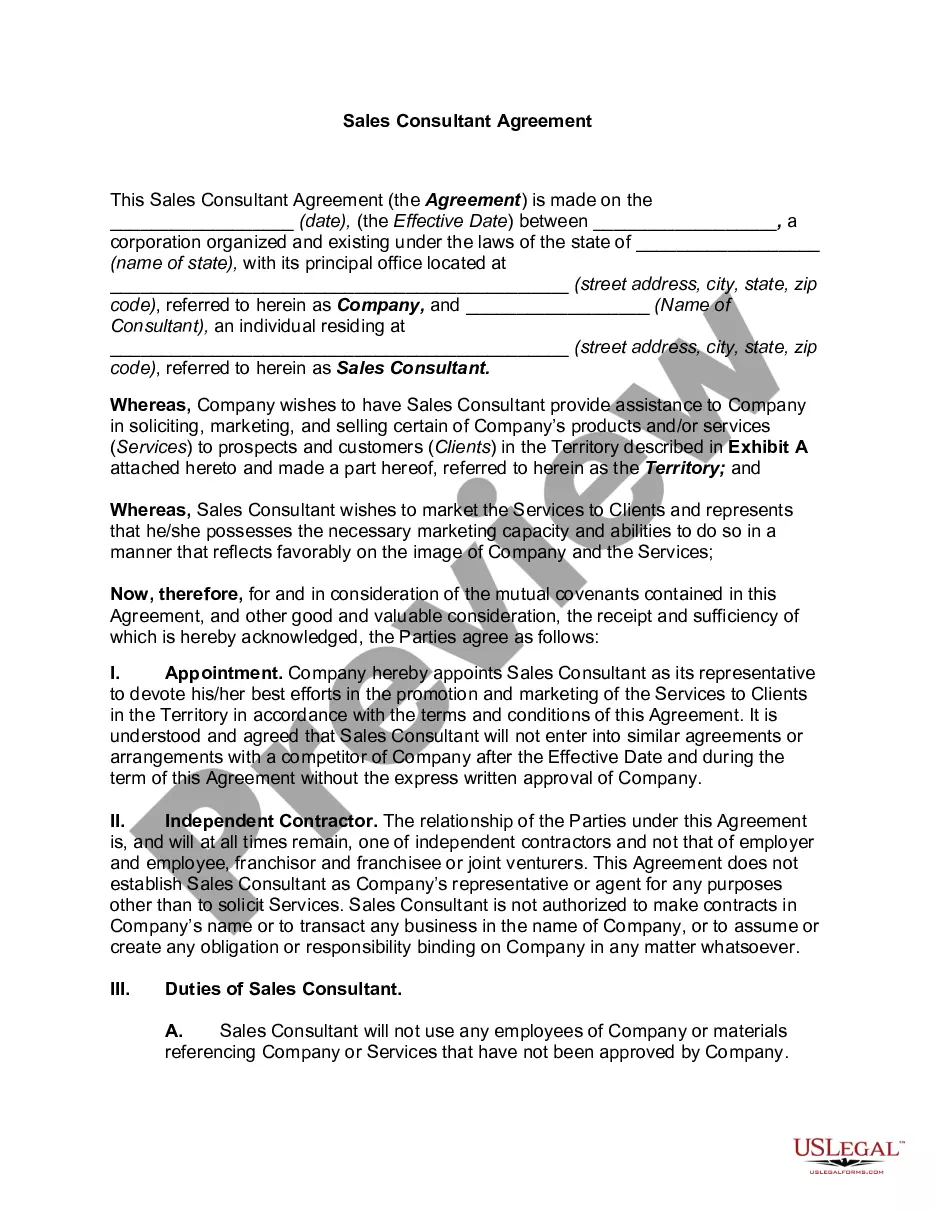

Pennsylvania Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Identifying the correct authentic document template can be an arduous task. Certainly, there are countless templates available online, but how can you find the genuine form that you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Pennsylvania Unrestricted Charitable Contribution of Cash, which can be used for both business and personal purposes.

All forms are reviewed by experts and comply with both state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate form. When you are confident that the form is suitable, click the Order now button to obtain the form. Select the pricing plan you wish to choose and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Pennsylvania Unrestricted Charitable Contribution of Cash. US Legal Forms is the premier repository of legal forms where you can find a wide variety of document templates. Use the service to download properly designed documents that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to access the Pennsylvania Unrestricted Charitable Contribution of Cash.

- Use your account to browse through the legal forms you have previously acquired.

- Visit the My documents tab of your account to obtain another copy of the form you need.

- If you are a new user of US Legal Forms, here are a few straightforward steps to follow.

- First, ensure you have selected the correct form for your city/region.

- You can preview the form using the Preview button and read the form description to ensure it is suitable for your needs.

Form popularity

FAQ

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

Your deduction for charitable contributions generally can't be more than 60% of your adjus- ted gross income (AGI), but in some cases 20%, 30%, or 50% limits may apply. The 60% limit is suspended for certain cash contributions.

Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes (AGI) for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI.

You can deduct up to $300 if you're single or married filing separately (or $600 if you're married filing jointly) for cash contributions made to qualifying charitieseven if you don't itemize.

Expanded tax benefits help individuals and businesses give to charity during 2021; deductions up to $600 available for cash donations by non-itemizers.

The adjusted gross income (AGI) limit for cash contributions to qualifying public charities remains increased for individual donors. For cash contributions made in 2021, you can elect to deduct up to 100 percent of your AGI (formerly 60 percent prior to the CARES Act).

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. The CARES Act eliminated the 60% limit for cash donations to public charities.