Pennsylvania Agreement to Form Limited Partnership

Description

How to fill out Agreement To Form Limited Partnership?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive array of legal template forms that you can download or print.

By utilizing the website, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent iterations of forms such as the Pennsylvania Agreement to Form Limited Partnership within moments.

If you have a monthly subscription, Log In and download the Pennsylvania Agreement to Form Limited Partnership from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the purchase. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the format and download the document to your device. Modify the form. Fill out, edit, print, and sign the downloaded Pennsylvania Agreement to Form Limited Partnership. Every template you upload to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you require. Access the Pennsylvania Agreement to Form Limited Partnership with US Legal Forms, the most extensive collection of legal document templates. Utilize a variety of professional and state-specific templates that cater to your business or personal needs.

- If this is your first time using US Legal Forms, here are some simple steps to get you started.

- Ensure you have selected the appropriate form for your city or county.

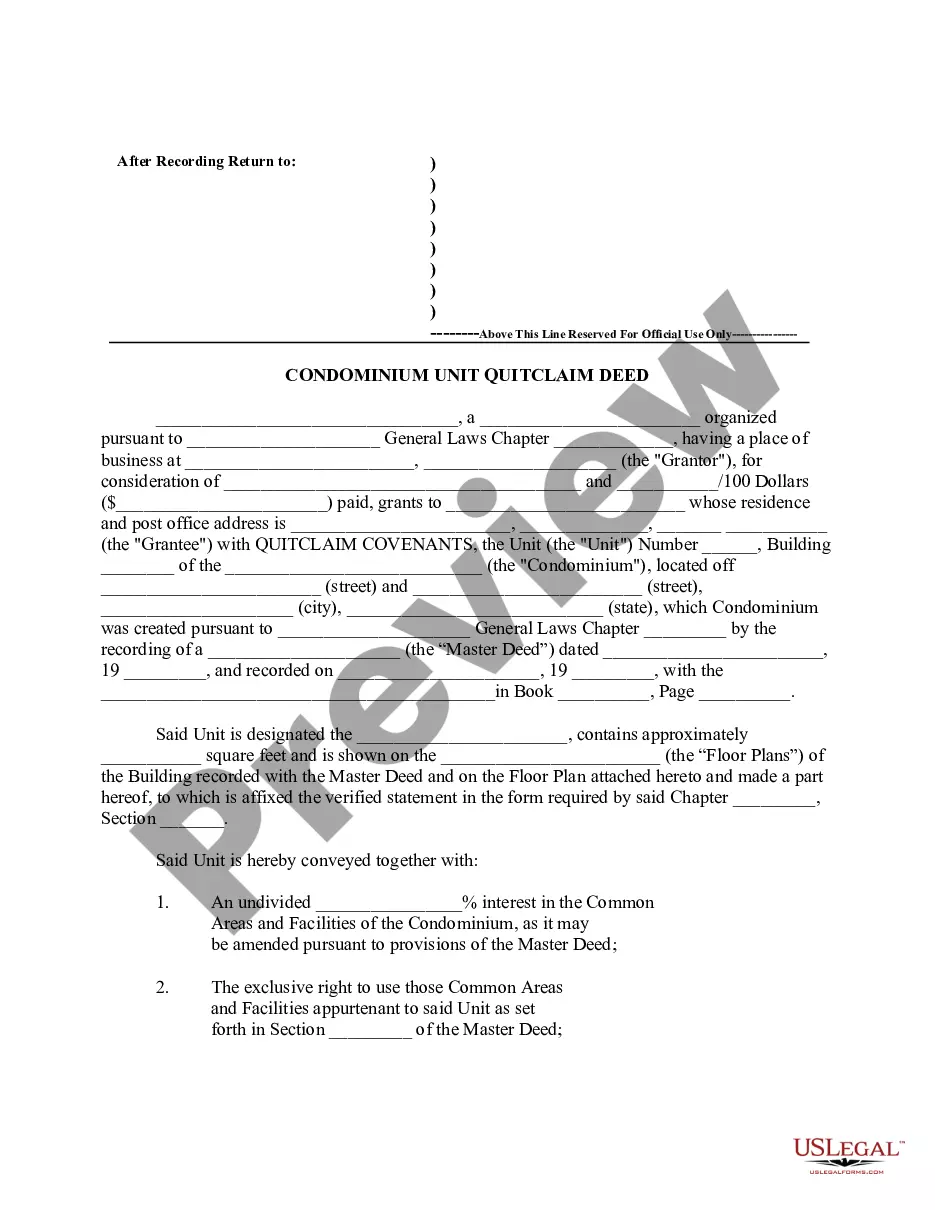

- Click the Preview button to examine the form's content.

- Review the form details to confirm you have selected the correct document.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Select your payment option for the subscription and provide your details to register for the account.

Form popularity

FAQ

Yes, a partnership can indeed be formed without a written agreement in Pennsylvania. However, operating without a Pennsylvania Agreement to Form Limited Partnership increases the risk of disputes and misunderstandings among partners. To safeguard your business and clarify each partner's role, creating a written agreement is highly recommended.

To form a partnership in Pennsylvania, at least two individuals must intend to engage in a business for profit. While a written agreement simplifies the process, it is not a legal requirement. Nonetheless, utilizing a Pennsylvania Agreement to Form Limited Partnership can clarify your intentions and responsibilities, ensuring smooth business operations.

While Pennsylvania law does not mandate a written partnership agreement, it is highly advisable to have one. A clear, written Pennsylvania Agreement to Form Limited Partnership helps outline the roles, responsibilities, and profit distributions among partners. It provides a framework that can protect all parties involved and minimize potential conflicts.

