Pennsylvania Promissory Note Payable on a Specific Date

Description

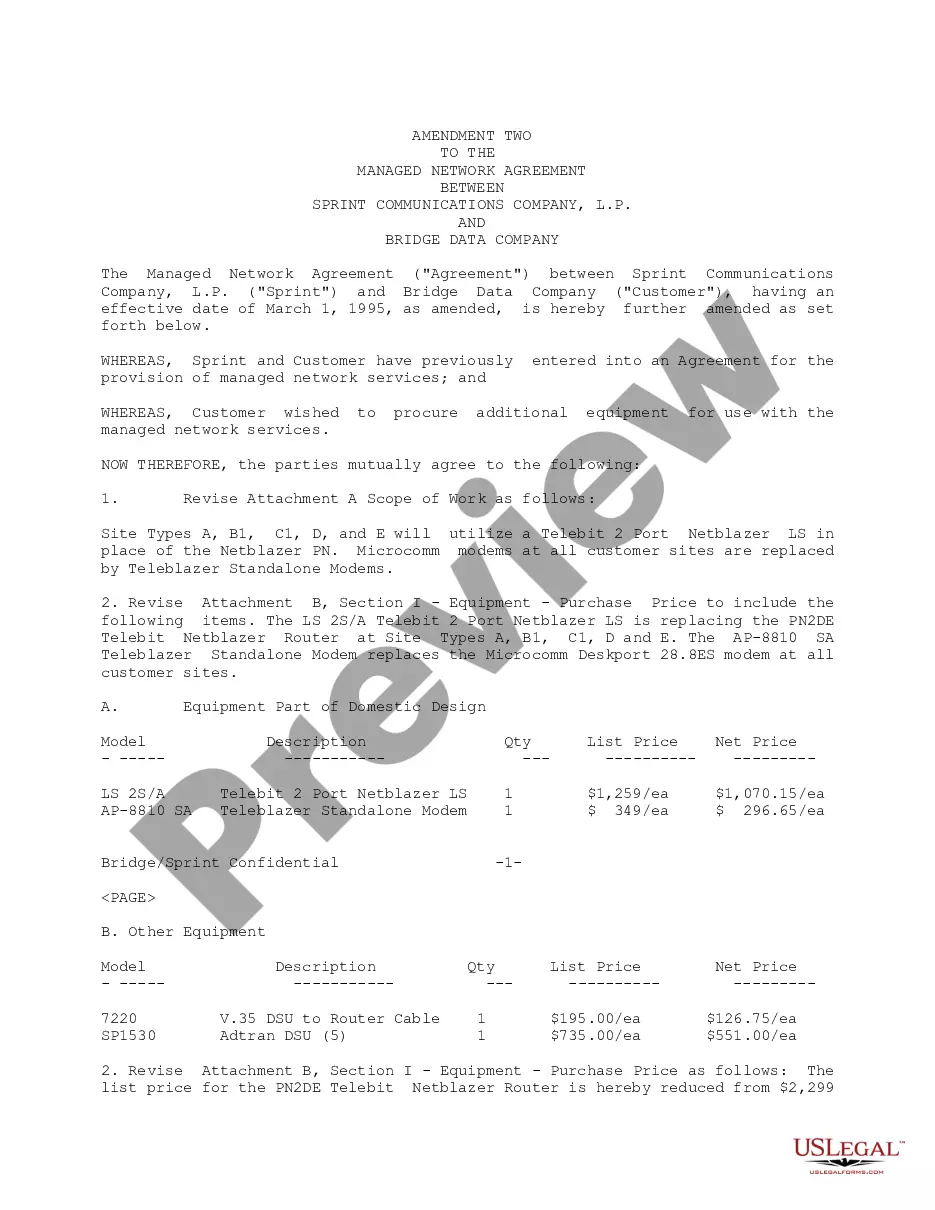

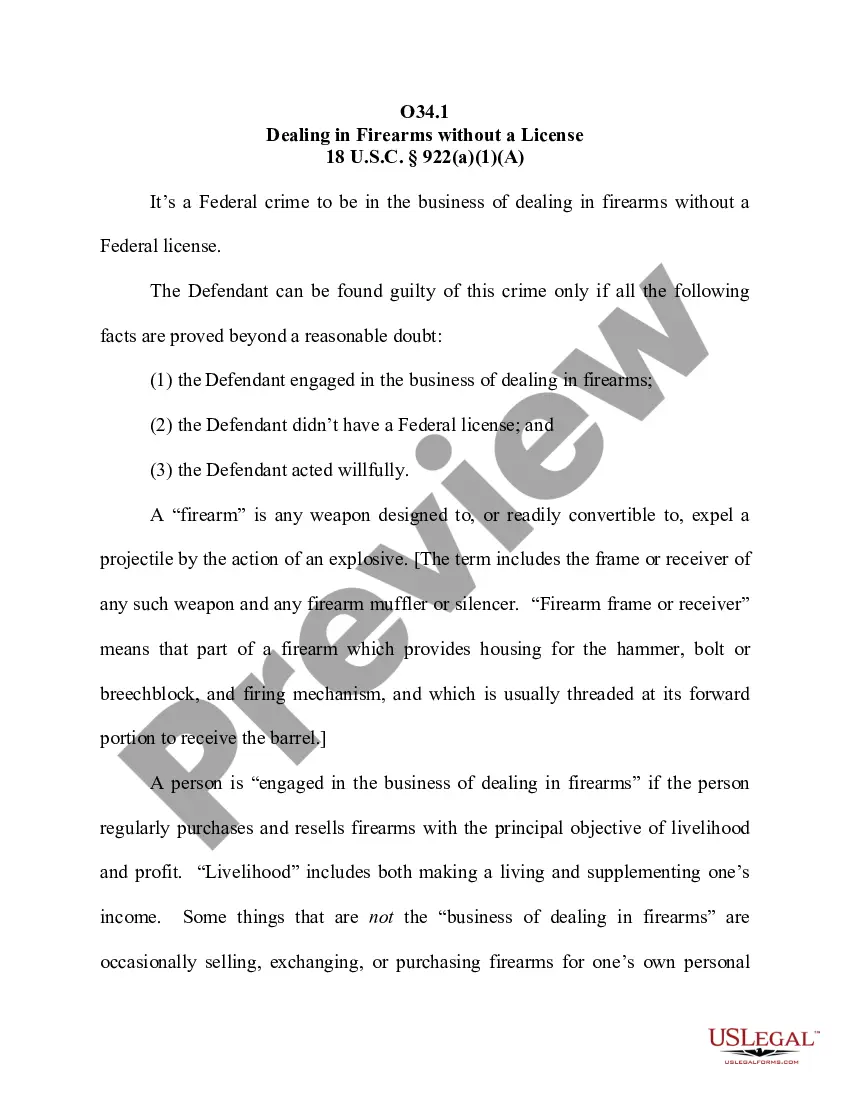

How to fill out Promissory Note Payable On A Specific Date?

You might invest time online seeking the appropriate legal document format that complies with the federal and state requirements you have. US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can easily download or print the Pennsylvania Promissory Note Payable on a Specific Date from my services.

If you already have a US Legal Forms account, you can Log In and then click the Download button. Afterward, you can complete, modify, print, or sign the Pennsylvania Promissory Note Payable on a Specific Date. Every legal document format you acquire is yours forever.

Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, and sign and print the Pennsylvania Promissory Note Payable on a Specific Date. Access and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal templates. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document format for your area/city of choice. Review the document description to confirm you have chosen the right document.

- If available, use the Preview button to examine the document format as well.

- If you want to find another version of the document, use the Search field to locate the format that meets your needs and requirements.

- Once you have located the format you desire, click Purchase now to continue.

- Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

Form popularity

FAQ

When a promissory note is issued, you would typically find the principal amount, interest rate, payment date, and signatures of the involved parties. Additionally, it may include terms regarding late fees or default provisions. If you are considering a Pennsylvania Promissory Note Payable on a Specific Date, ensure all relevant information is included and clear. This minimizes misunderstandings and promotes smoother transactions.

The grace period for a Pennsylvania promissory note payable on a specific date varies depending on the terms set in the note itself. Typically, this period allows the borrower to make a payment without incurring penalties. However, it is essential to review the specific terms outlined in the agreement to fully understand the grace details.

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Demand Promissory Note: A note that needs to be repaid immediately when the lender asks. There is no specific term or due date for the money under these notes. Due Date: The date on which a loan must be paid in full. This is sometimes called the maturity date.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

A Promissory Note Due on a Specific Date is a loan contract that enables a lender and borrower to agree on a set date for repayment. By giving a clear deadline to the borrower, this lending document can help to ensure that the loan will be repaid in full and on time.

Many differences among promissory notes relate to when and how the borrowed amount will be repaid. Although you are free to negotiate terms that work for your arrangement, your note must either have an end date or be payable when the lender demands it. Unconditional .

The Note Date is the date of the Note.