A Pennsylvania Agreement Between Board Member and Close Corporation is a legally binding document that outlines the roles, responsibilities, and expectations of a board member in a close corporation operating in the state of Pennsylvania. This agreement is crucial for ensuring a clear understanding between the board member and the corporation, promoting transparency, and protecting the interests of both parties involved. Keywords: Pennsylvania, Agreement, Board Member, Close Corporation In Pennsylvania, there are different types of agreements that can exist between a board member and a close corporation. Some of the most common types include: 1. Board Member Appointment Agreement: This type of agreement outlines the process and criteria for appointing a board member to a close corporation in Pennsylvania. It specifies the qualifications, selection procedure, and terms of service for the board member. 2. Duties and Responsibilities Agreement: This agreement focuses on defining the specific duties and responsibilities of the board member within the close corporation. It outlines the expectations related to decision-making, governance, fiduciary responsibilities, and other obligations. 3. Compensation Agreement: The compensation agreement deals with the financial aspect of the board member's role in a close corporation. It details the methods and criteria for determining the compensation, including salary, bonuses, stock options, or other benefits. 4. Non-Disclosure Agreement (NDA): An NDA is essential for ensuring the confidentiality of sensitive information shared between the board member and the close corporation. It prohibits the board member from disclosing or using any confidential information for personal gain or unauthorized purposes. 5. Non-Compete Agreement: A non-compete agreement limits the board member's ability to engage in activities that would compete with the close corporation during or after their tenure. It prevents the board member from starting a similar business or working for a competitor, protecting the corporation's interests. 6. Term Agreement: A term agreement specifies the duration of the board member’s service in the close corporation. It outlines the commencement date, expected end date, and the conditions under which the board member's term can be extended or terminated. These agreements help ensure a harmonious relationship between the board member and the close corporation, maintain corporate governance standards, and protect the interests of all parties involved. It is advisable to consult legal professionals with expertise in Pennsylvania corporate laws when drafting or negotiating such agreements to ensure compliance with the relevant regulations.

Pennsylvania Agreement Between Board Member and Close Corporation

Description

How to fill out Pennsylvania Agreement Between Board Member And Close Corporation?

US Legal Forms - one of several biggest libraries of legitimate types in America - delivers an array of legitimate papers themes you are able to down load or printing. While using internet site, you can get a large number of types for company and personal functions, categorized by groups, states, or keywords.You will find the most recent types of types like the Pennsylvania Agreement Between Board Member and Close Corporation within minutes.

If you already possess a monthly subscription, log in and down load Pennsylvania Agreement Between Board Member and Close Corporation through the US Legal Forms local library. The Down load option will show up on each and every type you perspective. You get access to all formerly saved types inside the My Forms tab of your accounts.

In order to use US Legal Forms the first time, allow me to share simple recommendations to obtain started:

