The Pennsylvania Certificate of Borrower is a legal document specifically designed for commercial loans taken within the state of Pennsylvania. It serves as a crucial component of the loan application process, providing detailed information about the borrower and their financial standing. This document helps lenders assess the credibility and creditworthiness of the borrower before extending a commercial loan. Keywords: Pennsylvania Certificate of Borrower, commercial loan, legal document, loan application process, borrower, financial standing, credibility, creditworthiness, lenders. There are primarily two types of Pennsylvania Certificates of Borrower regarding commercial loans: 1. Pennsylvania Certificate of Borrower for Individual Commercial Loan: This type of certificate is applicable when an individual borrower, such as a sole proprietor or an individual entrepreneur, applies for a commercial loan in Pennsylvania. It entails gathering detailed personal information about the borrower, including full name, address, contact details, social security number, date of birth, and occupation. In addition, this certificate requires comprehensive financial information, such as income details, assets, liabilities, and credit history. The purpose is to provide lenders with a comprehensive understanding of the borrower's financial capacity and reliability. 2. Pennsylvania Certificate of Borrower for Business Entity Commercial Loan: This category is relevant when a business entity, such as a corporation, limited liability company (LLC), or partnership, applies for a commercial loan in Pennsylvania. Along with basic details of the business, such as its legal name, address, and contact information, this certificate necessitates providing information about the entity's legal structure, ownership, and management. Moreover, financial data, such as current and projected revenues, expenses, profit margins, outstanding debts, business credit history, and relevant tax returns, must be disclosed. By examining this information, lenders gain an understanding of the business's ability to fulfill repayment obligations. In both cases, the Pennsylvania Certificate of Borrower acts as a crucial instrument for lenders to evaluate the borrower's creditworthiness, assess risk, and make informed lending decisions. It helps establish trust and transparency between the borrower and lender, ultimately facilitating successful commercial loan transactions within Pennsylvania's regulatory framework.

Pennsylvania Certificate of Borrower regarding Commercial Loan

Description

How to fill out Pennsylvania Certificate Of Borrower Regarding Commercial Loan?

Have you been in a place where you need paperwork for either business or individual purposes nearly every working day? There are tons of legitimate document layouts available on the Internet, but getting kinds you can depend on is not effortless. US Legal Forms provides thousands of type layouts, much like the Pennsylvania Certificate of Borrower regarding Commercial Loan, which can be written to satisfy state and federal requirements.

Should you be currently familiar with US Legal Forms internet site and possess a free account, simply log in. Afterward, you are able to obtain the Pennsylvania Certificate of Borrower regarding Commercial Loan design.

Unless you offer an accounts and need to begin using US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for your correct area/state.

