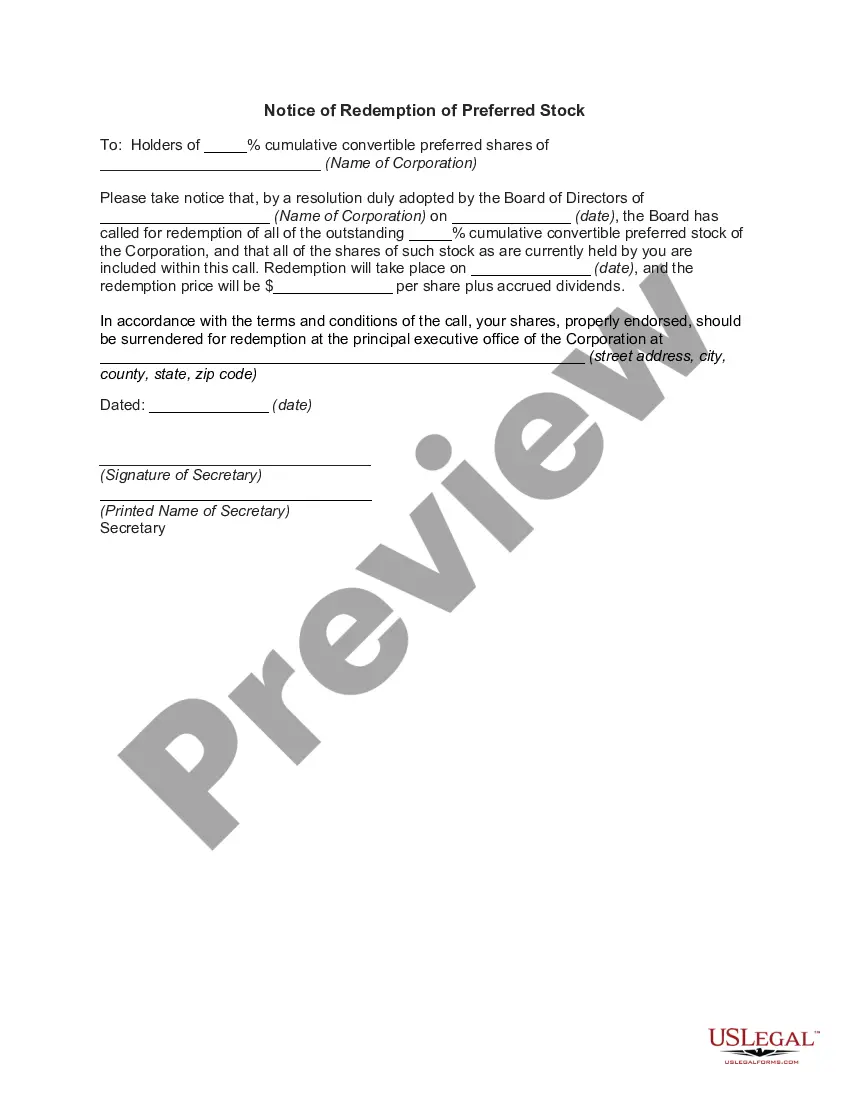

Pennsylvania Notice of Redemption of Preferred Stock

Description

How to fill out Notice Of Redemption Of Preferred Stock?

If you have to total, obtain, or printing legal file web templates, use US Legal Forms, the most important variety of legal types, which can be found on-line. Use the site`s easy and hassle-free search to find the paperwork you need. Numerous web templates for organization and personal uses are categorized by types and claims, or keywords. Use US Legal Forms to find the Pennsylvania Notice of Redemption of Preferred Stock with a handful of click throughs.

Should you be previously a US Legal Forms client, log in for your accounts and then click the Down load key to find the Pennsylvania Notice of Redemption of Preferred Stock. Also you can access types you previously saved within the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have selected the form for that appropriate city/country.

- Step 2. Take advantage of the Review solution to look over the form`s content material. Do not overlook to read through the explanation.

- Step 3. Should you be not happy with the develop, make use of the Research industry on top of the monitor to find other models in the legal develop web template.

- Step 4. When you have discovered the form you need, click the Get now key. Choose the prices strategy you prefer and add your credentials to sign up for an accounts.

- Step 5. Procedure the transaction. You can use your charge card or PayPal accounts to perform the transaction.

- Step 6. Find the format in the legal develop and obtain it in your gadget.

- Step 7. Full, revise and printing or signal the Pennsylvania Notice of Redemption of Preferred Stock.

Every legal file web template you buy is your own forever. You possess acces to every develop you saved in your acccount. Select the My Forms section and pick a develop to printing or obtain once again.

Be competitive and obtain, and printing the Pennsylvania Notice of Redemption of Preferred Stock with US Legal Forms. There are thousands of expert and condition-distinct types you may use to your organization or personal needs.

Form popularity

FAQ

Redeemable preferred stock is a type of preferred stock that allows the issuer to buy back the stock at a certain price and retire it, thereby converting the stock to treasury stock. These terms work well for the issuer of the stock, since the entity can eliminate equity if it becomes too expensive.

The cash account should be debited to record redemption of preference shares. If the preference shares are redeemed for $10 per share, a debit entry will be made to the cash account. Likewise, if preference shares are redeemed for Rs 10 per share, a credit entry will be made to the cash account.

Redemption or Repurchase of Preferred Stock: If a company repurchases its preferred stock, it would debit (decrease) the ?preferred stock? account and credit (decrease) the cash account for the repurchase price.

Redeemable preferred shares trade on many public stock exchanges. These preferred shares are redeemed at the discretion of the issuing company, giving it the option to buy back the stock at any time after a certain set date at a price outlined in the prospectus.

Redemption of preference shares means repayment by the company of the obligation on account of shares issued. ing to the Companies Act, 2013, preference shares issued by a company must be redeemed within the maximum period (normally 20 years) allowed under the Act.

If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. This fixed dividend is not guaranteed in common shares. If you take these payments and calculate the sum of the present values into perpetuity, you will find the value of the stock.

Non-Cumulative Preferred A type of preferred stock that does not pay the holder any unpaid or omitted dividends. If the corporation chooses to not pay dividends in a given year, the investor does not have the right to claim any of those forgone dividends in the future.