Pennsylvania Investment Management Agreement for Separate Account Clients

Description

How to fill out Investment Management Agreement For Separate Account Clients?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers thousands of template documents, such as the Pennsylvania Investment Management Agreement for Separate Account Clients, which are designed to meet both federal and state requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you want, complete the necessary information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Investment Management Agreement for Separate Account Clients template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

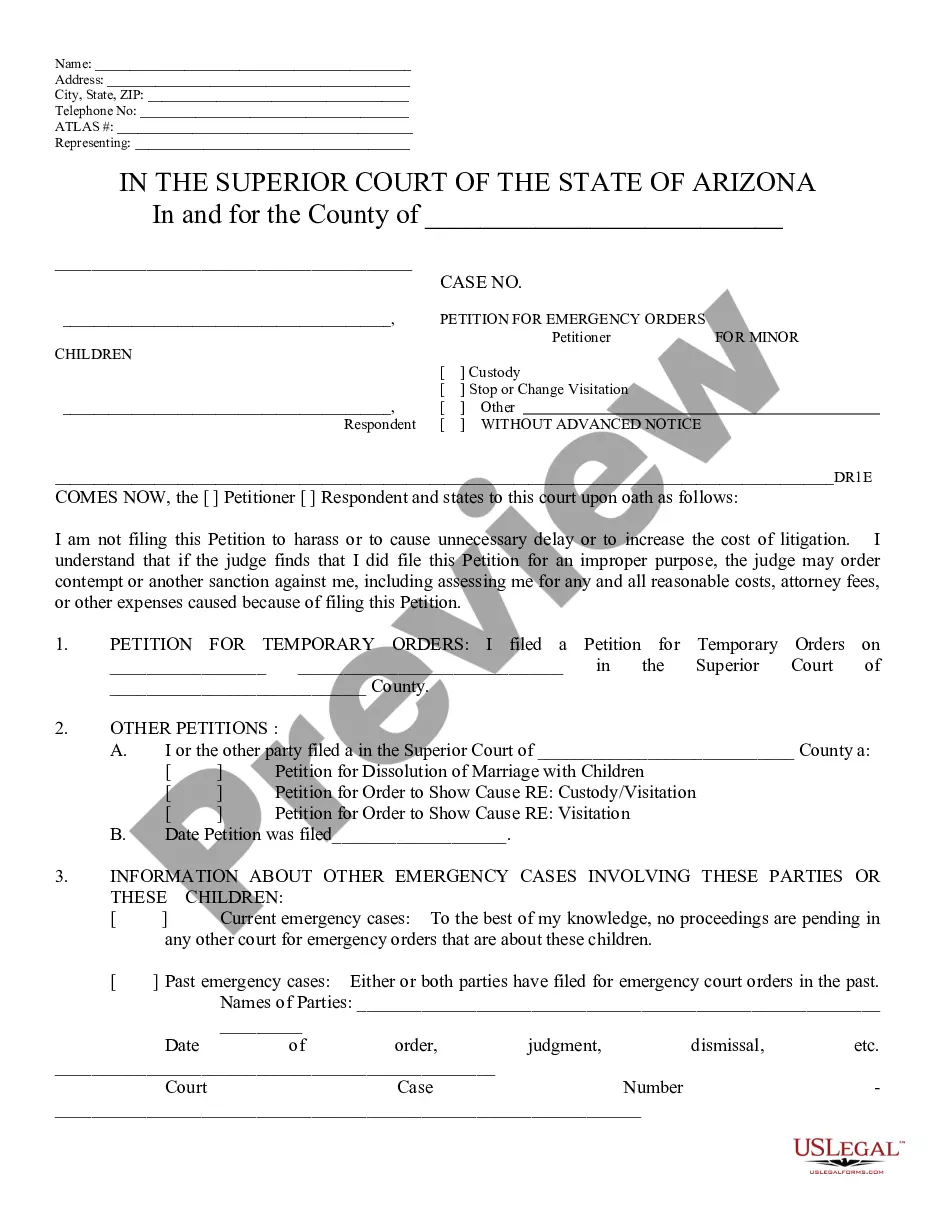

- Utilize the Review option to inspect the form.

- Check the details to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Lookup section to locate the form that fits your needs.

Form popularity

FAQ

Portfolio Managers build and maintain investment portfolios, while investment advisors sell a specific product. 1 Investment advisors play an important role in the financial markets, but are not in a position to support the needs of a client's long-range financial objectives. That's the job of the Portfolio Manager.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

A managed account (or separately managed account) is a portfolio of individual securities, such as stocks or bonds, that is managed on your behalf by a professional asset management firm. Unlike with a mutual fund or exchange-traded fund, you directly own the individual securities.

Exclusively tailored services. First Command's Investment Management Accounts (IMA) are asset allocation portfolios designed for high net worth clients. Each portfolio is tailored to the client's individual risk tolerance and investment objective.

Investment management is the process of building a portfolio of stocks, bonds and other investments based on your goals. You can hire an investment management service, or manage your own portfolio.

I would say that a manager is likely to have people reporting to them and budget responsibilites, whereas an advisor is more likely to just convey advice, guidance and information to help an organisation to remain compliant.

Investment Guidelines means the general criteria, parameters and policies relating to Investments as established by the Board of Directors, as the same may be modified from time-to-time.

Key Takeaways. Investment managers are people or organizations who handle all activities related to financial planning, investing, and managing a portfolio for individuals or organizations. Clients of investment managers can be either individual or institutional investors.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

An Investment Management Account (IMA) is a flexible fund management arrangement that allows you to diversify your portfolio by gaining access to a wide range of financial instruments that span various asset types.