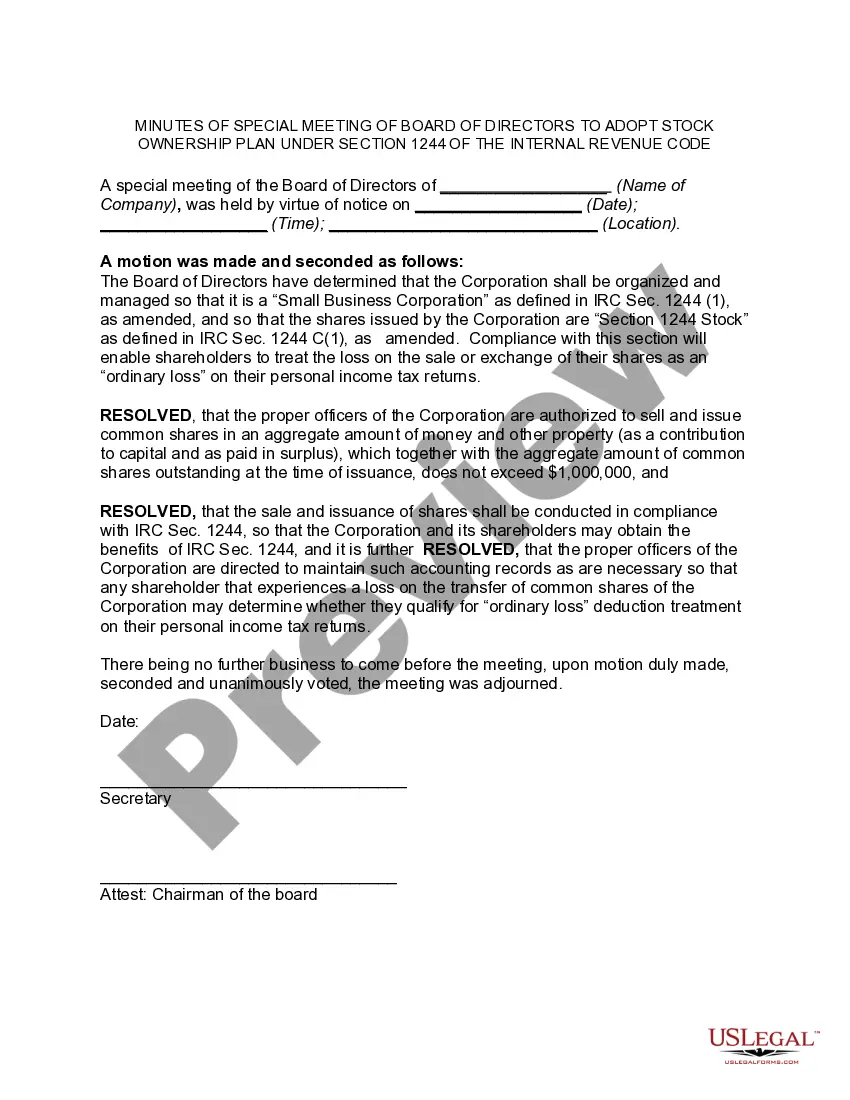

Pennsylvania Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

If you want to finalize, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site's straightforward and efficient search feature to locate the papers you require.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or by keywords.

Step 4. After locating the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the Pennsylvania Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to access the Pennsylvania Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Make sure to read through the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other models in the legal form format.

Form popularity

FAQ

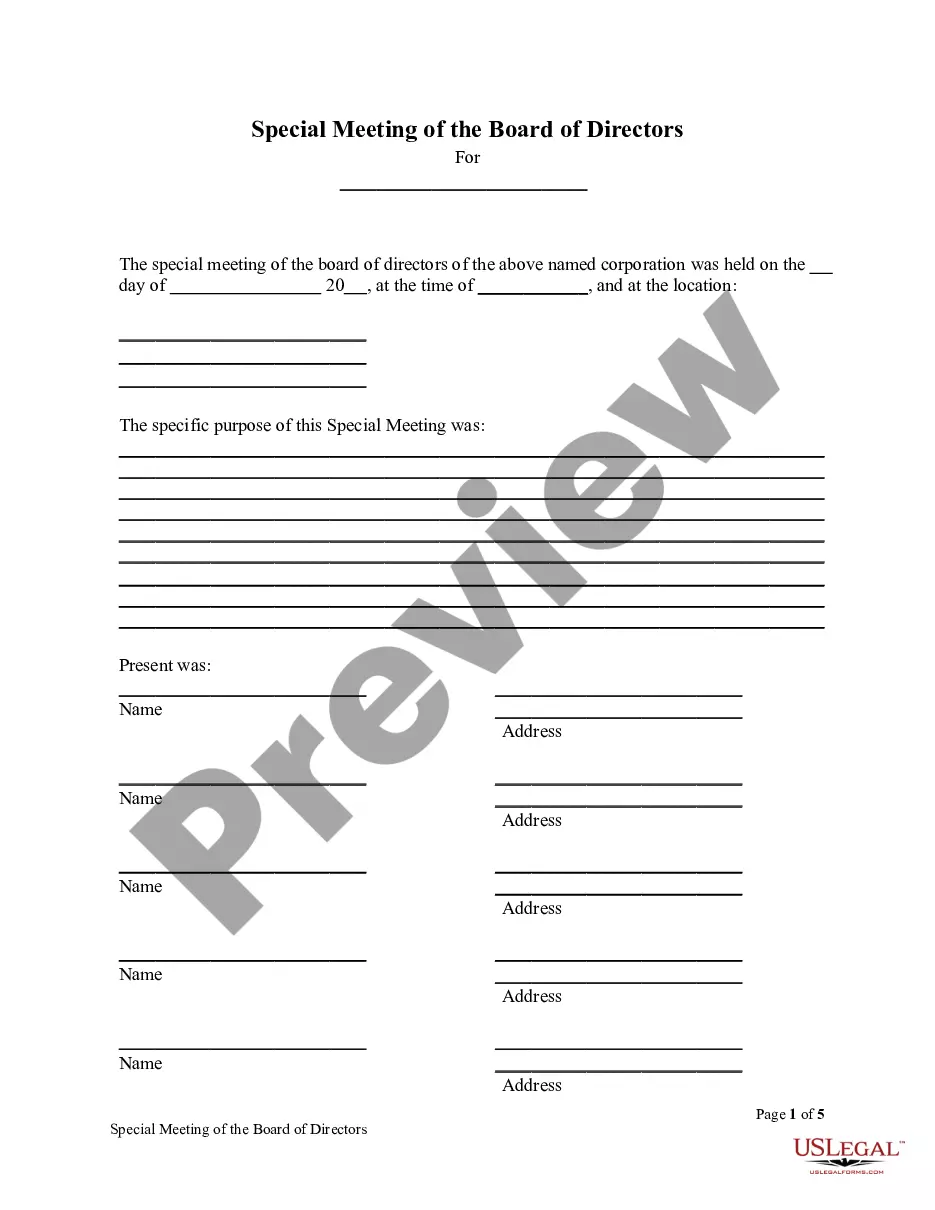

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

The determination of whether stock qualifies as Section 1244 stock is made at the time of issuance. Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Most special meetings involve director elections, which typically work pursuant to a less-restrictive plurality standard, rather than a majority standard.

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

Special meetings of the Board for any purpose or purposes may be called at any time by the chairman of the Board, the chief executive officer, the secretary or any two directors. The person(s) authorized to call special meetings of the Board may fix the place and time of the meeting.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

: a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of