Title: Pennsylvania Bond to Secure against Defects in Construction: A Comprehensive Guide Introduction: Pennsylvania Bond to Secure against Defects in Construction serves as a crucial protection mechanism for construction projects in the state. This detailed description will provide a comprehensive overview of what Pennsylvania Bonds are, their importance, and the various types available in the construction industry. 1. Understanding Pennsylvania Bonds to Secure against Defects in Construction: Pennsylvania Bonds to Secure against Defects in Construction are legally binding agreements between project owners, known as obliges, and contractors. These bonds ensure that contractors adhere to construction specifications, complete projects according to contractual terms, and rectify defects that may arise during or after the construction process. 2. Importance of Pennsylvania Bonds in Construction Projects: With construction defects, such as structural issues or failure to meet design specifications, a Pennsylvania Bond provides financial security for project owners. It ensures that the obliges will not face financial losses resulting from faulty workmanship or non-compliance to building codes. 3. Types of Pennsylvania Bonds to Secure against Defects in Construction: a. Performance Bonds: Performance Bonds in Pennsylvania guarantee that contractors will complete the project according to contractual obligations. They ensure that the obliges receive quality work, and in case of default, the bond's funds can be utilized to hire a replacement contractor or cover additional costs required for completion. b. Payment Bonds: Pennsylvania Payment Bonds ensure that contractors make timely payments to subcontractors, suppliers, and laborers involved in the construction project. In the event of contractor default, these bonds protect the obliges from any financial liability resulting from unpaid invoices, wages, or material costs. c. Maintenance Bonds: Maintenance Bonds are another type of Pennsylvania Bond commonly used to secure against defects. These bonds guarantee that contractors will perform necessary repairs or address defects within a specified period after project completion. They provide additional peace of mind to obliges against construction-related issues that may arise after the project handover. 4. The Bonding Process: To obtain a Pennsylvania Bond, a contractor typically has to engage with a surety company capable of issuing surety bonds. The contractor undergoes a thorough underwriting process, including financial evaluation to determine their stability and ability to fulfill the bond obligations. Once approved, the surety company issues the bond to the obliged, solidifying the contractor's commitment and financial backing. 5. Benefits of Pennsylvania Bonds: — Protects thobligedee's financial interests from defects in construction. — Increases confidence in the construction project's success and completion. — Assures product quality, adherence to specifications, and compliance with building codes. — Provides legal recourse and financial recovery options in case of non-compliance or default by the contractor. — Offers a competitive advantage, particularly for contractors with established bonding capabilities. Conclusion: Pennsylvania Bonds to Secure against Defects in Construction play a vital role in safeguarding the interests of project owners and ensuring successful project completion. These bonds, including Performance Bonds, Payment Bonds, and Maintenance Bonds, protect against defects, non-compliance, and financial losses, making them an essential component in construction projects across the Keystone State.

