Pennsylvania Sample Letter for Petition to Close Estate

Description

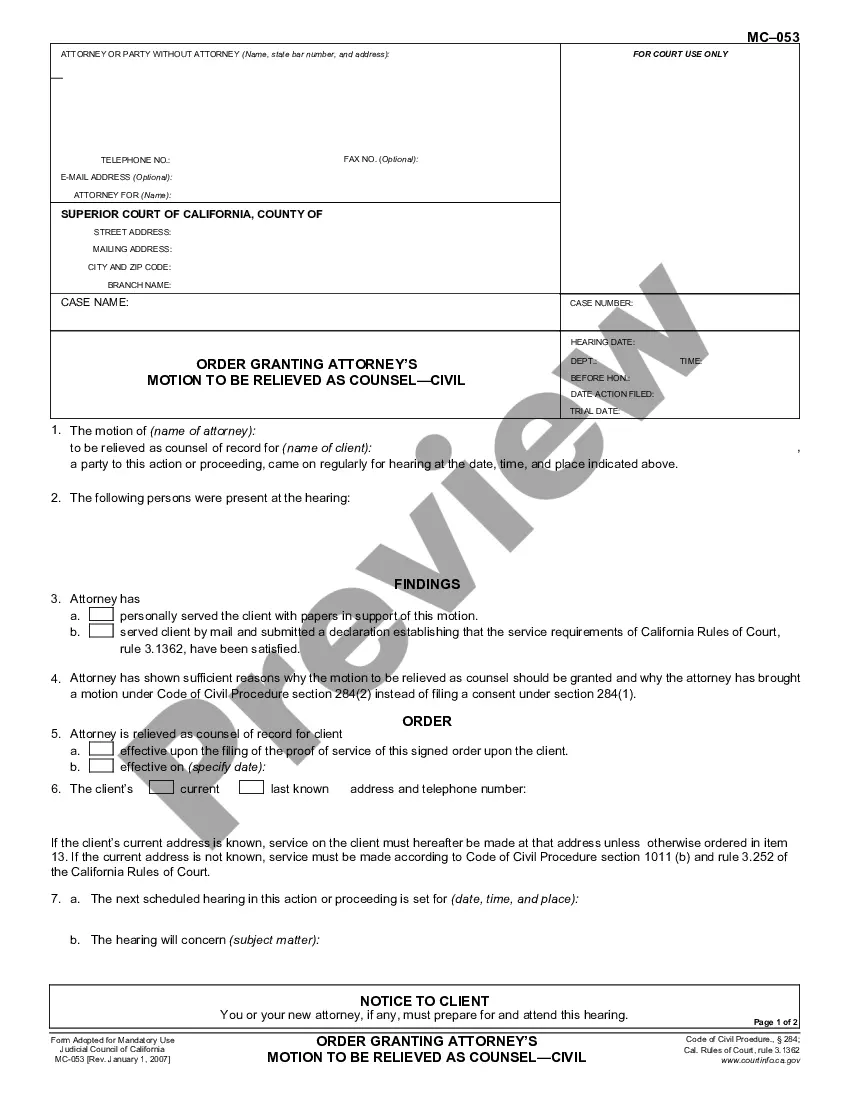

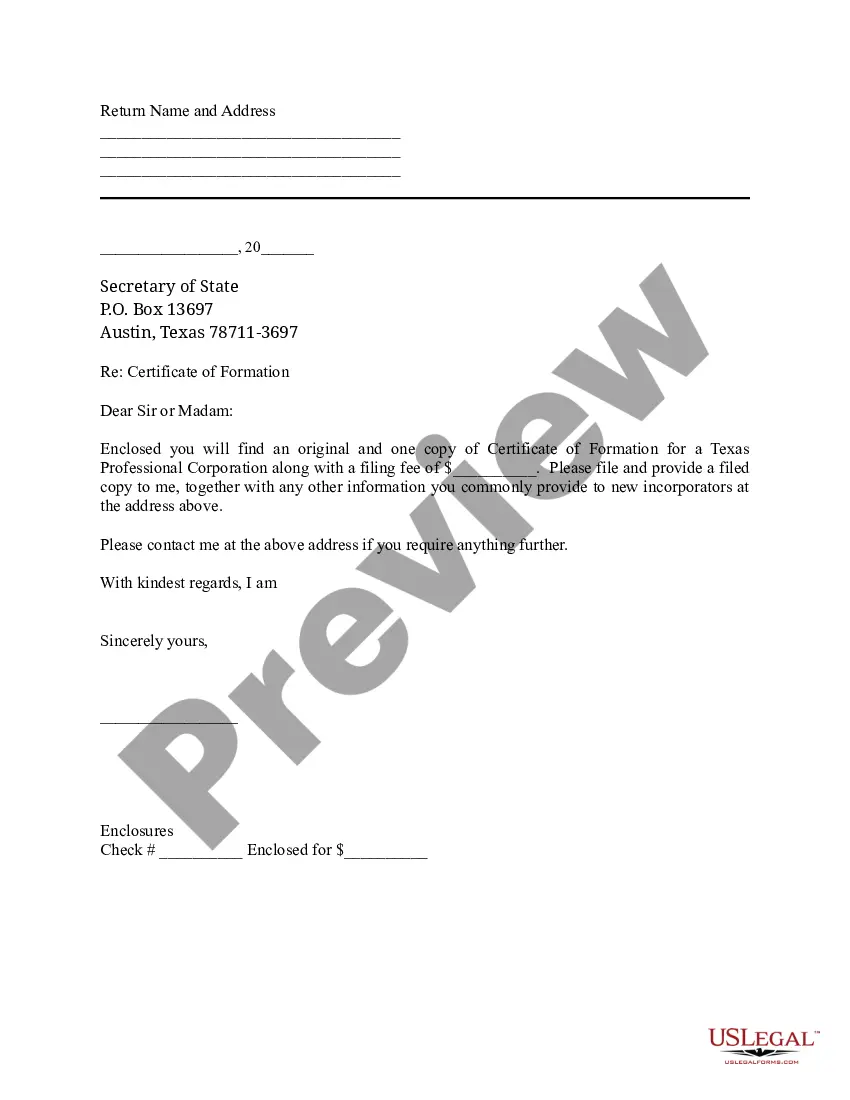

How to fill out Sample Letter For Petition To Close Estate?

If you need to complete, acquire, or print authorized file templates, use US Legal Forms, the greatest assortment of authorized kinds, that can be found on-line. Take advantage of the site`s easy and handy research to find the documents you will need. A variety of templates for company and specific purposes are sorted by types and states, or search phrases. Use US Legal Forms to find the Pennsylvania Sample Letter for Petition to Close Estate with a number of click throughs.

In case you are presently a US Legal Forms consumer, log in in your accounts and click on the Acquire button to obtain the Pennsylvania Sample Letter for Petition to Close Estate. You can also entry kinds you previously delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your right town/region.

- Step 2. Use the Preview method to check out the form`s content material. Do not overlook to read through the description.

- Step 3. In case you are not satisfied together with the form, make use of the Search area near the top of the display to locate other versions in the authorized form template.

- Step 4. After you have discovered the shape you will need, click on the Acquire now button. Pick the rates strategy you like and add your credentials to register for an accounts.

- Step 5. Process the financial transaction. You can use your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Pick the file format in the authorized form and acquire it on your gadget.

- Step 7. Comprehensive, modify and print or indication the Pennsylvania Sample Letter for Petition to Close Estate.

Every single authorized file template you buy is your own for a long time. You have acces to each and every form you delivered electronically in your acccount. Click on the My Forms segment and choose a form to print or acquire once again.