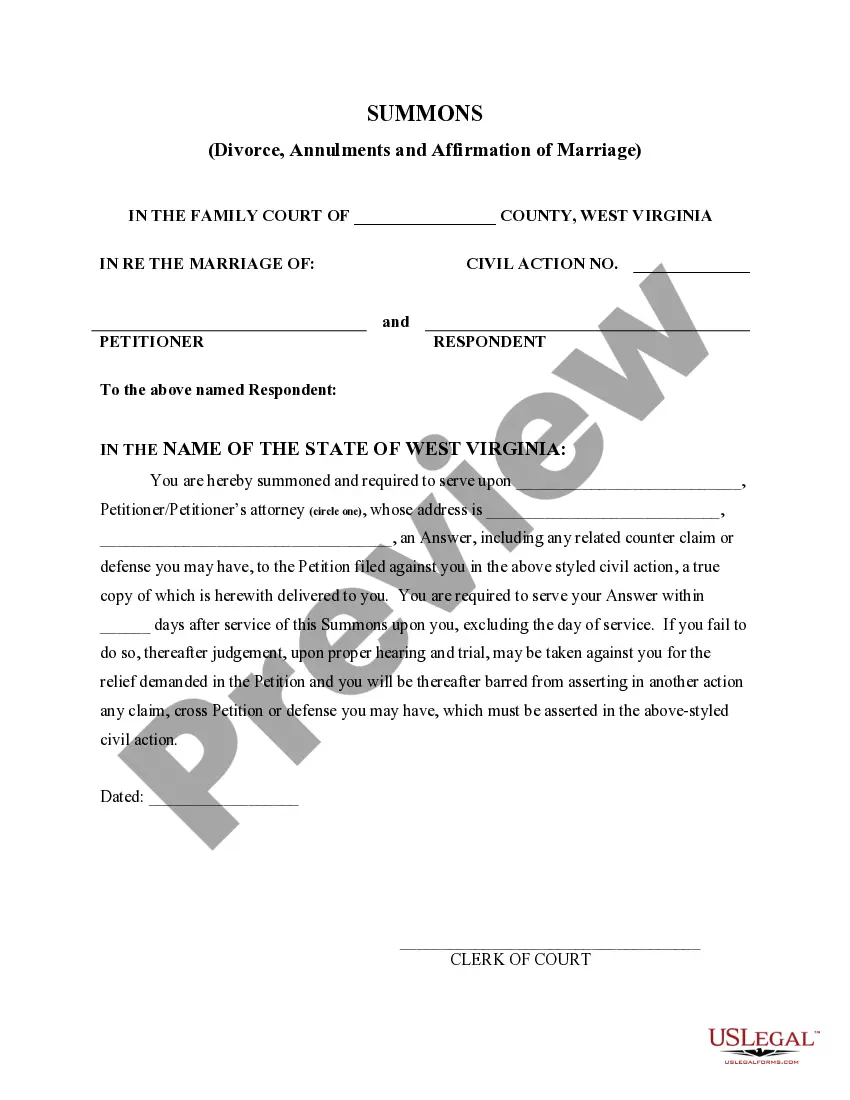

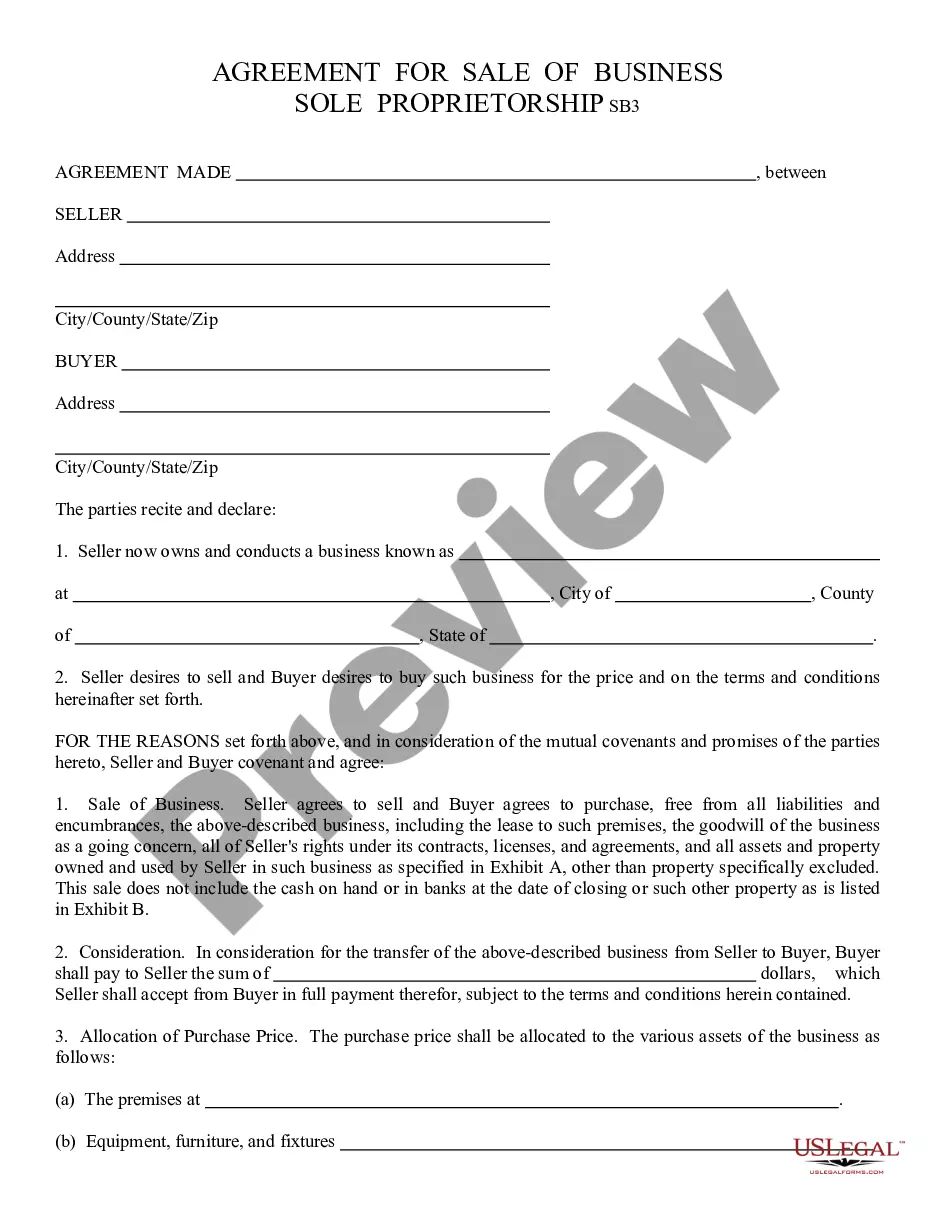

- Utilize the Review button to check the shape.

- Read the outline to ensure that you have selected the appropriate type.

- In case the type is not what you`re searching for, make use of the Search industry to discover the type that meets your requirements and requirements.

- Whenever you obtain the correct type, simply click Get now.

- Select the pricing program you desire, complete the desired information and facts to produce your money, and purchase the order making use of your PayPal or bank card.

- Select a practical paper structure and obtain your copy.

Find all the document layouts you have bought in the My Forms menus. You can get a additional copy of Pennsylvania Certificate of Borrower regarding Commercial Loan anytime, if required. Just click the required type to obtain or produce the document design.

Use US Legal Forms, one of the most comprehensive collection of legitimate kinds, in order to save some time and prevent mistakes. The services provides professionally made legitimate document layouts which you can use for a range of purposes. Produce a free account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

Borrowing Certificate means a borrowing request executed by the Borrower in substantially the form attached hereto as Exhibit A or such other form as may be acceptable to the Bank in its sole and absolute discretion.

Borrower shall have executed and delivered to Lender a certificate (the "LOANS TO ONE BORROWER CERTIFICATE") with respect to the compliance of the transactions contemplated by this Agreement with applicable federal law concerning lending limits to borrowers generally.

A nontraditional mortgage is a unique loan that doesn't fit the requirements for a conventional or even unconventional loan. Nontraditional mortgages are usually easier to qualify for in terms of credit score and debt-to-income ratio (DTI) but can be risky for both lenders and borrowers.

Borrower Certification means, with respect to any request for a Loan, a certification of the Borrower stating that (i) no Default or Event of Default will occur or be continuing after giving effect to such Loan, and (ii) the proceeds of such Loan will be used solely for Permitted Uses.

Summary. This certificate of borrower (limited liability company) is a form of officer's certificate delivered by a borrower (that is organized as a limited liability company) to the lender at the closing of an acquisition loan transaction.

A legal lending limit is the most a bank or thrift can lend to a single borrower. The legal limit for national banks is 15% of the bank's capital. If the loan is secured by readily marketable securities, the limit is raised by 10%, bringing the total to 25%.

If the loan defaults, hard money lenders often expect to be repaid by taking the collateral and selling it. In doing so, they foreclose on the entire real property serving as collateral and forfeit interest payments that the borrower may have made in the future.

A certificate secured loan is a loan provided through a credit union that is secured by the amount available on deposit in the borrower's share account. The funds are kept in the share for a specific period of time based on the terms of the loan.