Pennsylvania Joint Trust with Income Payable to Trustees During Joint Lives is a type of trust that offers financial benefits to multiple individuals in the state of Pennsylvania. It aims to provide a secure and flexible way to manage assets and generate income while ultimately benefiting the trustees during their joint lives. This trust type involves a wide range of features and considerations which will be discussed below. One notable benefit of a Pennsylvania Joint Trust with Income Payable to Trustees During Joint Lives is the ability to receive income generated from the trust during the trustees' lifetimes. This income can be derived from various sources such as investments, rental properties, or businesses held within the trust. By maximizing the income potential, trustees can enjoy a regular stream of revenue while maintaining control over their assets. Additionally, the Pennsylvania Joint Trust allows for the ease of asset management through the appointment of trustees. Trustees are responsible for managing and administering the trust, ensuring that assets are protected and investments are made wisely. Trustees can choose to act as trustees themselves or appoint a trusted individual or institution to handle these responsibilities. This flexibility provides the opportunity to minimize potential conflicts of interest and benefit from professional expertise. Furthermore, Pennsylvania Joint Trusts offer potential tax advantages. By placing assets into the trust, trustees can potentially reduce their estate taxes upon their passing. Additionally, income generated within the trust can be taxed at lower rates compared to individual tax brackets. It's crucial to consult with a qualified attorney or tax advisor to maximize the tax planning benefits specific to the trustees' needs and circumstances. While the general concept remains the same, there are various types of Pennsylvania Joint Trusts with Income Payable to Trustees During Joint Lives that cater to different objectives, preferences, and family dynamics. These variations include: 1. Revocable Joint Trust: This type of trust allows trustees to maintain control and flexibility over their assets by retaining the option to modify or revoke the trust during their lifetime. It provides the trustees with a sense of security and ease of adaptability to potential changes in circumstances. 2. Irrevocable Joint Trust: As the name suggests, an irrevocable joint trust cannot be modified or revoked after it's established. This type of trust offers more asset protection, potential tax advantages, and ensures that the trustees' wishes are preserved in perpetuity. 3. Joint Living Trust: Also known as a shared living trust, this arrangement allows trustees to pool their assets and enjoy joint control. They can make decisions together, outline specific conditions, or distributions, and generally experience the benefits of trust management as a team. 4. Joint Marital Trust: This trust variation is specifically designed for married couples. It allows assets to be transferred between spouses while granting income to both during their joint lives. It ensures that both partners benefit from the trust's income while providing for distribution after the passing of the second spouse. Pennsylvania Joint Trust with Income Payable to Trustees During Joint Lives offers a multitude of advantages, including income generation, asset protection, tax planning, and adaptability to individual needs. Engaging the guidance of legal and financial professionals is essential when considering the establishment of any trust to ensure it aligns with personal goals and complies with relevant Pennsylvania legislation.

