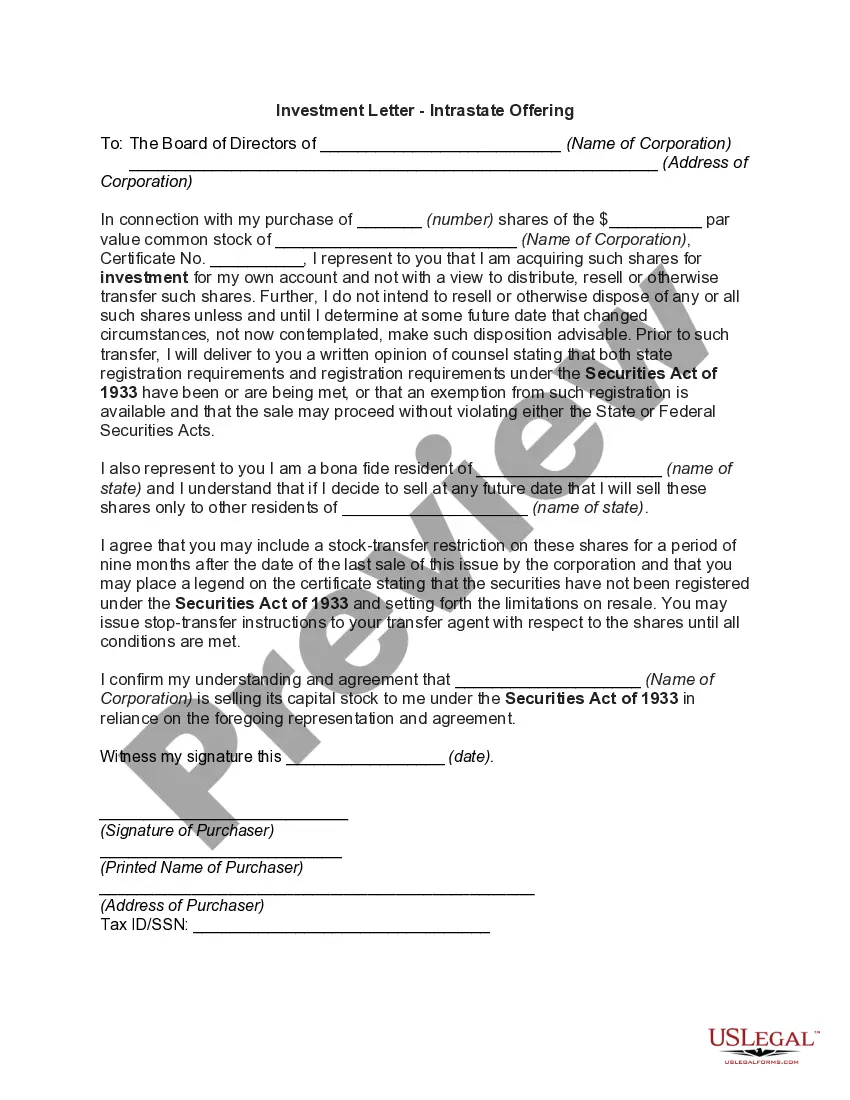

Pennsylvania Investment Letter — Intrastate Offering is a legal document that allows businesses in Pennsylvania to raise funds through the sale of securities to local investors. This offering is distinct from federal securities' registration requirements, making it a cost-effective way for companies to access capital from in-state residents. The Pennsylvania Investment Letter — Intrastate Offering serves as a disclosure document that provides potential investors with detailed information about the company, its financials, business operations, risks involved, and other relevant information. By providing transparency and offering protection to investors, this document ensures compliance with Pennsylvania state securities laws. There are two primary types of Pennsylvania Investment Letter — Intrastate Offerings: 1. Equity-based Offering: This type of offering allows businesses to sell shares or ownership stakes to in-state investors. Investors who purchase these shares become partial owners of the company and have the potential to benefit from its growth and profits. 2. Debt-based Offering: In this type of offering, companies issue debt securities like bonds or promissory notes to Pennsylvania investors. Investors who participate in this offering become creditors of the company and receive regular interest payments and a return of principal at maturity. Both types of offerings require the company to file the Pennsylvania Investment Letter (PIL) and comply with relevant regulations set forth by the Pennsylvania Securities Commission. The PIL must include comprehensive information about the business, its officers and directors, financials, potential risks, and investment terms. By conducting an Intrastate Offering, companies can tap into local resources and networks, fostering economic growth within the state. It allows Pennsylvania residents to support local businesses and share in their success, promoting community development and job creation. It is crucial for businesses to consult legal advisors or securities professionals to ensure a compliant and successful Intrastate Offering. These professionals can guide companies through the complex process of preparing the Pennsylvania Investment Letter, determining suitable offering terms, and complying with all necessary state regulations. Overall, the Pennsylvania Investment Letter — Intrastate Offering provides a valuable mechanism for companies to raise capital locally while enabling investors to diversify their investment portfolio and actively contribute to the growth of Pennsylvania's economy.

Pennsylvania Investment Letter - Intrastate Offering

Description

How to fill out Pennsylvania Investment Letter - Intrastate Offering?

Choosing the right authorized record format can be a have difficulties. Needless to say, there are tons of web templates available online, but how will you find the authorized type you need? Utilize the US Legal Forms website. The support gives a large number of web templates, such as the Pennsylvania Investment Letter - Intrastate Offering, which can be used for organization and private requirements. Every one of the kinds are checked out by pros and meet up with federal and state demands.

If you are presently registered, log in to your profile and click on the Acquire option to obtain the Pennsylvania Investment Letter - Intrastate Offering. Make use of profile to appear through the authorized kinds you may have ordered previously. Visit the My Forms tab of your respective profile and acquire one more duplicate of your record you need.

If you are a whole new consumer of US Legal Forms, listed below are simple directions that you should stick to:

- First, ensure you have selected the right type for your city/region. You are able to look through the shape utilizing the Review option and study the shape description to guarantee this is the right one for you.

- In case the type is not going to meet up with your preferences, take advantage of the Seach field to discover the right type.

- When you are certain the shape is proper, go through the Buy now option to obtain the type.

- Opt for the pricing strategy you desire and enter the essential information. Design your profile and purchase the transaction utilizing your PayPal profile or Visa or Mastercard.

- Pick the data file format and download the authorized record format to your product.

- Comprehensive, change and print and indication the obtained Pennsylvania Investment Letter - Intrastate Offering.

US Legal Forms is the most significant local library of authorized kinds that you will find a variety of record web templates. Utilize the service to download expertly-created files that stick to status demands.