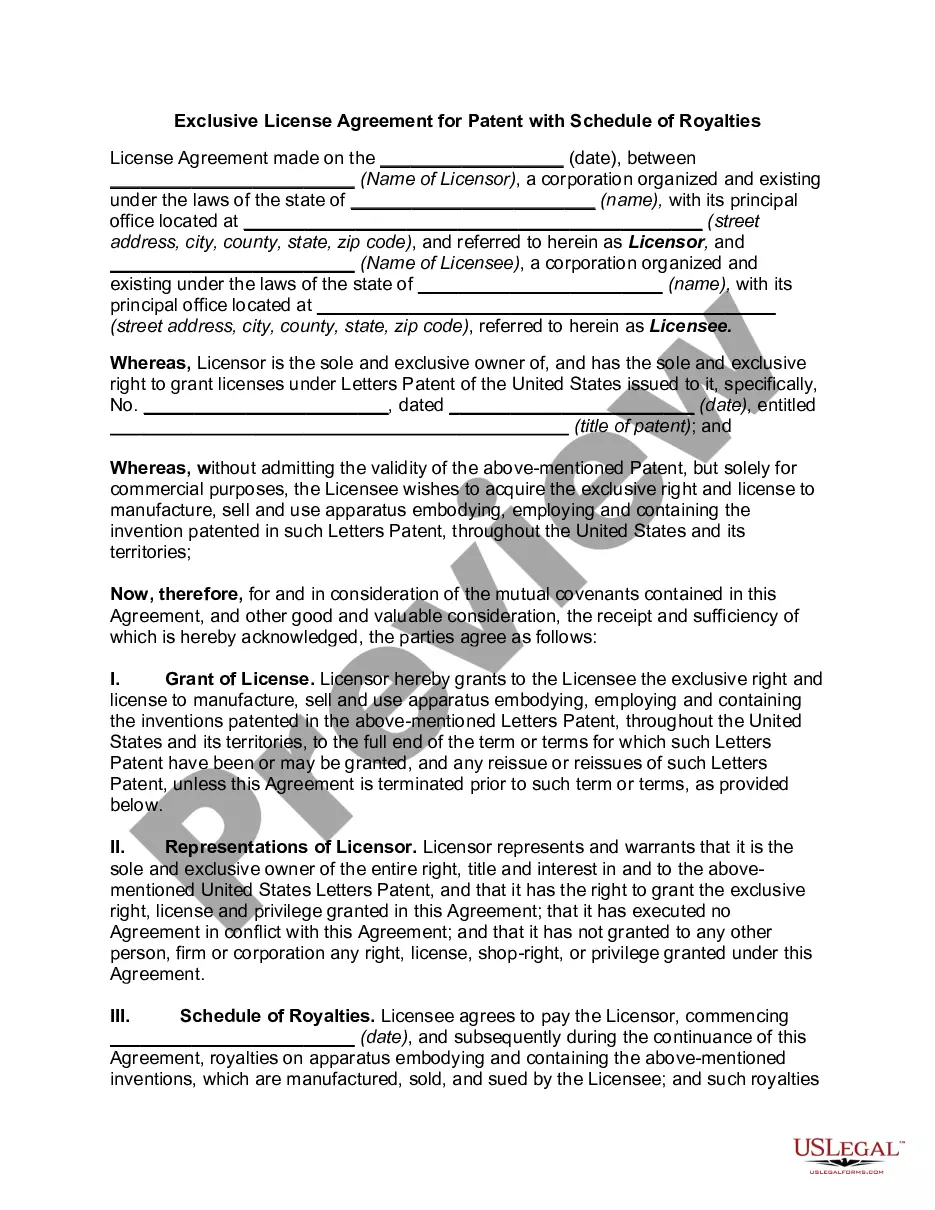

A Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name is a legally binding document that allows an insurance company to pursue legal action on behalf of the insured party. This agreement facilitates the process of subrogation, which is when an insurance company steps into the shoes of the insured to seek reimbursement for damages they have already paid. In Pennsylvania, there are two main types of Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name: 1. Property Subrogation Agreement: This type of agreement is used when an insured property has been damaged or destroyed due to the actions or negligence of a third party. In such cases, the insurance company, having compensated the insured for the loss, seeks to recover the amount paid from the responsible party. 2. Personal Injury Subrogation Agreement: This variant of the agreement comes into play when an insured individual suffers personal injury or bodily harm due to the fault of another person, such as in a car accident, slip and fall, or any other incident resulting in injury. The insurance company reimburses the insured for medical expenses, lost wages, or other related costs and then proceeds to initiate legal action against the liable party to recover the amount paid out. In these subrogation agreements, certain important keywords or clauses must be included to ensure their validity and enforceability. Some of these keywords include: 1. Insured's Consent: The insured must explicitly provide their consent for the insurance company to pursue legal action in their name. This clause ensures that the insured is aware of and agrees to the subrogation process. 2. Full Reimbursement: The agreement should outline that the insurance company will be entitled to complete reimbursement for the amount paid to the insured in connection with the claim. This ensures that the insurer recovers the entire sum they have paid out and does not suffer any financial losses. 3. Right to File Lawsuit: The agreement should state that the insurance company has the authority to file a lawsuit against the responsible third party, or handle the legal proceedings in any other appropriate manner to recover the insurance payment. 4. Subrogation Rights: This clause clarifies that the insurance company assumes the rights of the insured to collect any damages from the liable party, including filing a lawsuit, settling claims, or any other legal action necessary to obtain recovery. 5. Cooperation of Insured: The insured's cooperation throughout the subrogation process is crucial. The agreement may include a provision that requires the insured to provide all necessary information, testimonies, or documents to support the insurance company's subrogation claim. A Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name provides a legal framework for insurance companies to recover their expenses by pursuing legal remedies on behalf of the insured. By including the appropriate keywords and clauses, these agreements ensure that the rights and interests of both parties are protected, facilitating an efficient subrogation process.

Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

How to fill out Pennsylvania Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

