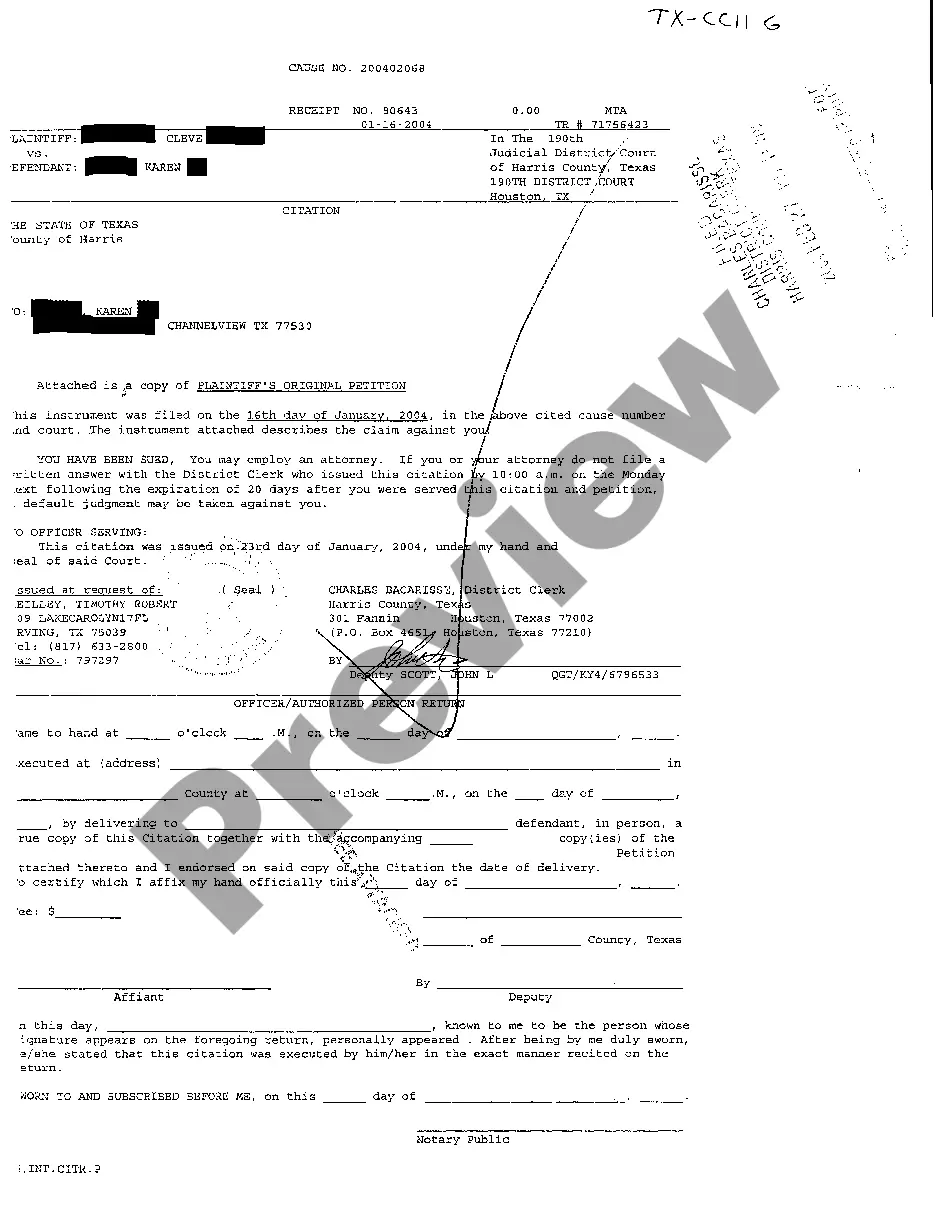

Pennsylvania Notice of Disputed Account

Description

How to fill out Notice Of Disputed Account?

Are you currently in a position where you require documents for either business or personal reasons nearly every day.

