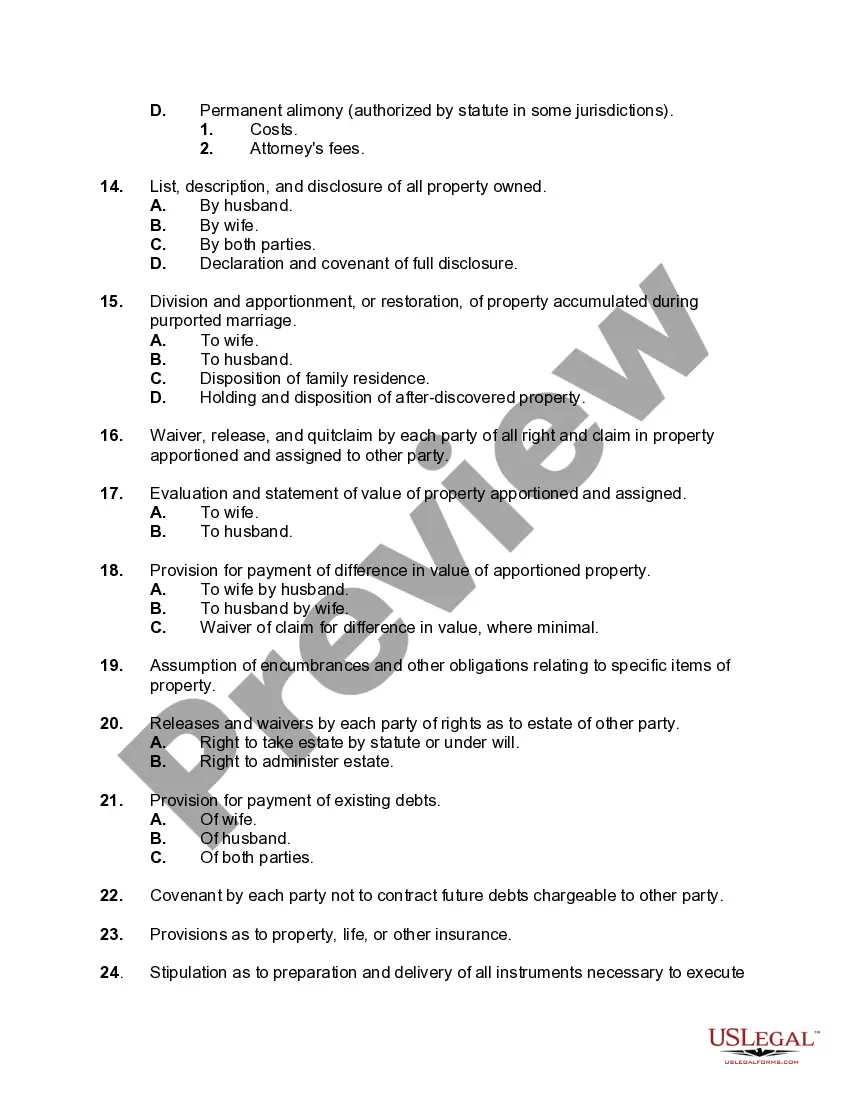

Pennsylvania Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

US Legal Forms - among the greatest libraries of lawful types in America - provides a wide range of lawful document layouts it is possible to down load or printing. While using internet site, you can get thousands of types for company and personal reasons, categorized by categories, claims, or search phrases.You will discover the newest types of types such as the Pennsylvania Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage within minutes.

If you currently have a registration, log in and down load Pennsylvania Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage in the US Legal Forms library. The Obtain button will appear on every develop you perspective. You gain access to all previously saved types from the My Forms tab of your accounts.

If you would like use US Legal Forms initially, listed here are easy guidelines to help you get began:

- Be sure you have chosen the correct develop for your metropolis/state. Go through the Preview button to analyze the form`s content material. Look at the develop explanation to ensure that you have selected the correct develop.

- If the develop does not fit your needs, make use of the Search discipline near the top of the display screen to find the the one that does.

- In case you are pleased with the shape, affirm your choice by clicking on the Get now button. Then, opt for the prices plan you favor and offer your references to sign up for the accounts.

- Procedure the financial transaction. Make use of your bank card or PayPal accounts to finish the financial transaction.

- Select the format and down load the shape in your gadget.

- Make changes. Complete, change and printing and sign the saved Pennsylvania Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage.

Each format you added to your bank account does not have an expiration day and is the one you have eternally. So, if you want to down load or printing an additional duplicate, just proceed to the My Forms segment and then click in the develop you will need.

Gain access to the Pennsylvania Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage with US Legal Forms, one of the most comprehensive library of lawful document layouts. Use thousands of skilled and state-particular layouts that meet up with your business or personal demands and needs.

