Pennsylvania Receipt for Payment of Loss for Subrogation

Description

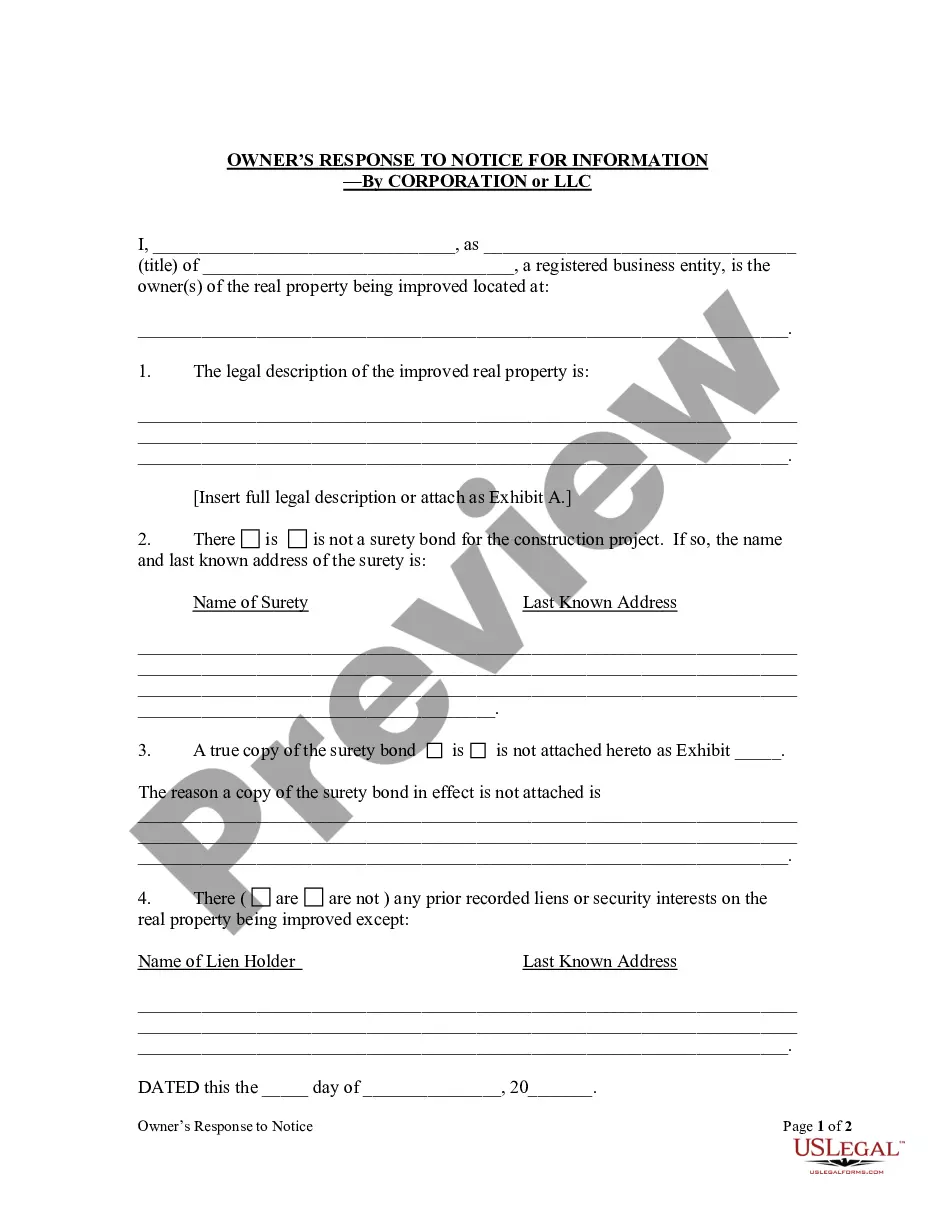

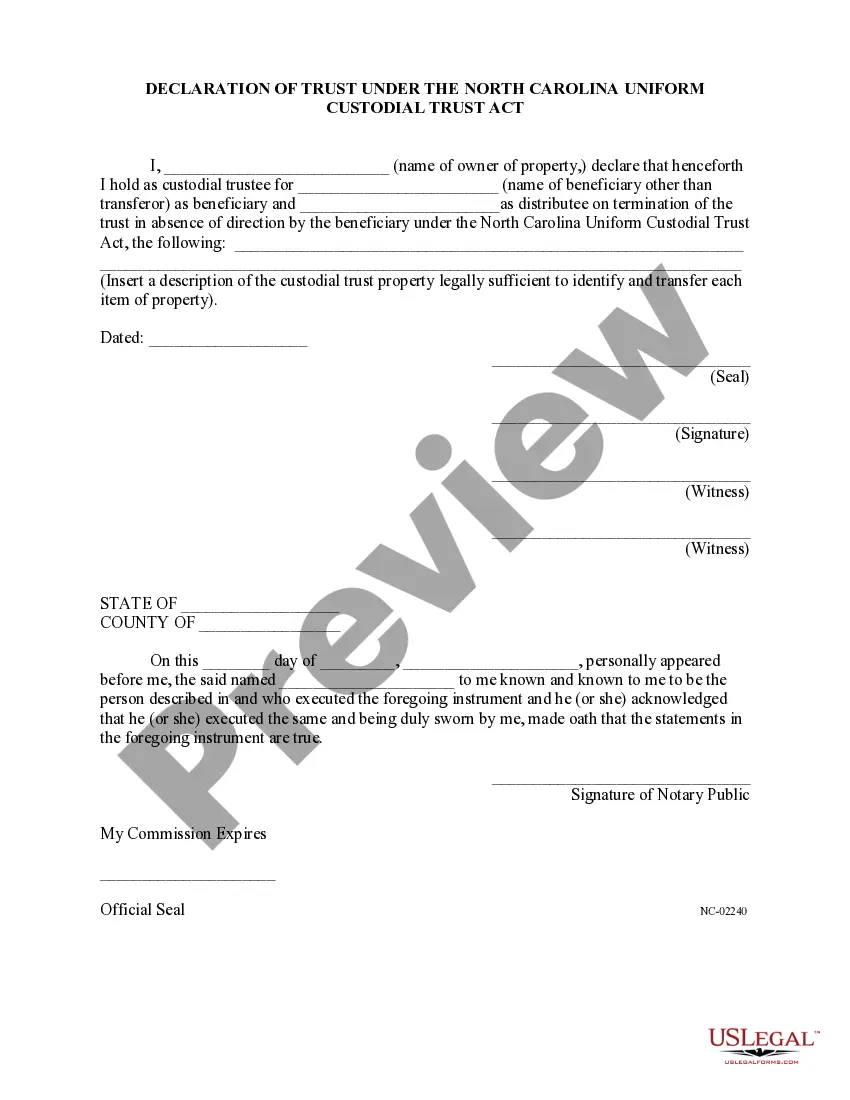

How to fill out Receipt For Payment Of Loss For Subrogation?

Choosing the best legitimate papers design might be a have a problem. Of course, there are a lot of layouts accessible on the Internet, but how would you obtain the legitimate type you require? Take advantage of the US Legal Forms site. The assistance offers a huge number of layouts, such as the Pennsylvania Receipt for Payment of Loss for Subrogation, which you can use for company and private needs. All of the varieties are examined by professionals and meet up with state and federal needs.

If you are currently authorized, log in to the profile and click on the Acquire key to find the Pennsylvania Receipt for Payment of Loss for Subrogation. Make use of profile to look through the legitimate varieties you may have bought previously. Check out the My Forms tab of your own profile and have an additional copy of your papers you require.

If you are a new user of US Legal Forms, listed below are simple guidelines that you can comply with:

- First, ensure you have selected the correct type for the metropolis/area. You may look over the form utilizing the Preview key and look at the form explanation to guarantee this is basically the right one for you.

- In case the type is not going to meet up with your needs, take advantage of the Seach field to discover the appropriate type.

- When you are certain the form is proper, select the Purchase now key to find the type.

- Choose the pricing prepare you desire and enter the required details. Create your profile and pay for the transaction utilizing your PayPal profile or credit card.

- Select the data file file format and acquire the legitimate papers design to the product.

