Pennsylvania Accredited Investor Representation Letter: A Comprehensive Overview In Pennsylvania, an Accredited Investor Representation Letter is a formal document utilized in financial transactions to verify that an individual or entity meets the criteria to be classified as an accredited investor under the Securities and Exchange Commission (SEC) regulations. It serves as evidence that the investor possesses a certain level of financial sophistication, allowing them to participate in certain investment opportunities that are typically reserved for accredited investors. An accredited investor is generally defined as an individual or entity that meets specific income or net worth requirements, demonstrating their ability to bear the risks associated with certain types of investment opportunities. By obtaining an Accredited Investor Representation Letter, investors in Pennsylvania can present reliable proof of their accredited status when dealing with financial institutions, funds, or other parties involved in the investment process. Key Components of a Pennsylvania Accredited Investor Representation Letter: 1. Accredited Investor Status: The letter affirms that the recipient meets the required qualifications as an accredited investor in Pennsylvania. This may be based on factors such as income, net worth, professional experience, investment knowledge, or other relevant criteria defined by the SEC. 2. Compliance with SEC Regulations: The letter ensures compliance with the regulations outlined by the SEC, which are essential to protect investors and maintain market integrity. It guarantees that the investor understands the risks associated with certain investment opportunities and is capable of making informed decisions. 3. Legal and Financial Documentation: The Accredited Investor Representation Letter may require the investor to provide supporting documents and financial statements to validate their accredited status. These may include tax returns, bank statements, investment portfolios, or other authenticating records. Different Types of Pennsylvania Accredited Investor Representation Letters: 1. Individual Accredited Investor Representation Letter: This type of letter is issued to individuals who meet the specific criteria defined by the SEC, such as high net worth or annual income surpassing a certain threshold. It allows them to access investment opportunities reserved exclusively for accredited individuals. 2. Entity Accredited Investor Representation Letter: This variant of the letter is issued to entities like corporations, partnerships, limited liability companies, trusts, or other legal entities that qualify as accredited investors based on the SEC's criteria. It ensures that the entity can engage in investments that require accredited status. 3. Exempt Organization Accredited Investor Representation Letter: Accredited status is also applicable to certain exempt organizations, including charitable trusts, educational institutions, foundations, or endowments. This type of letter verifies their eligibility to participate as accredited investors in specific investment opportunities. Conclusion: The Pennsylvania Accredited Investor Representation Letter serves as a crucial document that verifies an individual's or entity's accredited status, allowing them to engage in investment opportunities that are otherwise restricted to non-accredited investors. By providing evidence of financial sophistication and compliance with SEC regulations, the letter enables investors to explore a wider range of investment options and potentially benefit from ventures with higher risks and returns.