Pennsylvania Bond to Secure against Defects in Construction

Description

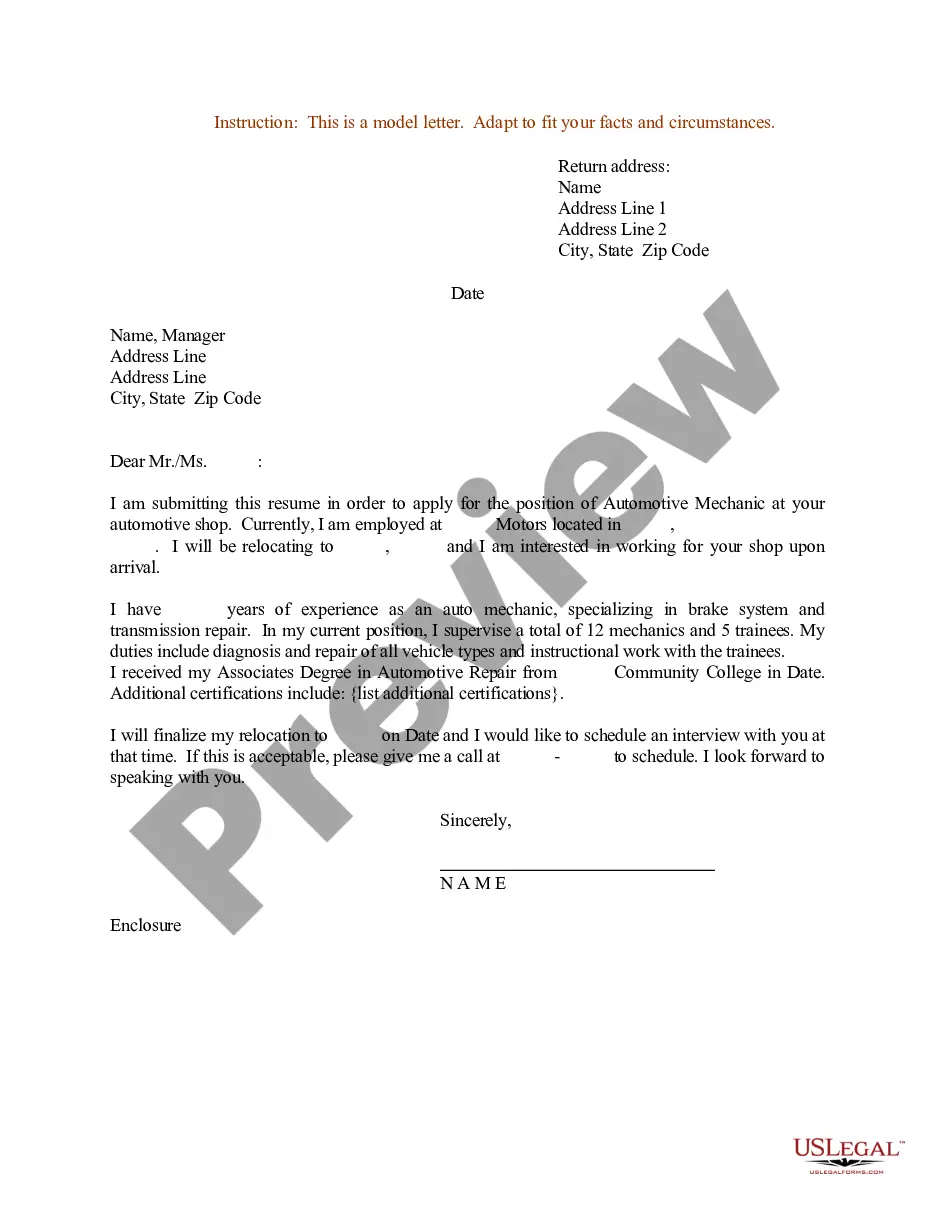

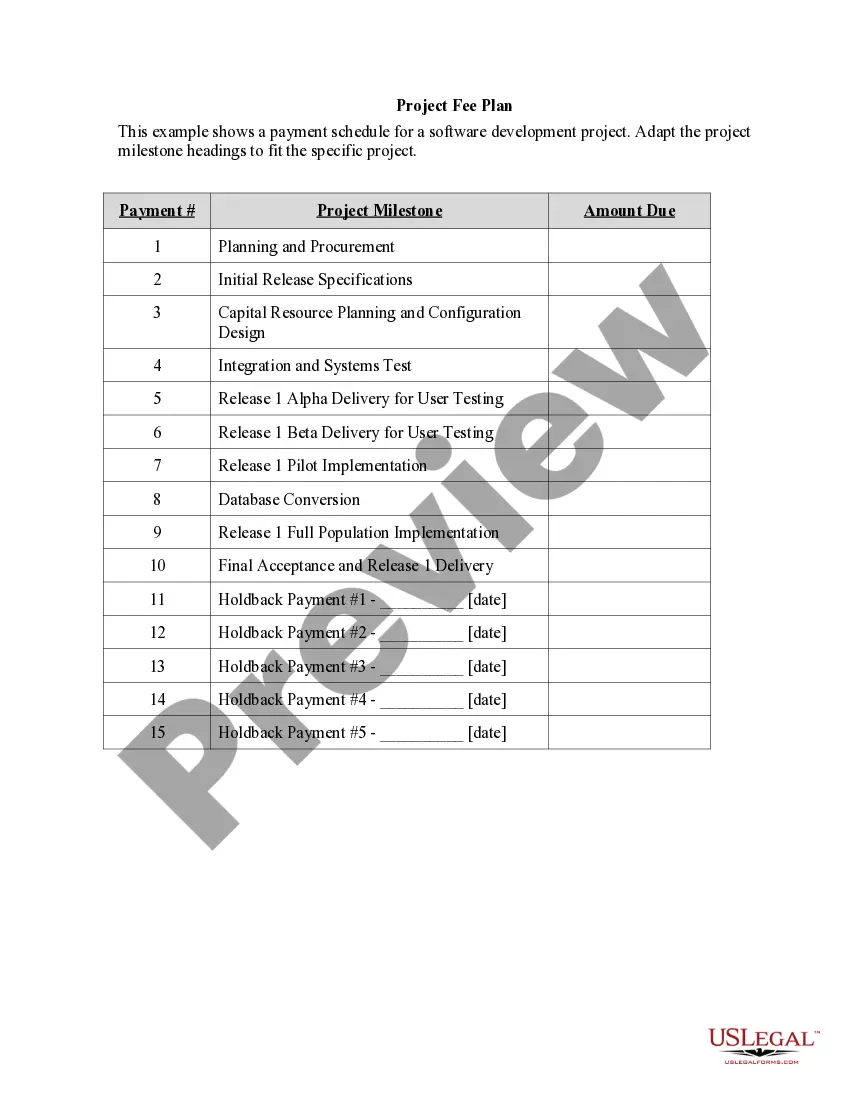

How to fill out Pennsylvania Bond To Secure Against Defects In Construction?

Are you presently in a situation that you require documents for sometimes company or specific purposes just about every time? There are a lot of authorized file layouts available on the net, but finding versions you can trust isn`t easy. US Legal Forms gives thousands of form layouts, like the Pennsylvania Bond to Secure against Defects in Construction, which can be published to fulfill state and federal needs.

Should you be previously knowledgeable about US Legal Forms internet site and possess your account, simply log in. Following that, you are able to acquire the Pennsylvania Bond to Secure against Defects in Construction web template.

Unless you offer an bank account and want to begin to use US Legal Forms, adopt these measures:

- Discover the form you will need and make sure it is for that proper metropolis/state.

- Utilize the Review button to review the shape.

- Read the information to actually have chosen the right form.

- In the event the form isn`t what you are looking for, use the Lookup area to obtain the form that fits your needs and needs.

- Whenever you discover the proper form, click Purchase now.

- Opt for the pricing prepare you want, fill out the required info to create your money, and purchase the transaction with your PayPal or Visa or Mastercard.

- Pick a hassle-free document format and acquire your backup.

Locate all the file layouts you have purchased in the My Forms menu. You may get a extra backup of Pennsylvania Bond to Secure against Defects in Construction at any time, if possible. Just click the needed form to acquire or print out the file web template.

Use US Legal Forms, the most considerable assortment of authorized varieties, to save lots of time as well as steer clear of faults. The service gives professionally made authorized file layouts that you can use for a selection of purposes. Make your account on US Legal Forms and initiate generating your way of life easier.