If no written agreement exists, the terms of the partnership may become unclear, leading to potential disputes between partners. In Pennsylvania, a verbal agreement can still form a partnership, but it is challenging to prove the specific terms and intentions of the partners. Thus, without a written Pennsylvania Agreement to Form Limited Partnership, you risk misunderstandings, which could complicate operations and profit-sharing.

One significant disadvantage of a limited partnership is that general partners have unlimited liability, exposing them to more risk than limited partners. Additionally, raising capital can be more challenging, as limited partners cannot take an active role in management. It is important to weigh these factors carefully when considering a Pennsylvania Agreement to Form Limited Partnership, as they impact the overall business operation and partners' involvement.

Creating a limited partnership involves drafting a Pennsylvania Agreement to Form Limited Partnership and filing it with the appropriate state authorities. You’ll need to specify the roles of general and limited partners, along with other required details. After the agreement is filed, your limited partnership will be officially recognized, allowing you to operate your business under this structure.

While it is possible to have a verbal partnership agreement, a written agreement is highly recommended to clearly outline each partner's rights and obligations. A Pennsylvania Agreement to Form Limited Partnership serves as an essential document that helps prevent misunderstandings and disputes among partners. Having a written agreement also provides a clear reference point in case of any legal issues.

To form a limited partnership in Pennsylvania, you must establish a Pennsylvania Agreement to Form Limited Partnership, which outlines the roles and responsibilities of each partner. Additionally, you need to file a certificate of limited partnership with the Pennsylvania Department of State. Both general and limited partners must be identified in the agreement to ensure clarity and legal compliance.

Choosing a limited partnership (LP) instead of a limited liability company (LLC) can be advantageous for certain business structures. An LP allows for passive investors to join without being involved in management, which is ideal for venture capital or real estate ventures. Additionally, the clarity of a Pennsylvania Agreement to Form Limited Partnership provides legal guidelines that may be appealing for specific investment strategies.

Filling out a partnership agreement involves providing clear information about each partner and their contributions to the partnership. You should include details on how profits and losses will be distributed, as well as how decisions are made. Using a Pennsylvania Agreement to Form Limited Partnership template from Uslegalforms can simplify this process by guiding you through all the essential elements.