You may commit hrs online attempting to find the legitimate file design that meets the state and federal needs you will need. US Legal Forms gives 1000s of legitimate forms that are evaluated by specialists. It is simple to acquire or print the Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name from my service.

If you already have a US Legal Forms accounts, you can log in and then click the Obtain switch. Next, you can complete, modify, print, or indication the Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Every single legitimate file design you purchase is your own property permanently. To have another copy of any obtained form, proceed to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site the first time, stick to the simple directions under:

- Initial, ensure that you have chosen the right file design for that region/metropolis of your choice. Look at the form outline to ensure you have picked the appropriate form. If offered, use the Review switch to check with the file design also.

- If you wish to discover another edition from the form, use the Look for area to discover the design that meets your requirements and needs.

- Upon having located the design you want, click Get now to move forward.

- Find the prices program you want, enter your qualifications, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal accounts to cover the legitimate form.

- Find the format from the file and acquire it in your system.

- Make alterations in your file if required. You may complete, modify and indication and print Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

Obtain and print 1000s of file templates while using US Legal Forms site, that provides the most important variety of legitimate forms. Use expert and status-specific templates to deal with your organization or specific needs.

Form popularity

FAQ

Immunity From Subrogation Recently, the Pennsylvania Supreme Court ruled that medical expenses are not considered installments of compensation; therefore, workers' compensation insurance carriers may not subrogate future medical expenses.

Essentially, the principle of subrogation permits one (i.e., the insurer) who is legally obligated to pay the debt of another to "stand in the shoes" of the person owed payment (i.e., the insured) and enforce that person's right against the actual wrongdoer.

Additional Details letter creation date. insured name. claim number and policy number. date of loss. recipient name. damage amount. claims specialist name and title.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party.

The principle of subrogation in insurance enables the insurer to take over the policyholder's legal right to recover damages. In other words, the insurance company has the right to pursue any third-party liable for the damages that it has paid out to the policyholder.

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.

Insured is the person who is covered against risk. On the other hand, the insurer is the company that is providing coverage. It is a service that an insurer provides under a particular insurance policy against a premium paid by the policyholder.

Subrogation, subrogation rights, rights of subrogation: These terms are used to describe the legal right of an insurance company to recover its loss from a third party. It is usually triggered where a claim payment is made to a policyholder, but the policyholder's loss was actually caused by another party.