Pennsylvania Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Provisions For Testamentary Charitable Remainder Unitrust For One Life?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By utilizing the site, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords. You can find the most recent versions of forms like the Pennsylvania Provisions for Testamentary Charitable Remainder Unitrust for One Life in just a few minutes.

If you already have a membership, Log In to access the Pennsylvania Provisions for Testamentary Charitable Remainder Unitrust for One Life from the US Legal Forms library. The Download button will be available on every form you review. You can access all previously acquired forms through the My documents tab of your account.

Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit it. Complete, modify, print, and sign the downloaded Pennsylvania Provisions for Testamentary Charitable Remainder Unitrust for One Life. Each template added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to obtain or print another copy, simply visit the My documents section and click on the form you require. Access the Pennsylvania Provisions for Testamentary Charitable Remainder Unitrust for One Life with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your region/state.

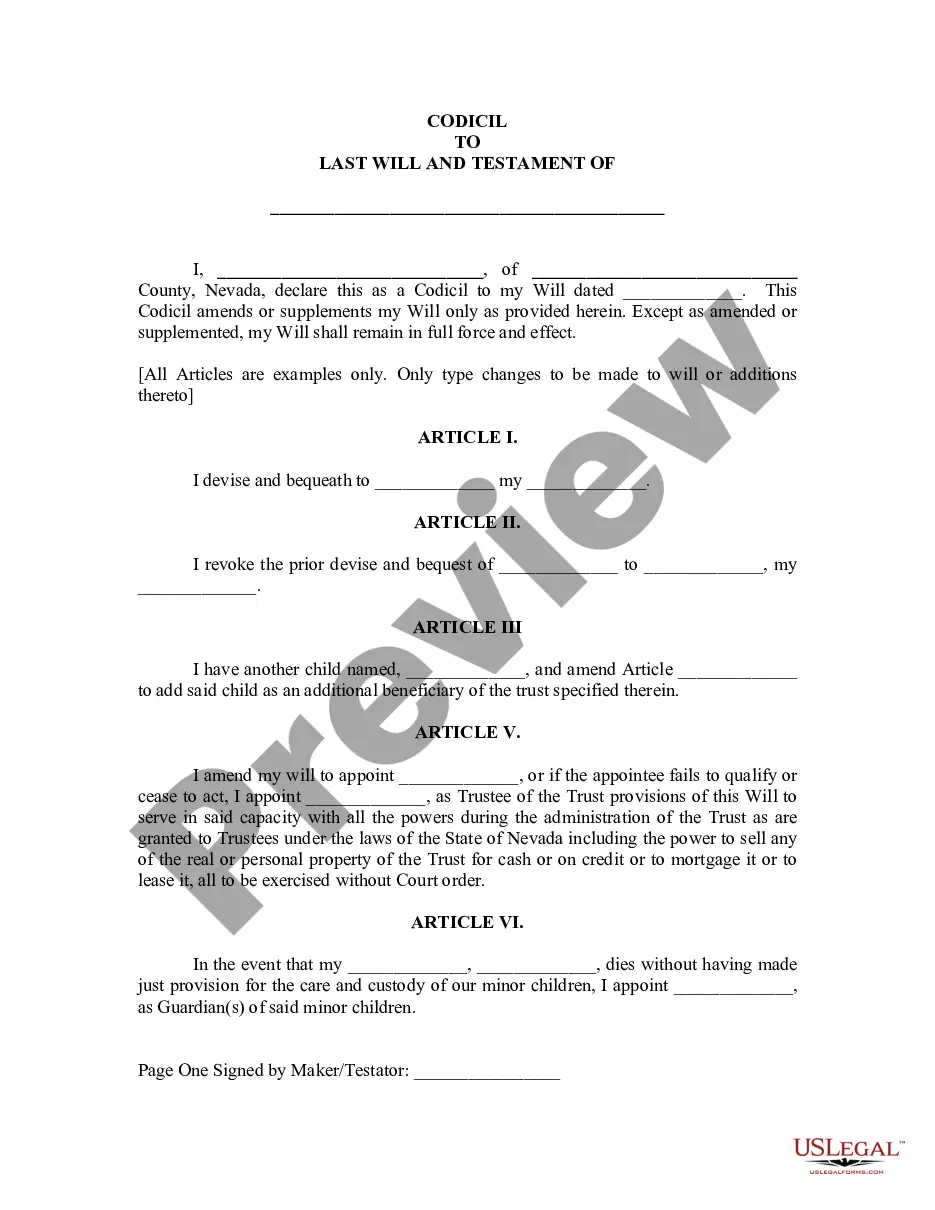

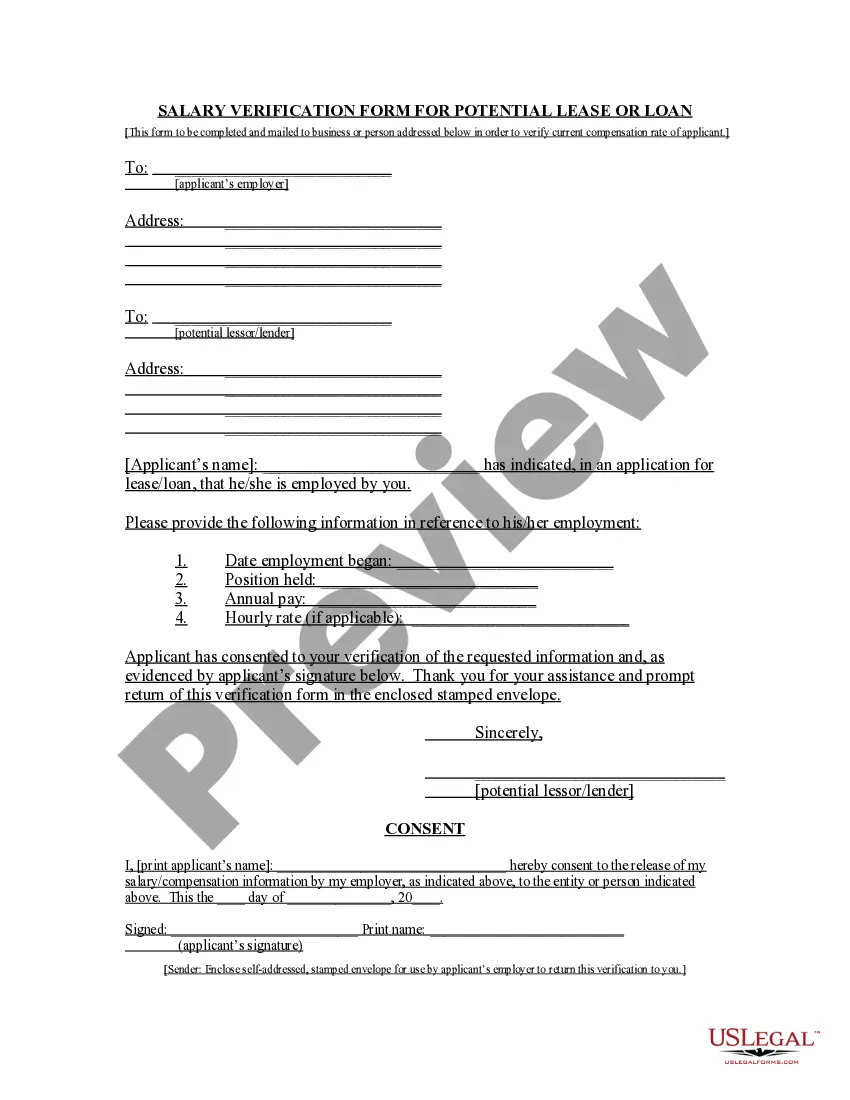

- Use the Preview option to check the contents of the form.

- Review the form summary to confirm you have the right document.

- If the document does not match your needs, make use of the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

Use Schedule A of Form 5227 to report:Accumulations of income for charitable remainder trusts,Distributions to noncharitable beneficiaries/recipients, and.Information about donors and assets contributed during the year.

How to Set up a Charitable Remainder TrustCreate a Charitable Remainder Trust.Check with the IRS that the charity you want to benefit is approved.Transfer assets into the Trust.Name the charity as Trustee.Create a provision that states who the lead beneficiary is - remember, this can be yourself or someone else.More items...

Yes, in most cases you can name yourself (and/or spouse) as trustee. As a matter of fact, according to a recent IRS Statistics of Income Bulletin, trust grantors or beneficiaries were the most common listed trustee of charitable remainder trusts.

There are two types of CRTs, Charitable Remainder Annuity Trusts (CRATS) and Charitable Remainder Unitrusts (CRUTs). Both CRATs and CRUTs require that the payments be made to designated individuals for their lifetimes, or for a fixed term not exceeding 20 years. There are two basic differences between CRATs and CRUTs.

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed. Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

If an individual establishes a charitable remainder trust for his or her life only, the trust assets will be included in his or her gross estate under IRC section 2036.

A charitable lead trust (CLT) is like the reverse of a charitable remainder trust. This type of trust disperses income to a named charity, while the noncharitable beneficiaries receive the remainder of the donated assets upon your death or at the end of a specific term, similar to a CRT.

How to Set up a Charitable Remainder TrustCreate a Charitable Remainder Trust.Check with the IRS that the charity you want to benefit is approved.Transfer assets into the Trust.Name the charity as Trustee.Create a provision that states who the lead beneficiary is - remember, this can be yourself or someone else.More items...

The minimum funding amount to establish a charitable remainder unitrust with Stanford as trustee is at least $200,000, with the actual minimum determined based on the term of the trust and the payout rate.

What does it take in terms of time and financial costs to create and maintain the CRT for life? The time it takes to create the trust depends on how efficiently the attorney and client work together. The one-time cost can be $3,000-$8,000 depending on the complexity of the trust.