There are numerous legitimate document templates available online, but finding ones you can rely on isn't straightforward.

US Legal Forms offers a multitude of form templates, including the Pennsylvania Notice of Disputed Account, that are crafted to comply with federal and state regulations.

Once you find the right form, click Get now.

Select the payment plan you prefer, fill in the required information to create your account, and submit the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply sign in.

- After that, you can download the Pennsylvania Notice of Disputed Account template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the appropriate city/county.

- Utilize the Preview button to examine the form.

- Review the outline to verify that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search area to find the form that meets your needs and requirements.

Form popularity

FAQ

The Pennsylvania Gaming Control Act is legislation that regulates gaming activities within the state. It establishes the legal framework for gaming licenses, the operations of casinos, and the enforcement of gaming laws. This act is crucial for ensuring transparency and fairness in the gaming industry. Understanding the Pennsylvania Gaming Control Act can help individuals navigate issues related to the Pennsylvania Notice of Disputed Account effectively.

Filing a complaint with the state of Pennsylvania can be done online or by mail, depending on the nature of your grievance. First, identify the appropriate agency for your issue, which might relate to consumer services or business regulations. If your complaint involves a Pennsylvania Notice of Disputed Account, be sure to include relevant details and documentation to support your claim. Utilizing platforms like uslegalforms can streamline the process and ensure that your complaint is documented correctly.

If you have a concern regarding the PA Gaming Board, you can file a complaint through their official website or contact their office directly. Consider documenting your issue clearly, as this will help in processing your Pennsylvania Notice of Disputed Account. You may also gather supporting evidence to strengthen your case. Addressing your complaint promptly increases the chance of a satisfactory resolution.

In Pennsylvania, the obstruction of justice code refers to laws that penalize individuals who interfere with the judicial process. This can include actions that obstruct investigations or impede legal proceedings. Understanding these laws can be beneficial if you find yourself in a situation regarding the Pennsylvania Notice of Disputed Account, where legal issues may arise.

Chapter 6600 of Title 55 in the Pennsylvania Code relates to regulations concerning financial assistance programs. It outlines eligibility requirements and the standards that organizations must follow to provide financial support. This chapter is crucial for understanding the broader context of financial responsibilities, particularly when dealing with the Pennsylvania Notice of Disputed Account.

Filing a notice of appeal in Pennsylvania involves submitting a formal document to the appropriate court within a specific time frame after a judgment. You must include essential information such as the case number and your contact details. For those dealing with matters related to the Pennsylvania Notice of Disputed Account, utilizing services like US Legal Forms can help ensure accurate and timely filings.

Title 55 PA Code Chapter 275 sets forth the regulations for reporting and handling financial disputes in Pennsylvania. It provides guidelines for businesses and individuals about managing accounts that may be contested. Familiarity with this chapter is crucial for navigating the complexities of the Pennsylvania Notice of Disputed Account and for ensuring that your interests are protected.

To publish a notice to creditors in Pennsylvania, you must follow specific legal procedures mandated by the Pennsylvania Code. Typically, you will need to file a notice in a designated newspaper and provide necessary details about the debts owed. Legal tools such as US Legal Forms can help streamline the process and ensure your notice is compliant with the Pennsylvania Notice of Disputed Account regulations.

Chapter 275 of Title 55 in the Pennsylvania Code outlines the procedures for the treatment of debts and the rights of consumers. This chapter is particularly relevant when addressing disputed accounts, especially if you need to publish a notice to creditors. Knowing this chapter can help you protect your rights and effectively manage issues related to the Pennsylvania Notice of Disputed Account.

Title 55 of the Pennsylvania Code contains regulations regarding social services in Pennsylvania. It covers topics such as welfare, public assistance, and eligibility criteria for various programs. Understanding Title 55 is essential when dealing with issues like the Pennsylvania Notice of Disputed Account, especially concerning how debts are managed and reported.