Pennsylvania Accredited Investor Representation Letter

Description

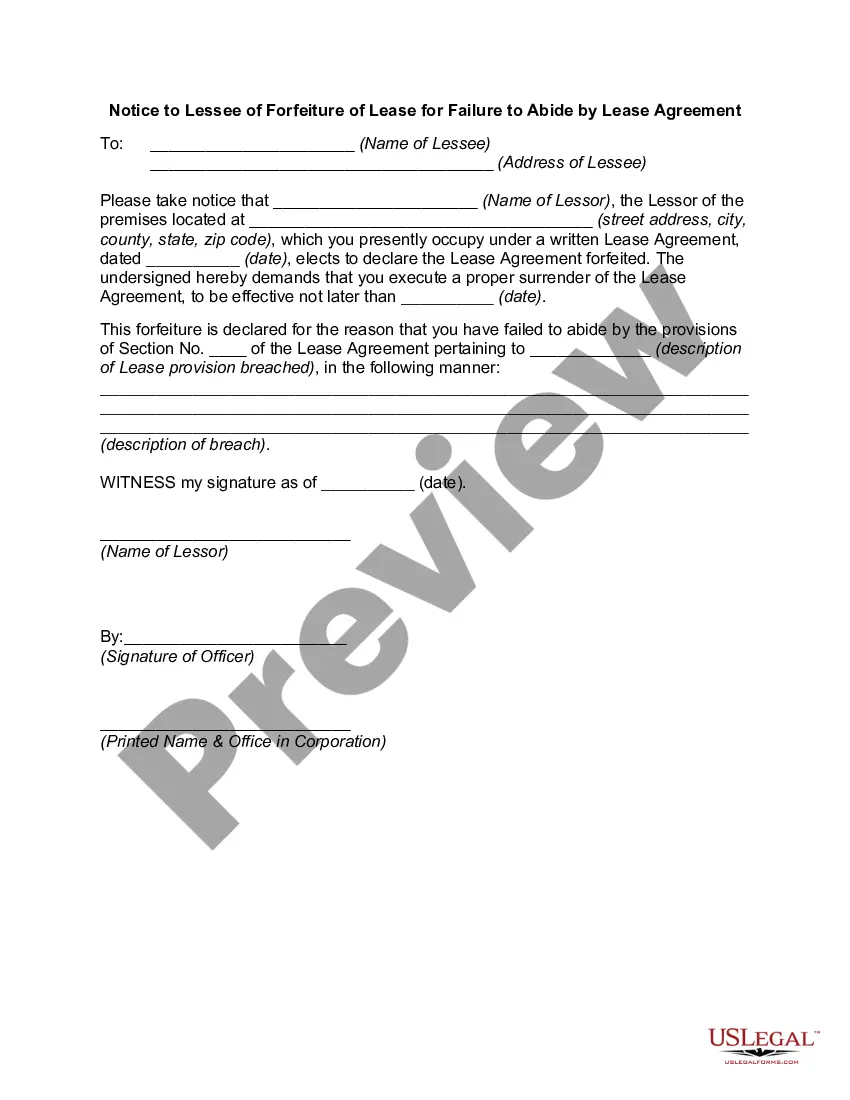

How to fill out Accredited Investor Representation Letter?

If you want to complete, download, or print lawful papers templates, use US Legal Forms, the greatest variety of lawful varieties, that can be found on the Internet. Take advantage of the site`s simple and easy handy search to get the papers you require. A variety of templates for organization and personal uses are sorted by categories and states, or keywords and phrases. Use US Legal Forms to get the Pennsylvania Accredited Investor Representation Letter within a handful of click throughs.

When you are currently a US Legal Forms customer, log in in your profile and then click the Acquire switch to get the Pennsylvania Accredited Investor Representation Letter. You may also access varieties you formerly downloaded in the My Forms tab of your profile.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for that proper metropolis/nation.

- Step 2. Make use of the Review method to check out the form`s information. Do not forget about to learn the explanation.

- Step 3. When you are not satisfied with all the form, make use of the Research area at the top of the screen to locate other versions of your lawful form web template.

- Step 4. After you have identified the form you require, go through the Acquire now switch. Select the prices strategy you choose and include your qualifications to sign up for an profile.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal profile to finish the purchase.

- Step 6. Pick the formatting of your lawful form and download it in your product.

- Step 7. Full, modify and print or indicator the Pennsylvania Accredited Investor Representation Letter.

Each and every lawful papers web template you buy is the one you have forever. You have acces to every single form you downloaded within your acccount. Click the My Forms segment and choose a form to print or download again.

Be competitive and download, and print the Pennsylvania Accredited Investor Representation Letter with US Legal Forms. There are many professional and condition-distinct varieties you can use for the organization or personal requires.

Form popularity

FAQ

An issuance of securities to yourself, your immediate family members and a few other investors will usually be totally exempt form both federal and state securities laws. In this case, the exemption generally is self-executingthat is, the exemption is automatic.

Some documents that can prove an investor's accredited status include:Tax filings or pay stubs;A letter from an accountant or employer confirming their actual and expected annual income; or.IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

A qualified institutional buyer (QIB) representation letter for an unlegended Rule 144A offering of securities by a Canadian issuer. The QIB representation letter relates to a concurrent public offering in Canada and an offering in the United States conducted in reliance on Rule 144A under the Securities Act.

Investor Representation Letter means a letter from initial investors of a Bond offering that includes but is not limited to a certification that they reasonably meet the standards of a Sophisticated Investor or Qualified Institutional Buyer, that they are purchasing Bonds for their own account, that they have the

Accredited Investor Definition Income: Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year. Professional: Is a knowledgeable employee of certain investment funds or holds a valid Series 7, 65 or 82 license.

An issuance of securities to yourself, your immediate family members and a few other investors will usually be totally exempt form both federal and state securities laws. In this case, the exemption generally is self-executingthat is, the exemption is automatic.

Under rule 506 b, issuers of securities are exempt from the registration requirements of the Securities Act for unlimited size offerings. However, to qualify under this rule, the securities that are being offered can only be bought by accredited investors and no more than thirty-five unaccredited investors.

In a Rule 506(b) offering, investors can self-certify, so this is where the opportunity for an investor to falsify their qualifications comes in. In a Rule 506(c) offering, investors must provide reasonable assurance to the Syndicator that they are accredited, which must be dated within 90 days of the investment.