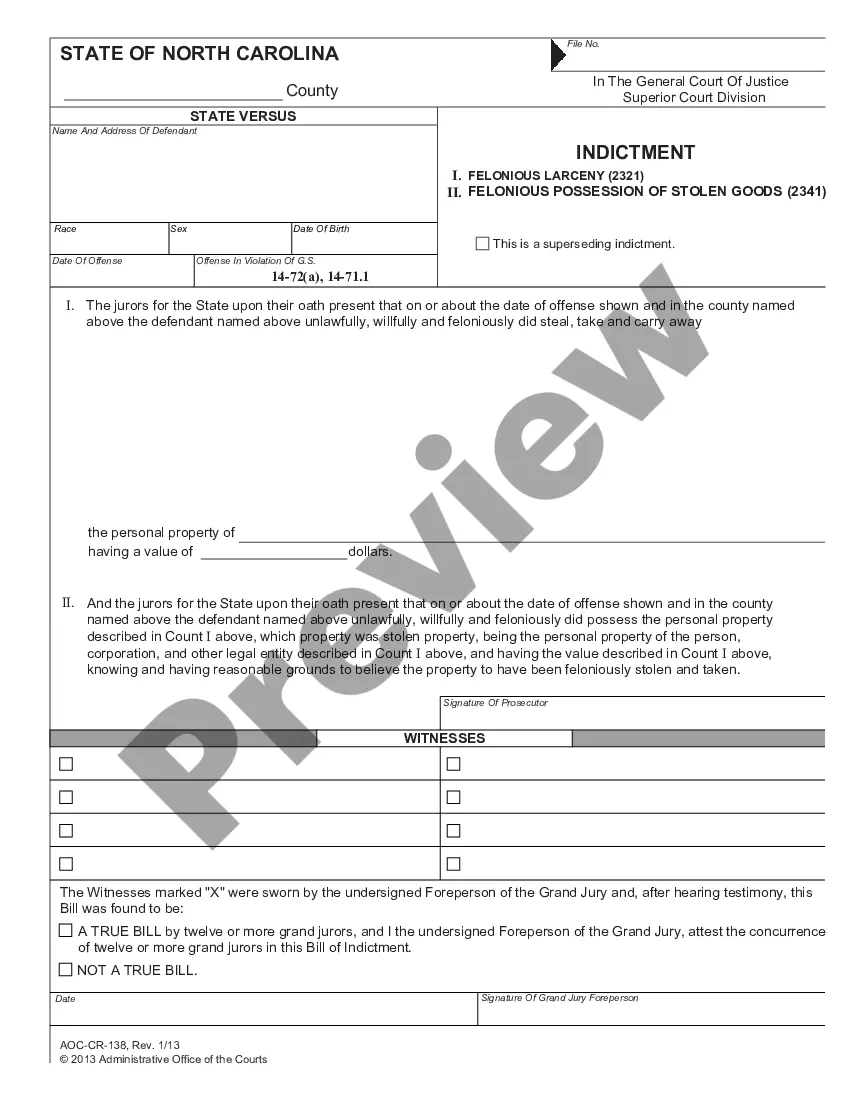

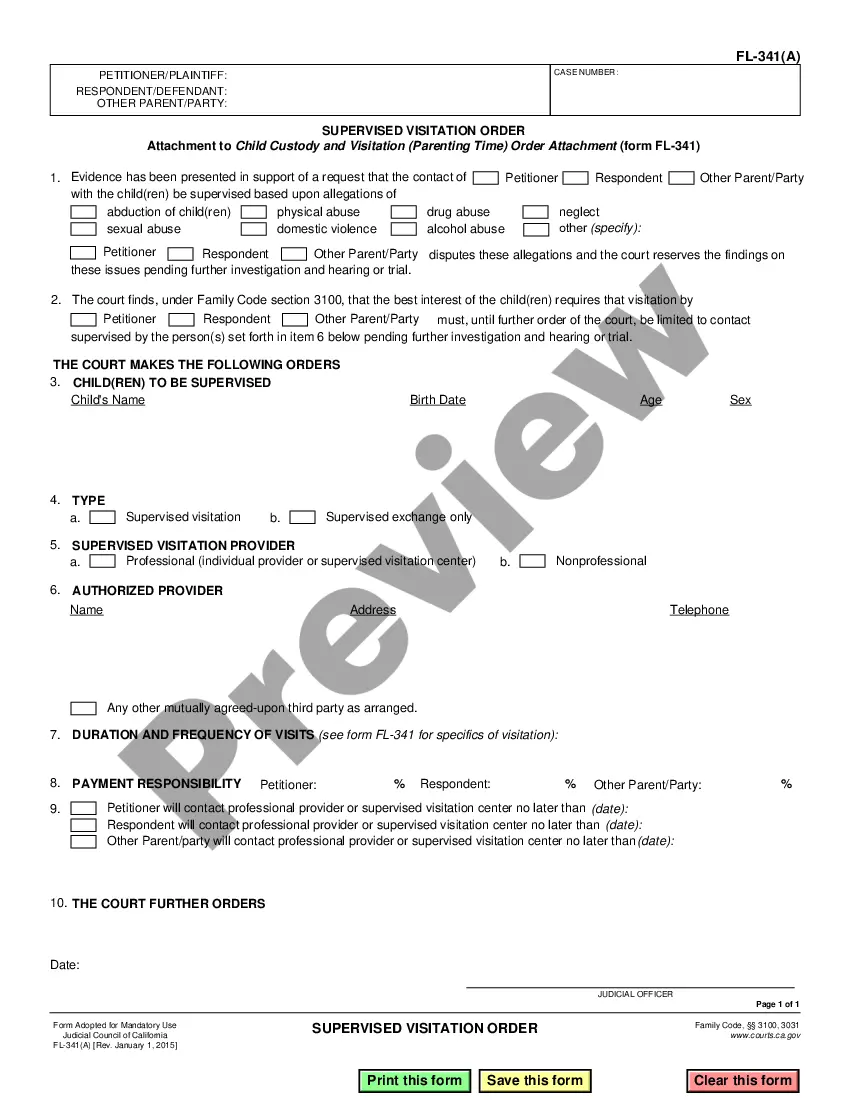

- Ensure you have selected the proper type for your personal metropolis/area. Click the Review option to review the form`s content. Browse the type information to actually have chosen the correct type.

- In the event the type does not match your specifications, utilize the Lookup area towards the top of the monitor to get the the one that does.

- If you are happy with the form, affirm your option by visiting the Purchase now option. Then, opt for the pricing prepare you favor and provide your qualifications to register on an accounts.

- Approach the deal. Utilize your Visa or Mastercard or PayPal accounts to finish the deal.

- Select the file format and down load the form on your own product.

- Make changes. Load, revise and printing and sign the saved Pennsylvania Agreement Between Board Member and Close Corporation.

Every format you included in your bank account does not have an expiry date and it is your own for a long time. So, if you want to down load or printing one more version, just check out the My Forms section and click in the type you need.

Get access to the Pennsylvania Agreement Between Board Member and Close Corporation with US Legal Forms, probably the most considerable local library of legitimate papers themes. Use a large number of expert and state-distinct themes that satisfy your company or personal requires and specifications.

Form popularity

FAQ

If your business is a corporation, then you are required by law to have a board of directors. Depending on your particular corporate structure and your state, one or two directors may be all that's legally required.

Close Corporations Key Featuresa Close Corporation (cc) is a legal entity.Audited financial statements are not required for Close Corporations.Meetings are not compulsory and can be held on an ad hoc basis.Close Corporations (CCs) may become shareholders in other companies.More items...

The articles of incorporation of a close corporation may provide that the business of the corporation shall be managed by the stockholders of the corporation rather than by a board of directors.

What is a Pennsylvania Statutory Close Corporation? In short, it is a special type of business corporation that has certain informal small company" protections built in.

For instance, US grocery giant Albertsons was a popular name as a close corporation with the backing of private equity firm Cerberus. In 2020, Albertsons became a publicly-traded company. It means that anybody can sell or buy these companies' shares from the open market.

ORC § 1701.591 entitled Close Corporation Agreement provides a mechanism for shareholders of a close corporation to agree in advance on issues related to the internal management and business operations of their corporation and the relations between and among themselves as shareholders.

A close corporation is a corporation which does not exceed a statutorily defined number of shareholders and is not a public corporation. This number depends on the state's business laws, but the number is usually 35 shareholders.

A Close Corporation has members and a Company has shareholders and directors. The Close Corporation has its own estate seperate from its members.

Different states have different rules for the organization of their S corporations and C corporations, but all for-profit and nonprofit corporations are required by law to have boards of directors. The rules of the state in which you incorporate determine when they must be named and how many directors are required.

A CC is similar to a private company. It is a legal entity with its own legal personality and perpetual succession and must register as a taxpayer in its own right. A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC.