Pennsylvania Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse array of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms like the Pennsylvania Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner in just minutes.

Read the form description to confirm that you have selected the right one.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find a suitable option.

- If you already hold a monthly subscription, Log In and download the Pennsylvania Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner from the US Legal Forms library.

- The Download button will be visible on each document you review.

- You can access all previously downloaded forms from the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/state.

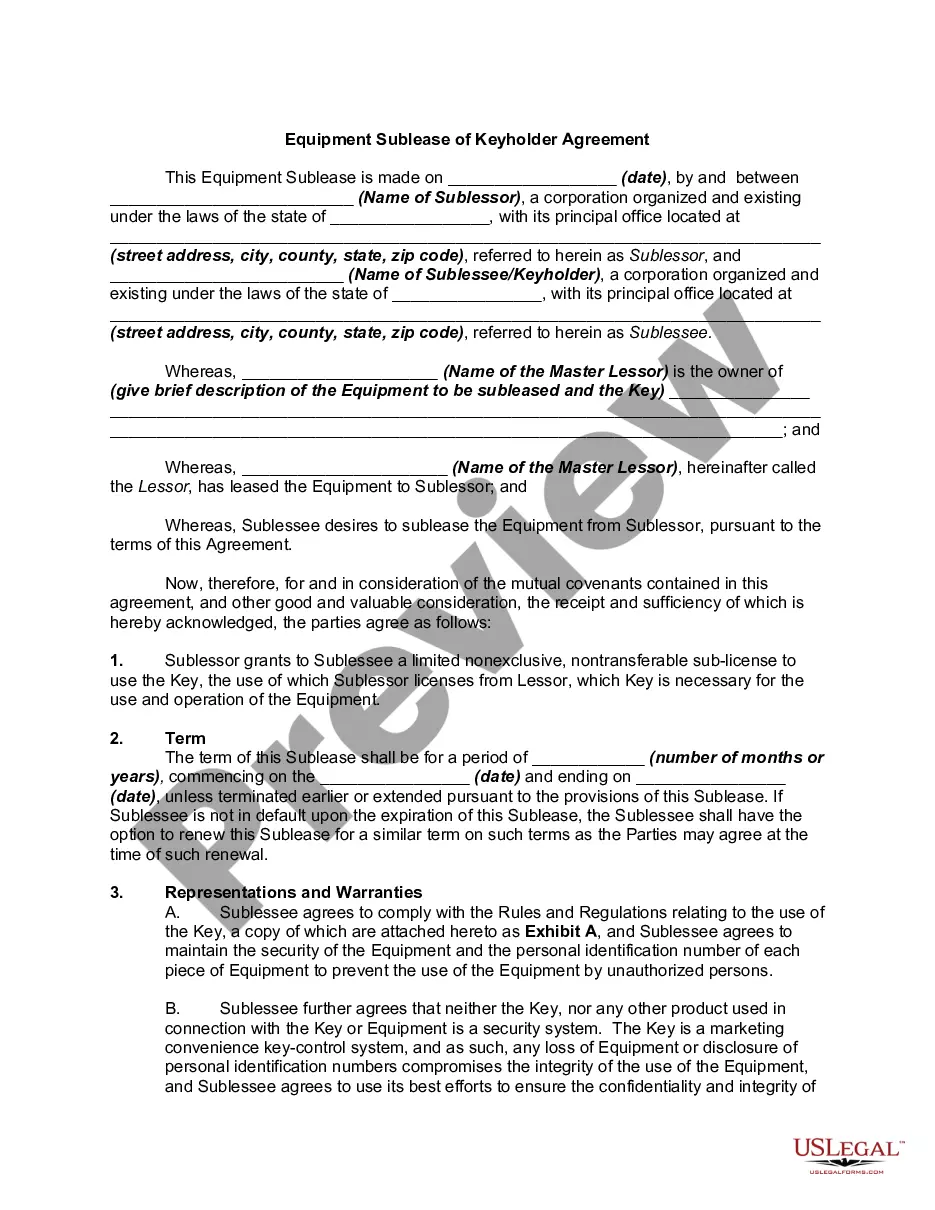

- Select the Review button to examine the content of the form.

Form popularity

FAQ

Pennsylvania has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

There is no specific deadline for filing probate after someone dies in Pennsylvania. However, the law does require that within three months of the death, creditors, heirs, and beneficiaries are notified of the death. Then, within six months, an inventory of assets must be prepared and filed with the Register of Wills.

The probate process in Pennsylvania is really quite simple and fairly easy and isn't something that should induce any fear or apprehension. If a person dies in Pennsylvania owning any assets in their name, their estate will need to be probated. Whether you have a will or not, your estate must be probated.

A gift given by means of the will of a decedent of an interest in real property.

The following steps explain what you will need to do to open the probate process here in the state of Pennsylvania.Step 1: Consider Hiring a Lawyer to Help You.Step 2: Gather Documentation.Step 3: Determine Assets that Can Skip Probate, if Any.Step 4: File the Will and Petition for Probate.

THE PROCESS OF ADMINISTERING A DECEDENT'S ESTATE INVOLVES:Collecting all assets.Locating all creditors.Paying all debts.Paying all applicable taxes.Distributing the remaining assets to the persons entitled to inherit.

Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.

If a friend or family member has passed without a will, their estate still needs to be handled through probate. Instead of deciding how their estate will pass to their heirs by looking at their last will and testament, Pennsylvania's intestacy statute governs how their money and assets will be dispersed instead.