Pennsylvania Joint Trust with Income Payable to Trustors During Joint Lives

Description

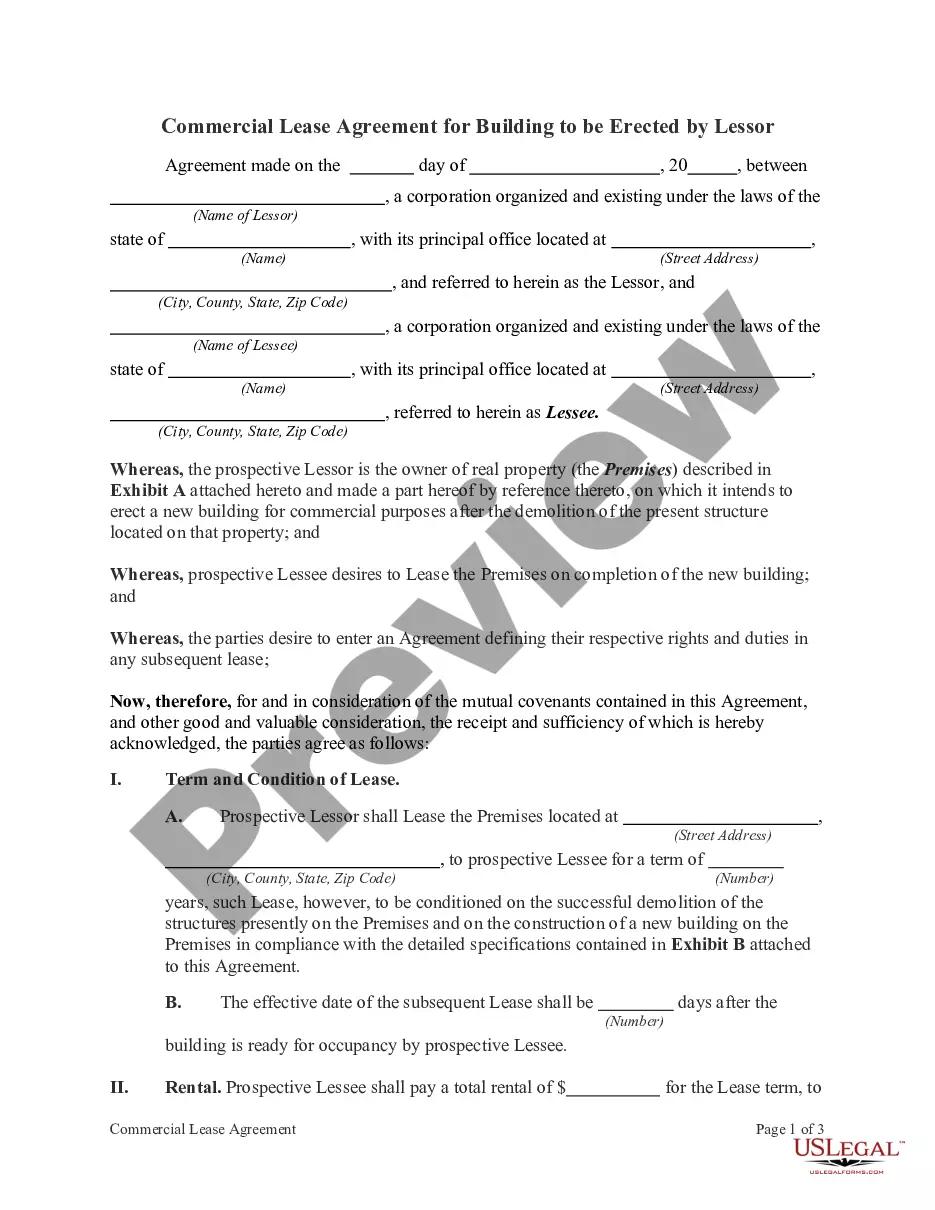

How to fill out Pennsylvania Joint Trust With Income Payable To Trustors During Joint Lives?

Finding the right legal record template can be a battle. Needless to say, there are plenty of layouts available online, but how would you obtain the legal type you need? Take advantage of the US Legal Forms site. The services gives thousands of layouts, including the Pennsylvania Joint Trust with Income Payable to Trustors During Joint Lives, that you can use for enterprise and personal requirements. Each of the forms are examined by pros and meet state and federal needs.

If you are previously registered, log in for your bank account and then click the Download switch to get the Pennsylvania Joint Trust with Income Payable to Trustors During Joint Lives. Use your bank account to look through the legal forms you possess bought earlier. Go to the My Forms tab of your own bank account and get one more duplicate in the record you need.

If you are a fresh user of US Legal Forms, allow me to share basic directions so that you can follow:

- Initially, be sure you have chosen the proper type for the area/region. You can look through the form using the Review switch and browse the form outline to make certain this is basically the best for you.

- In case the type does not meet your preferences, take advantage of the Seach field to get the appropriate type.

- Once you are certain the form is suitable, select the Purchase now switch to get the type.

- Opt for the pricing strategy you would like and enter the essential information. Create your bank account and buy your order using your PayPal bank account or charge card.

- Choose the data file formatting and down load the legal record template for your product.

- Complete, revise and print and signal the received Pennsylvania Joint Trust with Income Payable to Trustors During Joint Lives.

US Legal Forms will be the greatest library of legal forms in which you can discover a variety of record layouts. Take advantage of the service to down load appropriately-produced paperwork that follow express needs.