Pennsylvania Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide selection of legal form templates that you can download or print out.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Pennsylvania Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation in just minutes.

If you have an account, Log In and download the Pennsylvania Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation from the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously obtained forms in the My documents tab of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the payment.

Select the file format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Pennsylvania Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation. Every template you added to your account does not expire and is yours indefinitely. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need. Access the Pennsylvania Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize a wide variety of professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

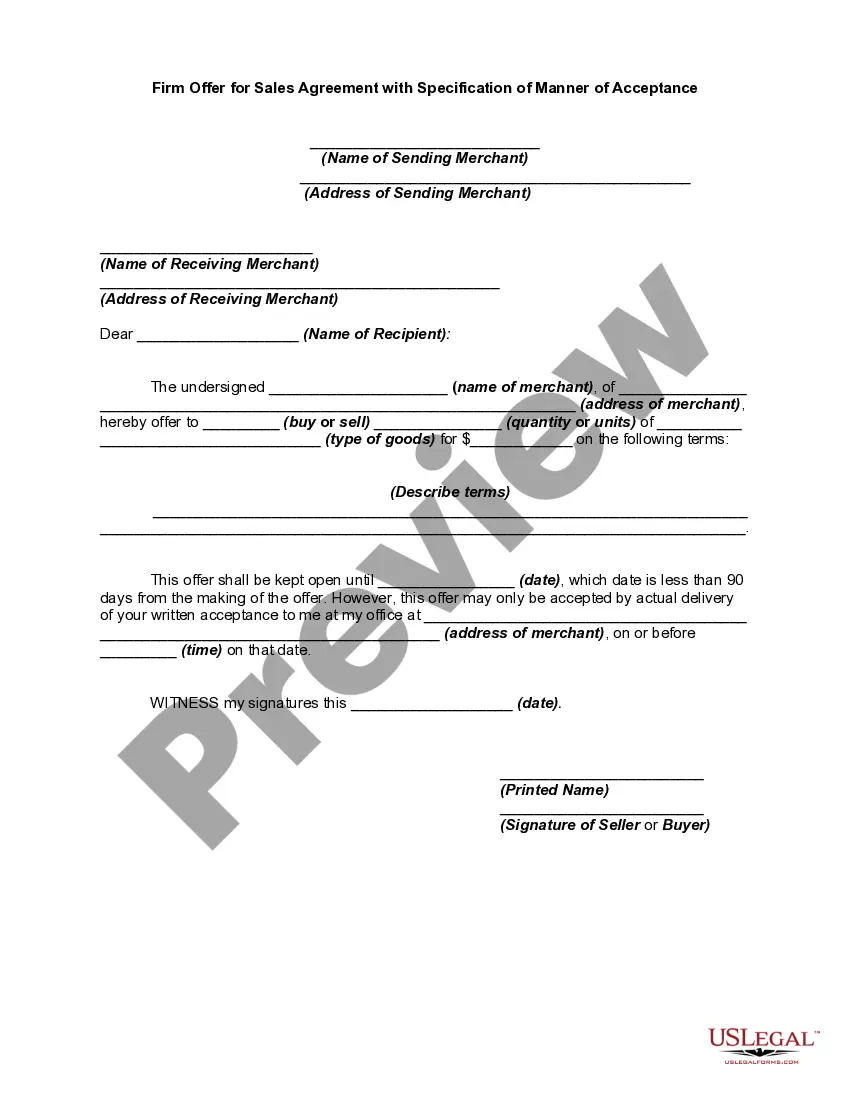

- Ensure you have selected the correct form for your location/county. Click the Preview button to review the form’s contents.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, select the pricing option you prefer and provide your information to sign up for the account.

Form popularity

FAQ

What to Think about When You Begin Writing a Shareholder Agreement.Name Your Shareholders.Specify the Responsibilities of Shareholders.The Voting Rights of Your Shareholders.Decisions Your Corporation Might Face.Changing the Original Shareholder Agreement.Determine How Stock can be Sold or Transferred.More items...

Having a shareholders' agreement is a cost effective way of minimizing any issues which may arise later on by making it clear how certain matters will be dealt with and by providing a forum for dispute resolution should an issue arise down the road.

A shareholders' agreement is a legally binding contract that outlines the regulations used to run a corporation. This agreement, also called a stockholders' agreement or SHA, is used to protect the interests of each individual shareholder and establish a fair relationship within the company.

The main things to consider including in a shareholders' agreement are: The nature of the company and its purpose. The process for appointing a director. How decisions about the company will be made.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

A Shareholders Agreement is a contract concluded between shareholders to a company that formalizes the relationship and governs the duties and responsibilities between all stakeholders to the company.

A Medium of Instruction Certificate (MOI) is the certificate which states the language in which you completed your degree education. It is not necessary that the instruction language is the official language of the country or state.

The main things to consider including in a shareholders' agreement are:The nature of the company and its purpose.The process for appointing a director.How decisions about the company will be made.How disputes will be resolved.The shareholders' rights to information.How shares will be distributed and sold.More items...?28-Nov-2018

The term MOI is an abbreviation for Memorandum of Incorporation. It is a document that sets out the rights, duties and responsibilities of shareholders, directors and other persons involved in a company.

The MOI automatically binds new shareholders without their explicit agreement, while a Shareholders Agreement needs to be agreed to before being binding.