Compete and acquire, and print the Pennsylvania Sample Letter for Petition to Close Estate with US Legal Forms. There are many skilled and status-distinct kinds you can use for your personal company or specific requirements.

Form popularity

FAQ

It is extremely important to have a Pennsylvania Family Settlement Agreement prepared by an experienced PA probate lawyer. The second way to close an estate in PA is to file an accounting with the local county Orphans' Court. The executor or administrator must file a legal breakdown of the estate assets and expenses.

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

Most Pennsylvania estates are closed informally, by release agreement. A release agreement or waiver allows the beneficiaries of the Pennsylvania estate to approve of the administration of the estate and consent to the final distribution of the estate assets.

The Small Estates Petition must provide the Court with: (1) a list of all the decedent's personal property and the value of each item; (2) a list of all known debts of the decedent and the value of each claim; (3) the type and amount of any taxes due as a result of the decedent's death, including the Pennsylvania ...

It is extremely important to have a Pennsylvania Family Settlement Agreement prepared by an experienced PA probate lawyer. The second way to close an estate in PA is to file an accounting with the local county Orphans' Court. The executor or administrator must file a legal breakdown of the estate assets and expenses.

Pennsylvania Probate Fee Schedule ? Attorney Fees For Estate Settlement In PA Value of Estate% of EstateFee$50,000.01 to $100,000.005%$2,500.00$100,000.01 to $200,000.004%$4,000.00$200,000.01 to $1,000,000.003%$24,000.00$1,000,000.01 to $2,000,000.002%$20,000.005 more rows

Any interested party that wishes to remove an executor would have to petition the probate court to have the executor removed and present a reason. It's best to have a qualified probate lawyer advise you first and help you with this petition.