- Comprehensive, modify and printing and signal the acquired Pennsylvania Receipt for Payment of Loss for Subrogation.

US Legal Forms will be the most significant library of legitimate varieties for which you will find a variety of papers layouts. Take advantage of the company to acquire skillfully-produced files that comply with status needs.

Form popularity

FAQ

What is Subrogation? Subrogation refers to the practice of substituting one party for another in a legal setting. Essentially, subrogation provides a legal right to a third party to collect a debt or damages on behalf of another party.

At the minimum, your subrogation file should contain all elements corresponding to liability determination and proof of damages. Being able to prove who is at fault is essential. You'll want to include documentation and any information you've gathered, such as witness statements or police reports.

SUBROGATION RECEIPTS - 8285 Subrogation is a legal right afforded to insurers (i.e., State Compensation Insurance Fund) to seek reimbursement for losses they have paid by billing or seeking legal action against the parties that caused the losses.

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

Subrogation is a legal concept that is commonly used in insurance claims. It refers to the right of an insurance company to recover funds that it has paid out on behalf of its policyholder from a third party who is responsible for causing the loss.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

And we hereby subrogate to you the rights and remedies that we have in consequence of or arising from loss/damage to our insured goods and we further hereby grant to you all power to take and use all lawful ways and means to demand, recover and to receive the said loss/damage and all and every debt from whom it may ...