Form popularity

FAQ

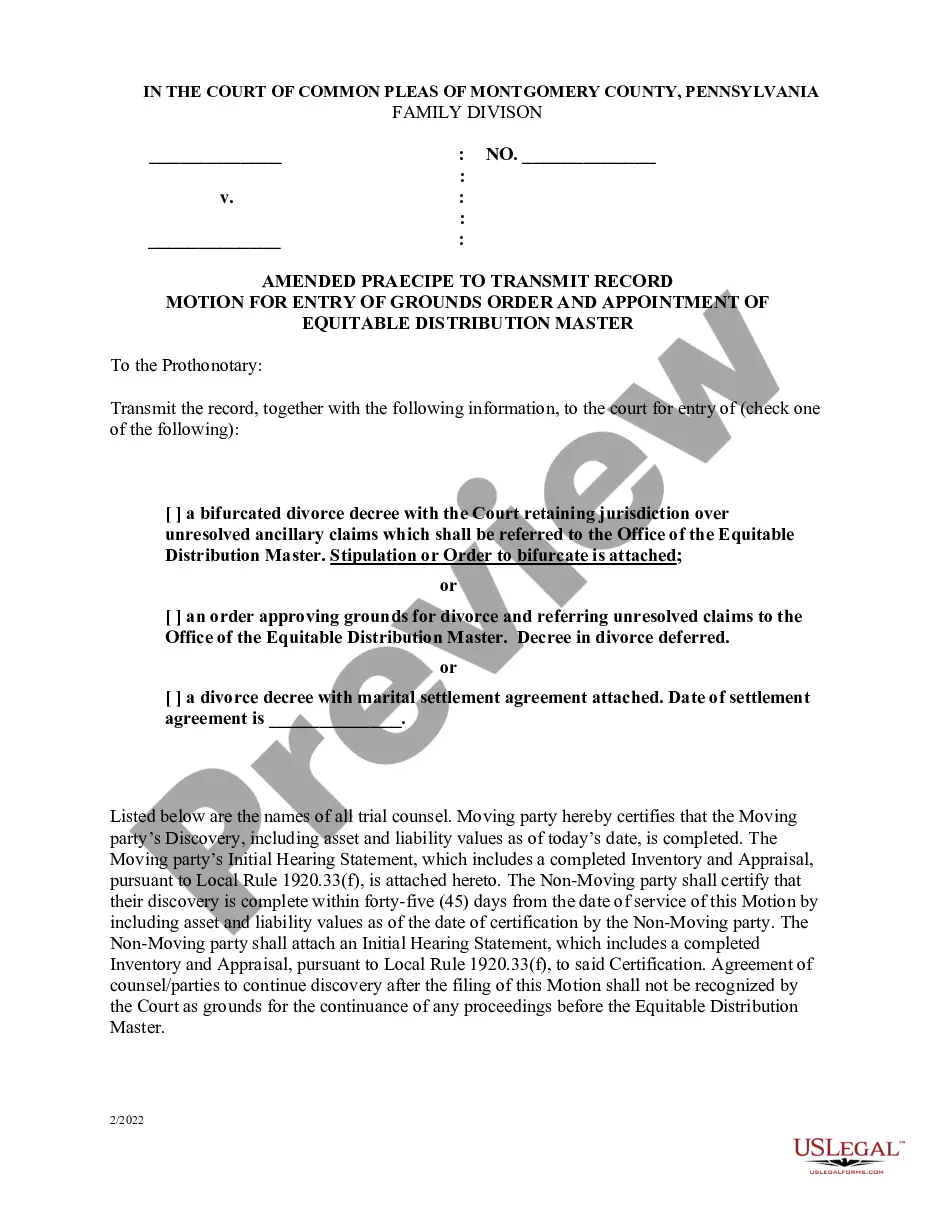

In a Pennsylvania divorce, marital property is equitably distributed between the spouses. Simply put, equitable distribution means that marital property will be divided ?fairly? between the parties.

Divorce Decree: The Main Difference. Your marital settlement agreement doesn't mean that you're divorced. Only your divorce decree means that you're divorced. Your marital settlement agreement will ultimately become your divorce, but it needs to be reviewed by a judge first.

A Settlement Agreement is a contract between you and your spouse, and it addresses the major issues you're likely to have when getting divorced with regard to your children and/or your property.

This agreement is intended to help the parties formalize an allocation of their property and finances and matters relating to child custody and visitation. Most courts will require a marital settlement agreement filed in conjunction with a COMPLAINT FOR DIVORCE within the Commonwealth of Pennsylvania.

Even though Pennsylvania law does not mandate a 50/50 division of marital property, in practice, a 50/50 division is quite common. If the divorcing spouses have similar incomes from their jobs and the marital assets include a home and modest retirement accounts, the courts will often order a 50/50 division.

What is a wife entitled to in a divorce in PA? The wife is not automatically entitled to anything that is not her direct property or assets in a divorce in PA. Alimony payments may be required based on the wife's situation and any division of property will also be determined based on other factors.

Grounds for Annulment of Marriage Under Pennsylvania law, a marriage can be annulled for four reasons 1) one of both spouses' mental state was impaired when they married, 2) one or both parties were unable to give valid consent to the married 3) the marriage is illegal and 4) the marriage cannot be consummated.

--No spouse is entitled to commence an action for divorce or annulment under this part unless at least one of the parties has been a bona fide resident in this Commonwealth for at least six months immediately previous to the commencement of the action.